The Stock Market can be very unforgiving for some Investors without knowledge and experience.

Still, knowledge and experience do not guarantee success when investing in the Stock Market. A bit of luck may help, but not in the long run.

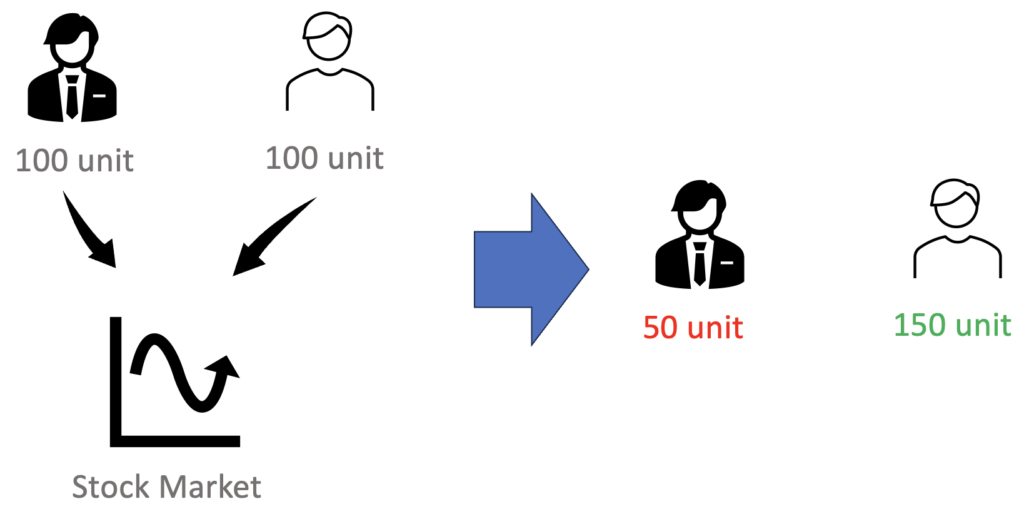

Zero Sum Game

Defined as when an Investor profits from a stock, there is another Investor that lose money on the other side.

This holds true if the market is on sideways; or, the Company whose stocks are being traded is neither growing nor declining (i.e. stagnant).

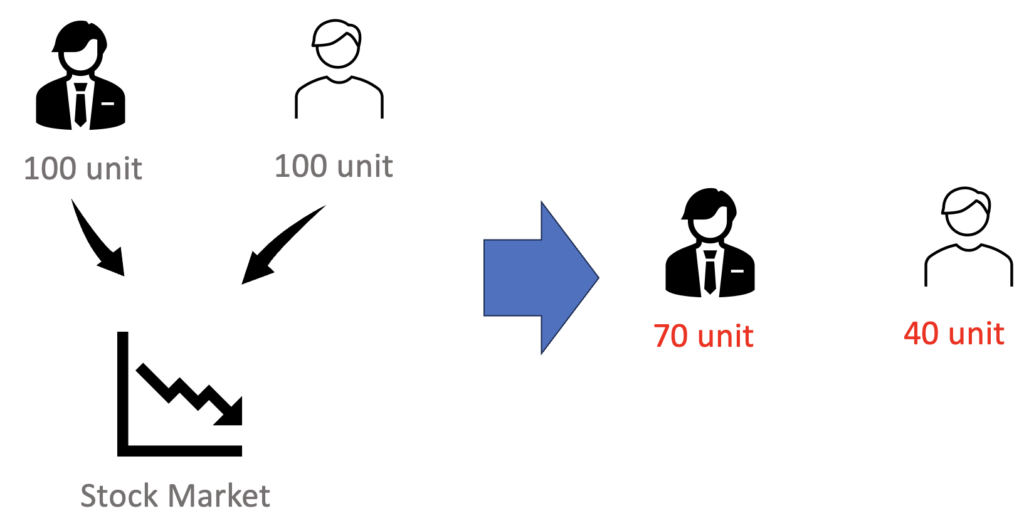

Negative Sum Game

Defined as lose-lose situation for both buyers and sellers, regardless of the fundamentals.

This occurs primarily on a bearish market; or, the Company whose stocks are being traded is in the state of decline.

Bear in mind, this excludes ‘Pump and Dump’ stocks in which the Company’s financial performance is irrelevant (disconnected) from its stock movement. Yet even in this situation, ‘Pump and Dump’ Operators are prone to significant loses if they could not close their position as liquidity dries up.

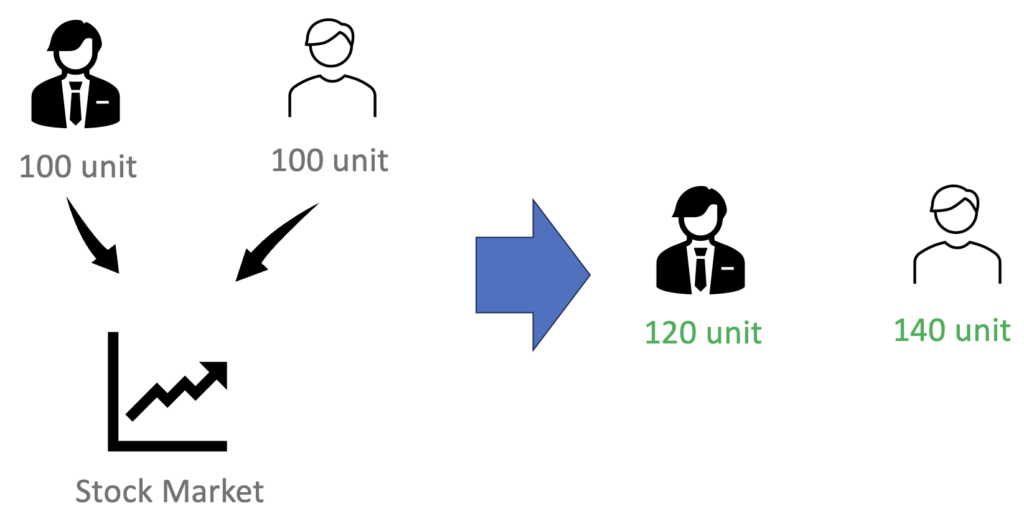

Positive Sum Game

Defined as win-win situation for nearly everyone, as the Stock Market enters bullish mode or even bubble mode.

However, even this scheme carries huge risk. Prolonged bullish market can push the bubbles to burst, especially if the fundamentals are not solid enough.

Recall how the tech stocks bubbled during the pandemic, then collapsed as the interest rates increased.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.