Timing is fundamental in the investment world. To gain is to understand when it is the right time to make a move.

Time to invest, time to sell

Most Investors know well when to invest in an asset, i.e. purchase a stock (or property / other assets). Yet, it is just as crucial to know when to sell.

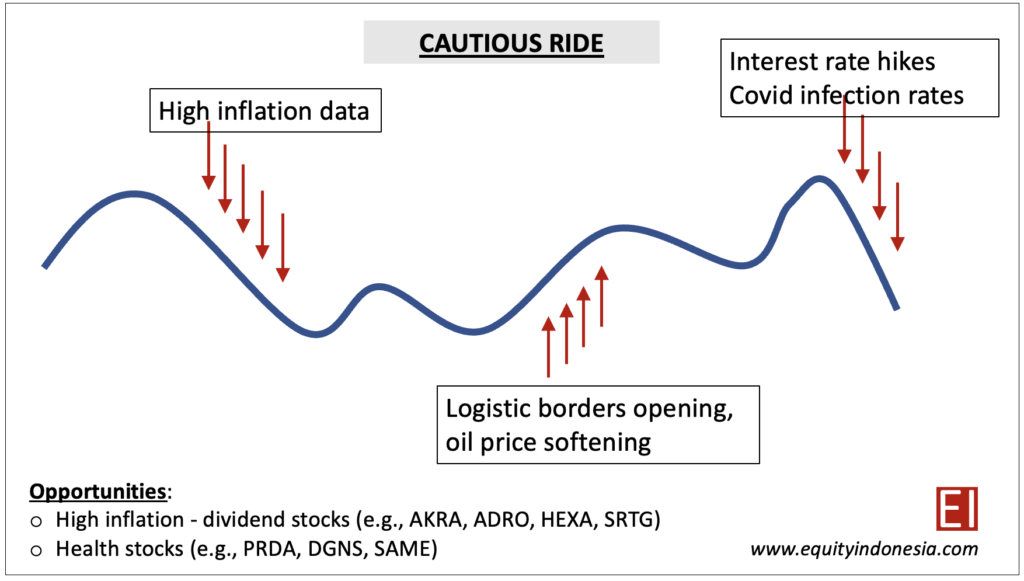

Asset value will always go through the cycle of ups and downs.

Invest when e.g.:

- The market is at the bottom (identifying the bottom is another matter to be discussed in the future).

- The external factors (e.g. interest rates going down, government stimulus, green energy push) are supporting.

Sell when e.g.:

- The target price of the asset is achieved.

- The paper loss becomes unbearable. Nothing is worse than looking at unrealized loss for a lifetime.

- If an Investor is certain of the value of an asset, selling at a loss and later buying the asset back at lower price means cancelling out (or even profiting) from earlier loss.

Time to slow down, time to be aggressive

When driving, always be aware of the traffic.

Drive slower when the traffic is high or danger is present, to avoid crashing.

Drive faster (less than speed limit of course) when on a low-traffic highway roads; otherwise others will take over.

“The best chance to deploy capital is when things are going down.” Warren Buffett.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.