What appeared to be temporary macroeconomic condition previously; now is more likely to be permanent as evident by high inflation and high interest rate. Households are saving less, but they are not necessarily spending more in terms of quantity.

There is no better time than revisiting whole portfolio and reshuffling to adjust to the new environment.

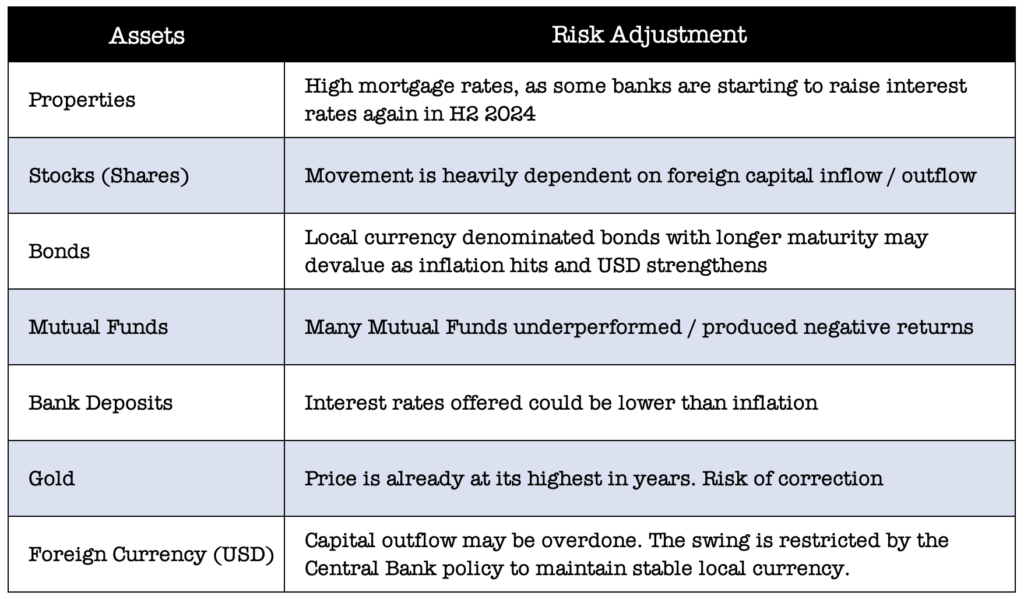

Risk Management

The risk profiles of most investment assets have shifted lately.

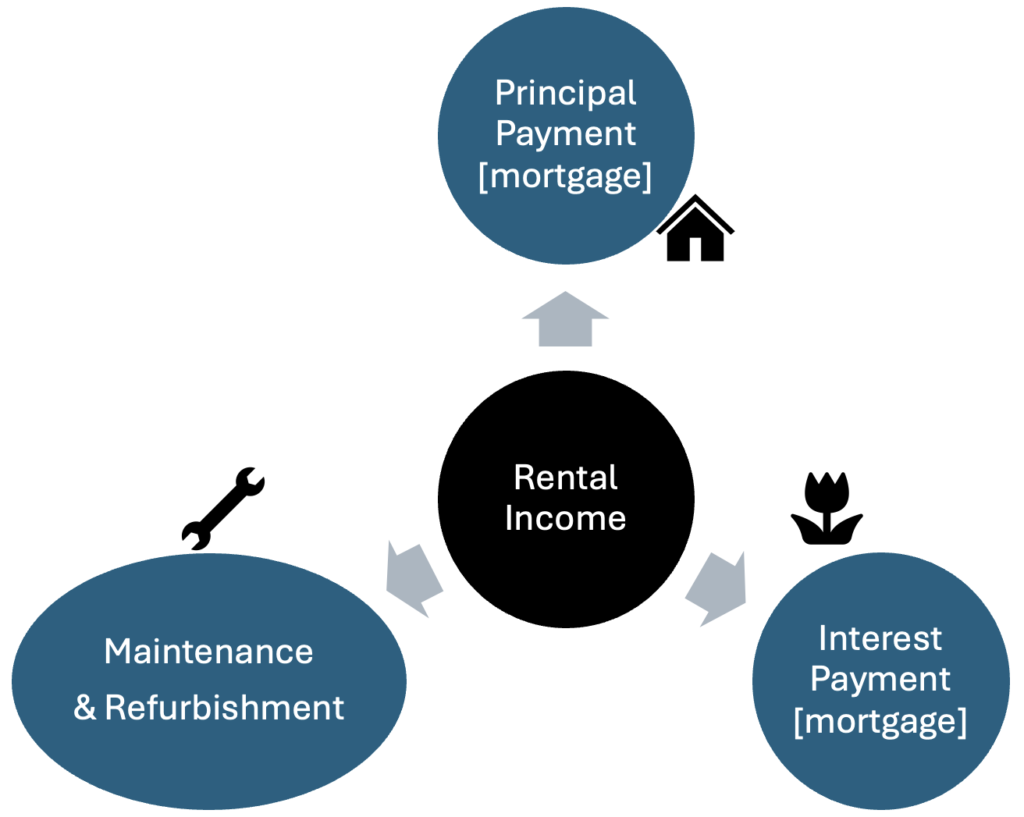

Money In, Money Out

At a time when liquidity is extremely tight, cash flow is extremely crucial.

Every asset should be cash generating on its own right, rather than relying on cross-subsidy from other assets. Property asset is not an exception.

More Ownership to Manage

Lack of financial acumen skills should not be an excuse to delegate the management of portfolio.

Consultants / Advisors, Mutual Funds, Investment Managers, Wealth Managers, News, Peers, etc. are just tools. Ultimately, the decisions to invest [where, when, and how much] hinge on the money owners.

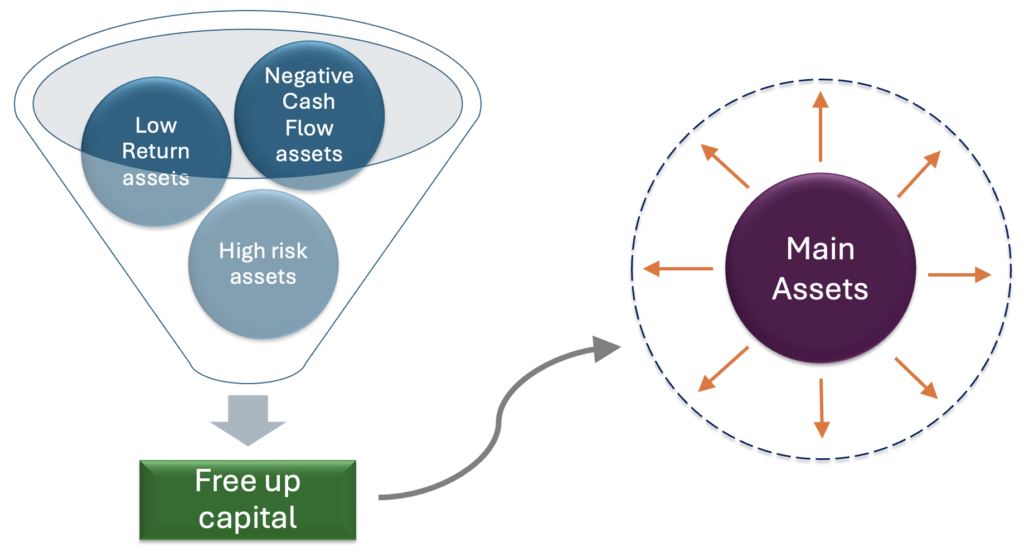

Less is Better

Sometimes, focusing on just a few investment assets may generate better returns (%) than having more assets.

Companies that have grown larger over the years tend to divest some of their smaller assets that are not producing as much return (%) as their main businesses. This applies to individual Investors as well.

The freed-up capital can be used to strengthen cash flow and more importantly, grow the main assets.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.