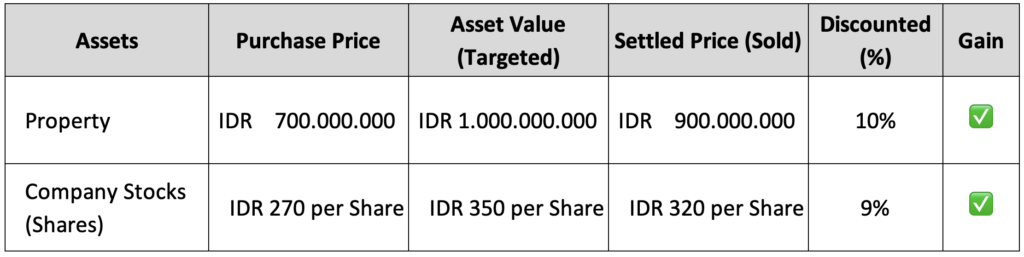

“Know your investment assets. Know how much it is worth, then sell at that price.” Quite often we heard of these words. There is nothing wrong if one chooses to follow this principle. Premium branded items are rarely discounted for sale, anyway.

Nevertheless, there are some Investors who choose different path, i.e. settling for less.

Why would an Investor sell the assets at discounts from target price?

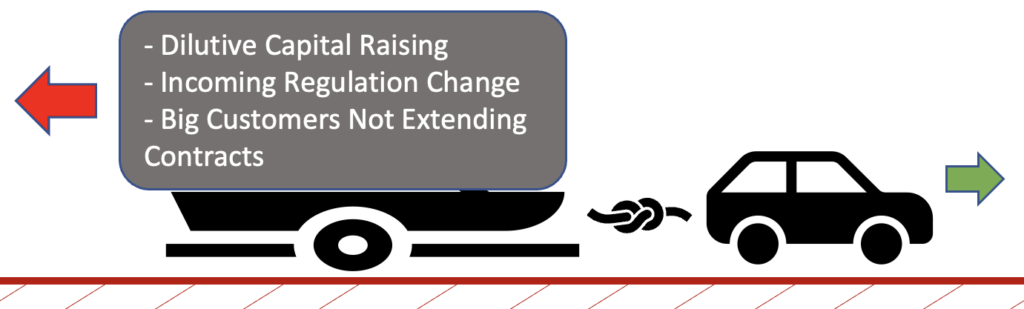

Imperfect Analysis

Maybe you just don’t know your asset well enough. Sometimes deep analysis is not enough. There are many factors that lurk underneath capable of dragging an asset from going forward.

Market Shocks

Even some professionals from huge financial firms are unable to forecast market shocks. Numbers and charts are useful mostly in usual circumstances only.

There last 3 years have witnessed 3 events that cause market shocks:

- Geopolitical event that causes energy market shocks.

- Pandemic event that causes supply chain shocks.

- Inflation that induces interest rate hikes, i.e. increased mortgage payments etc.

Companies Underperform

The pricing of products & services performed by Companies can be heavily dependent on fluctuating market price. For instance:

- Coal price for Coal Miners

- Container rates for Shippers

Another common reason for underperforming is poor risk management. For instance:

- Poor inventory management

- Raw materials supply disruption

Ample Liquidity

Cashing out investment assets early will improve liquidity. This allows an Investor to buy assets at extremely low-price during market downturns.

Just have to be mindful of the opportunity cost by holding cash for too long.

Ultimately, the idea of ‘settle for less’ strategy should foster peace of mind. Not the opposite.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.