Investing in Start-Ups is a risky move, yet if successful it pays off handsomely. Often, a Start-Up seeks initial funding from VCs before going public through IPO.

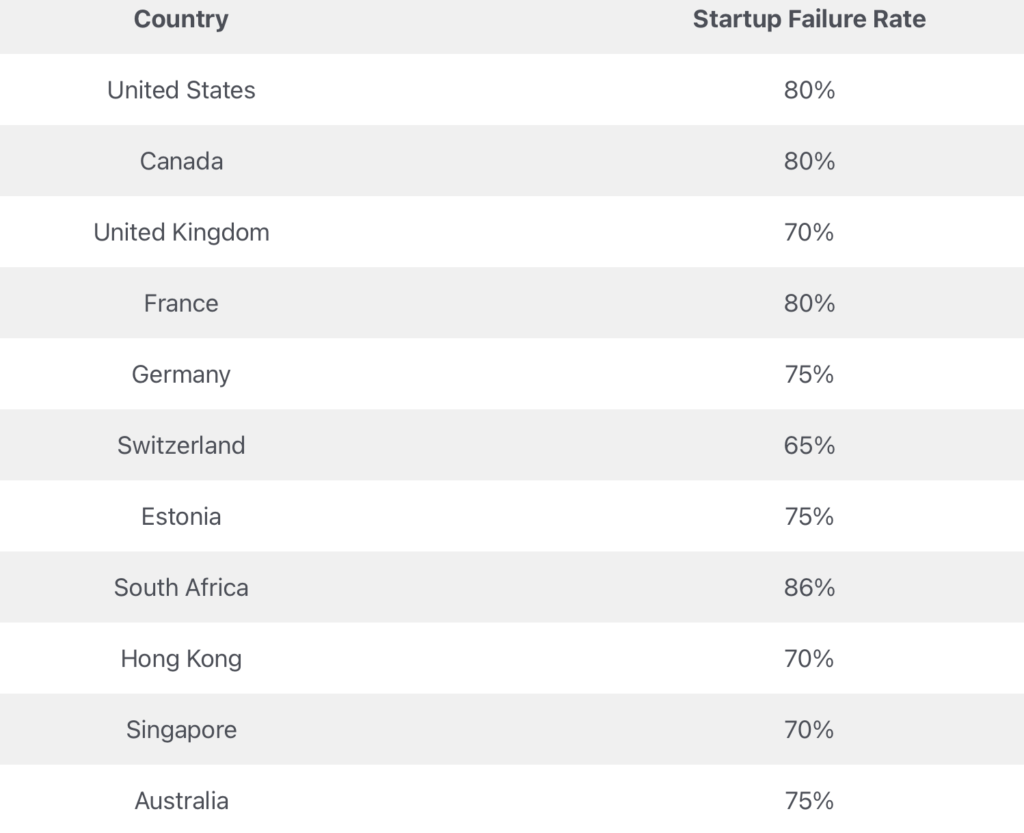

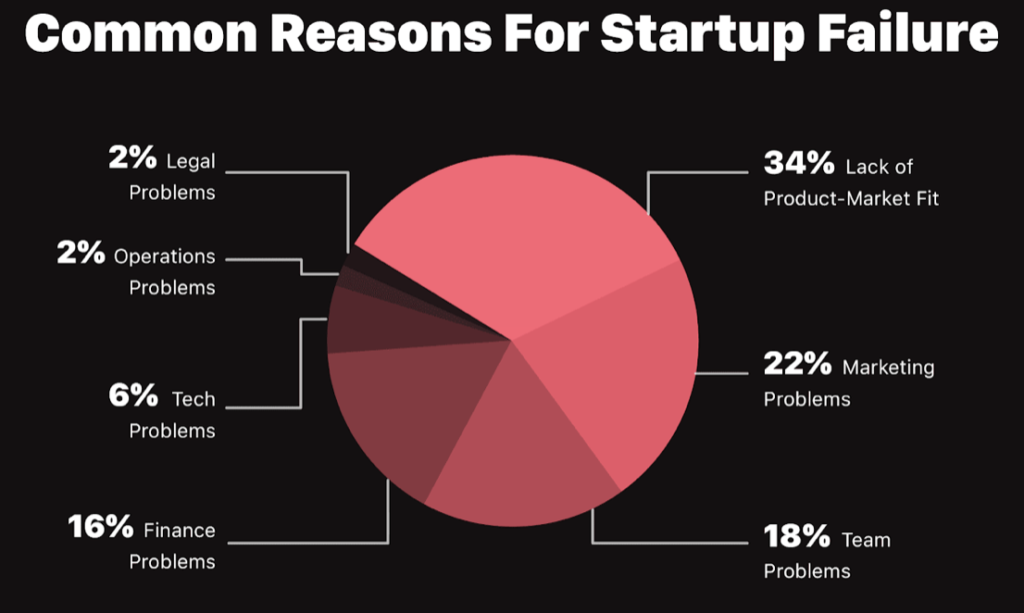

It is generally understood that 9 out of 10 Start-Ups fail for various reasons. This happens to even most advanced economies.

Why VC’s (Venture Capitals)

Early phase growth of Start-Ups is always associated with cash burn. For Individuals and Angel Investors, their pool of cash is limited. And, without path to profitability and consistent growth, IPOs won’t be successful.

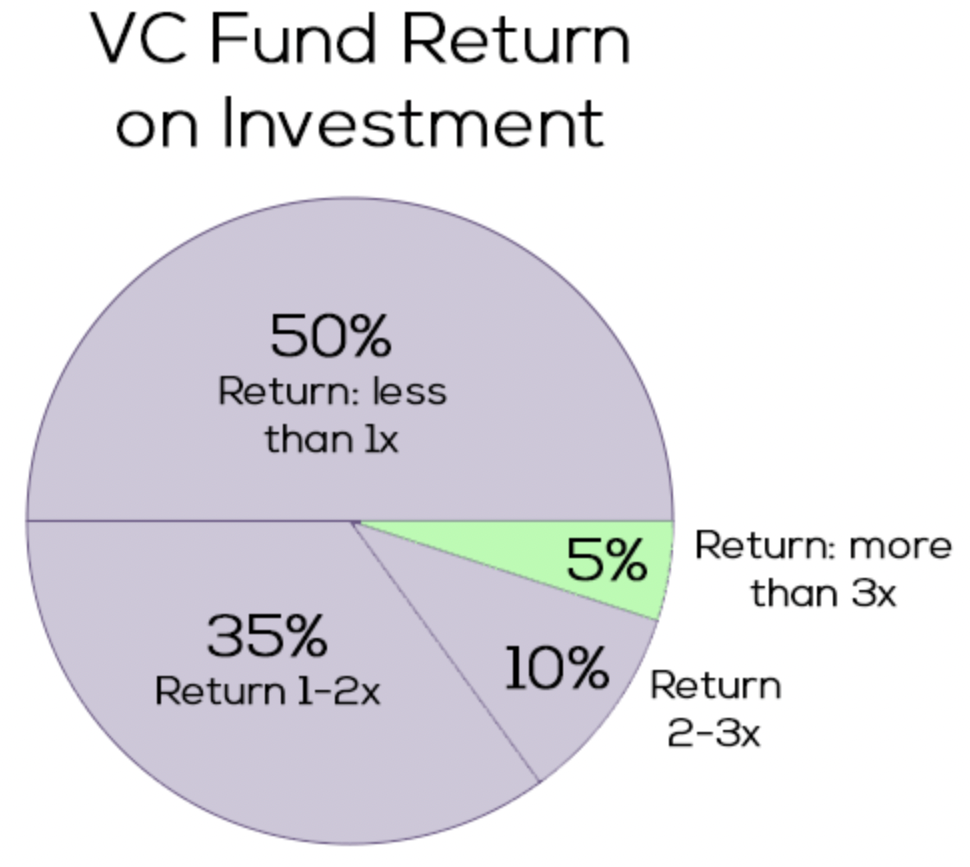

VC’s have the cash and the disposition to sustain losses for 5-10 years. Hence, it is reasonable that these VC’s expect over 50% – 500% gain from their investments if successful, considering the risk of losing their money is high (remember, 9 out of 10 Start-Ups fail). Even the best performing VC’s need to diversify their portfolio.

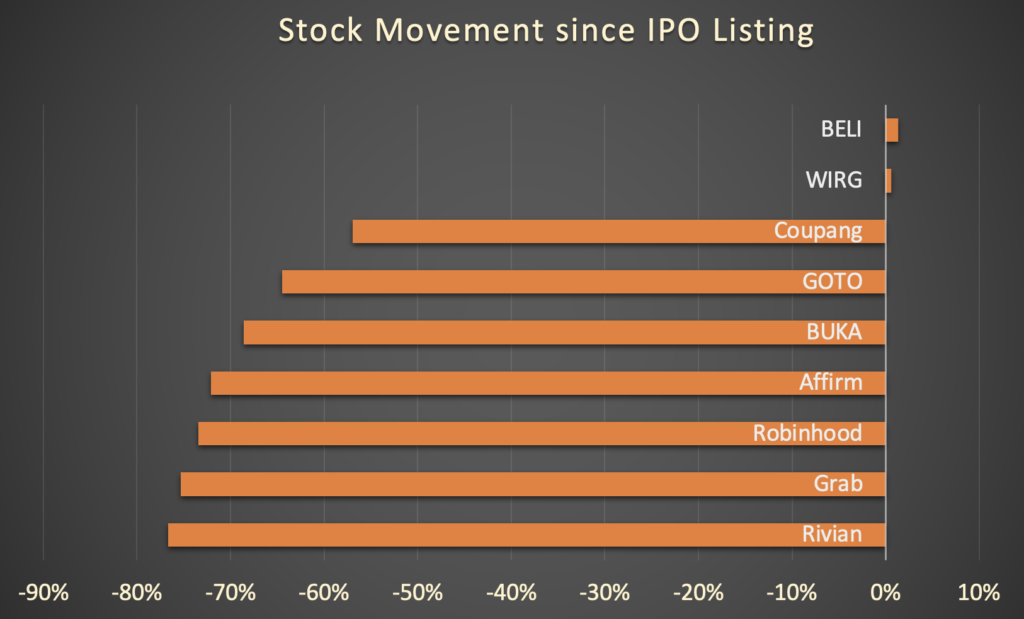

Sky-High Valuation

When publicly listed, the valuation of a Company is dictated by the market. It applies to a Start-Up Company as well.

The case of a few Start-Up stocks’ going under their IPO price is conceivable.

Exit or Stay

In the past, it was a common practice for a VC or a founder to cash out after a short period of IPO.

However, for those that genuinely believe that the Company has long way for sustainable growth, it is sensible to maintain their share ownership until the business matures.

For instance, Softbank’s Vision Fund and Alibaba’s Capital Partners still hold significant ownership in their Start-Ups post IPO’s.

Layoffs

It has never been an easy decision for layoffs.

For those Start-Ups that failed miserably, everyone is affected.

For those Start-Ups that barely survive, most are affected. The remnants could be just buying time until closure of business.

For those Start-Ups that continue growing and able to secure more funding (via VC’s or IPO’s), layoffs might still happen during consolidation and restructuring.

Regrettable, it is. For highly skilled professionals, looking for new opportunity shouldn’t be an issue. Sometimes, even better one that rewards more.

Leaving behind, they ought to be proud of what have been achieved. They kept the economy humming during the pandemic.

With the inflation and interest rate hike appear to be in control at the moment, maybe there’s a glimpse of hope for the rejuvenation of Start-Ups.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.