Year 2022 marks the third year of pandemic. While it is conceivable that the global economy was adversely impacted; it is also remarkable how resilient most economies (including Indonesia) have been so far.

Henceforth, what can Investors expect in 2022? Will the tiger roam?

Commodities

The country has enviable natural resources needed as raw materials for electronics, high-end metal products, conventional & renewable energy, etc. Nickel, copper, coking coal, bauxite, to name a few.

Post pandemic, expect huge spending on infrastructure, renewable energy and consumer products.

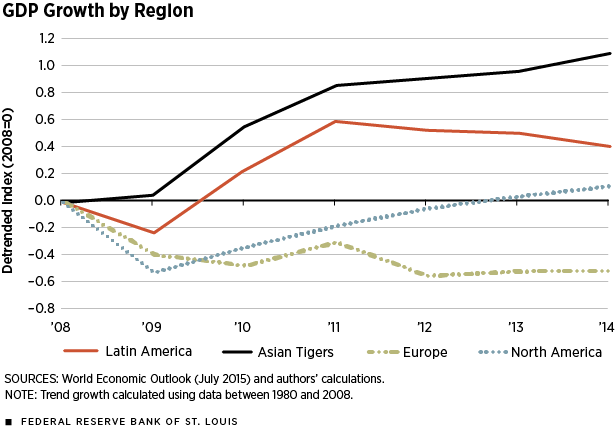

Referring to the aftermath of the 2008 financial crisis, some major Asian economies have witnessed significant growth over other economies.

Associated stocks: ADRO, HRUM, MDKA, ADMR

Digital ecosystem

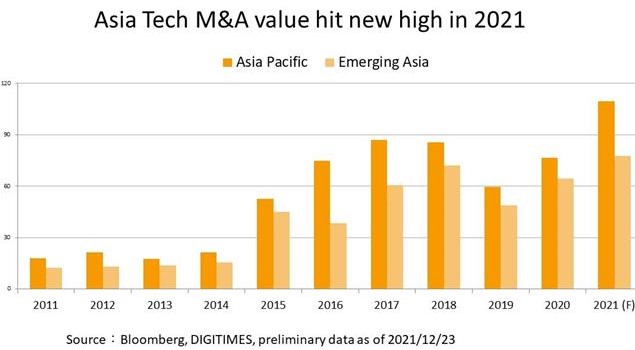

Winner takes all. Year 2021 has witnessed consolidation among start-ups. Expect for more M&A (mergers and acquisitions), particularly within the technology sector.

Associated stocks: SRTG, ARTO, MTDL, BNBA, MLPL, BBHI

Supply chain

Digitalization of the economy requires the betterment of supply chain management.

Inclusion of supply chain in the digital ecosystem mean there are huge opportunities for logistic companies that serve the e-commerce platforms.

Associated stocks: ASSA, SAPX, TNCA

Inflation

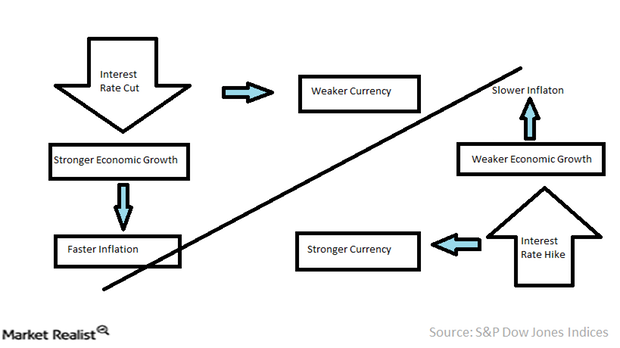

While economic growth is crucial, containing inflation is just as vital for public welfare.

Increasing foreign investment (and capital repatriation) may strengthen the IDR currency, inducing more imports in goods & services.

In turn, the interest rates would need some adjustment later to contain the inflation.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.