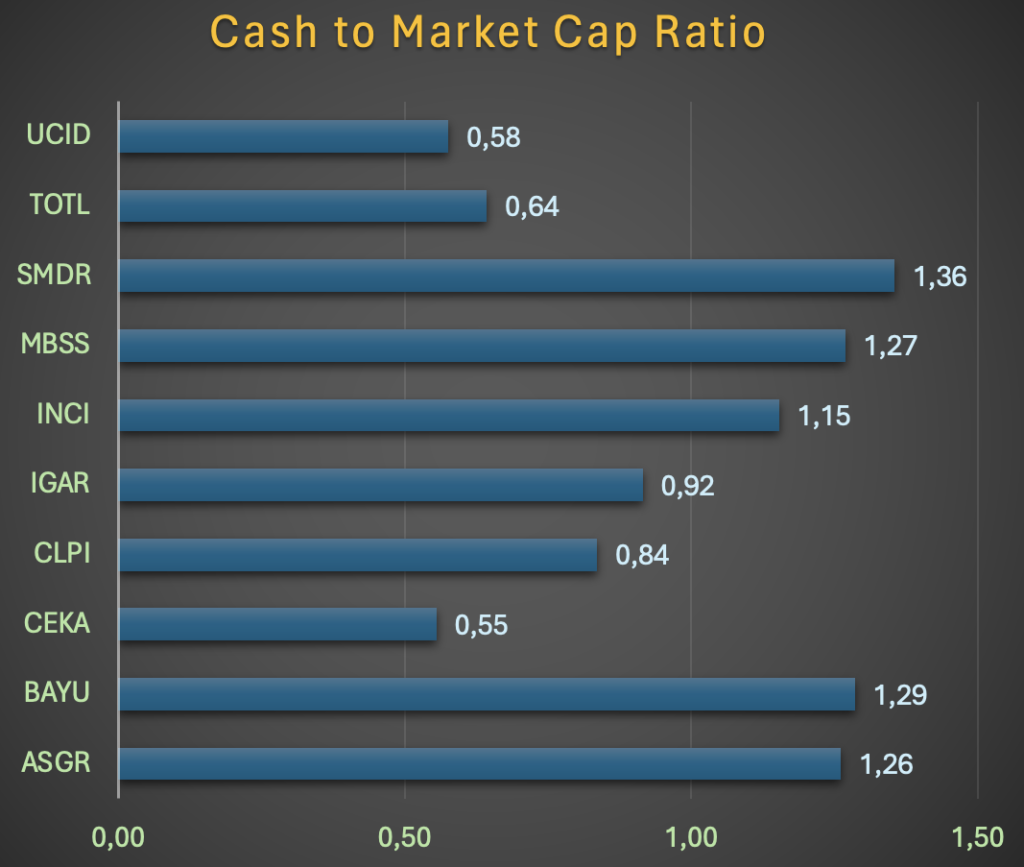

Some Companies hold cash reserves higher than their market caps. Some of these Stocks are rarely heard of.

Why is this the case?

- No Dividends. Most of these Companies do not pay dividends. If any, very little compared to their accumulated profits.

- Low Stock Liquidity. Without liquidity, there is limited number of Investors willing to invest in. In this case, the cash keeps building up while their market caps stagnate.

What are these Companies going to do with their cash reserves?

No one knows, except the controlling entities (owners). Some possible scenarios include:

Is it worth it to hold these Stocks?

It depends. One thing for sure, do not expect much. Nothing can happen for years, while the Stock prices might stagnate or dip further.

Another setback by holding these Stocks. Opportunity cost. Investing in these Stocks may give nothing or very little return on the money invested. Meanwhile, the same money can be invested elsewhere that generates dividends or capital gains.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.