Share market downturns (declines) are inevitable. Free market will always have ups and downs.

Sometimes downturns can be prolonged for 1-3 years. However, most of the times they happen within short periods (few days or weeks) due to market sentiments or correction from overshoots.

As such, several strategies can be deployed:

1. Hedging

Hedging position does not have to be outside the share market (e.g. buy gold, foreign currencies). It can be within (e.g. buy gold mining stocks).

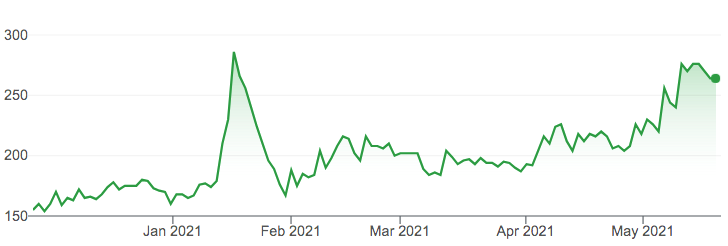

For example, MDKA ANTM (companies with gold mine operations) actually thrive during this uncertain times.

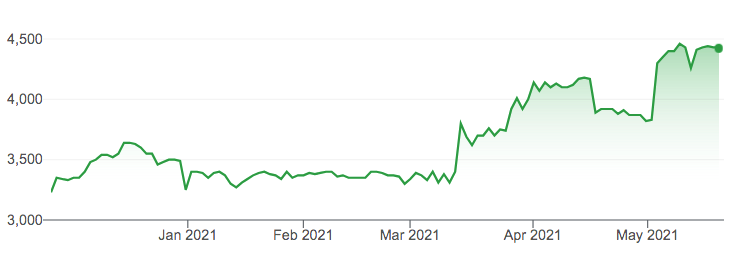

2. Identify opportunities

Not all industry is having bad times. Some medical and manufacturing companies have performed better than previous years.

3. Defensive stocks (high yields)

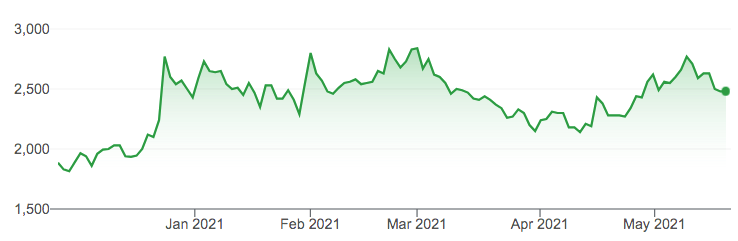

Understandable that defensive stocks are also affected by the downturns. Yet, compared to the rests, they are maintaining strong footholds at certain levels.

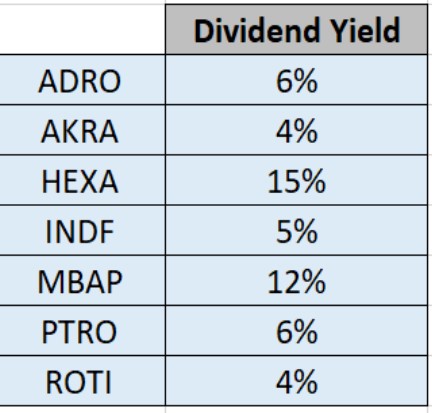

High yields can provide some consolation. The cash keep coming in. Some companies that have consistently provide good yield, yet low risks:

4. Damage control

What is best and safest action if a ship is sinking? Evacuate. Let the ship sinks, buy another ship.