The market is swamped with nickel supply. The price has dropped by nearly half since the start of 2023, although it rebounds little bit lately.

How do we even get here in the first place?

New Projects

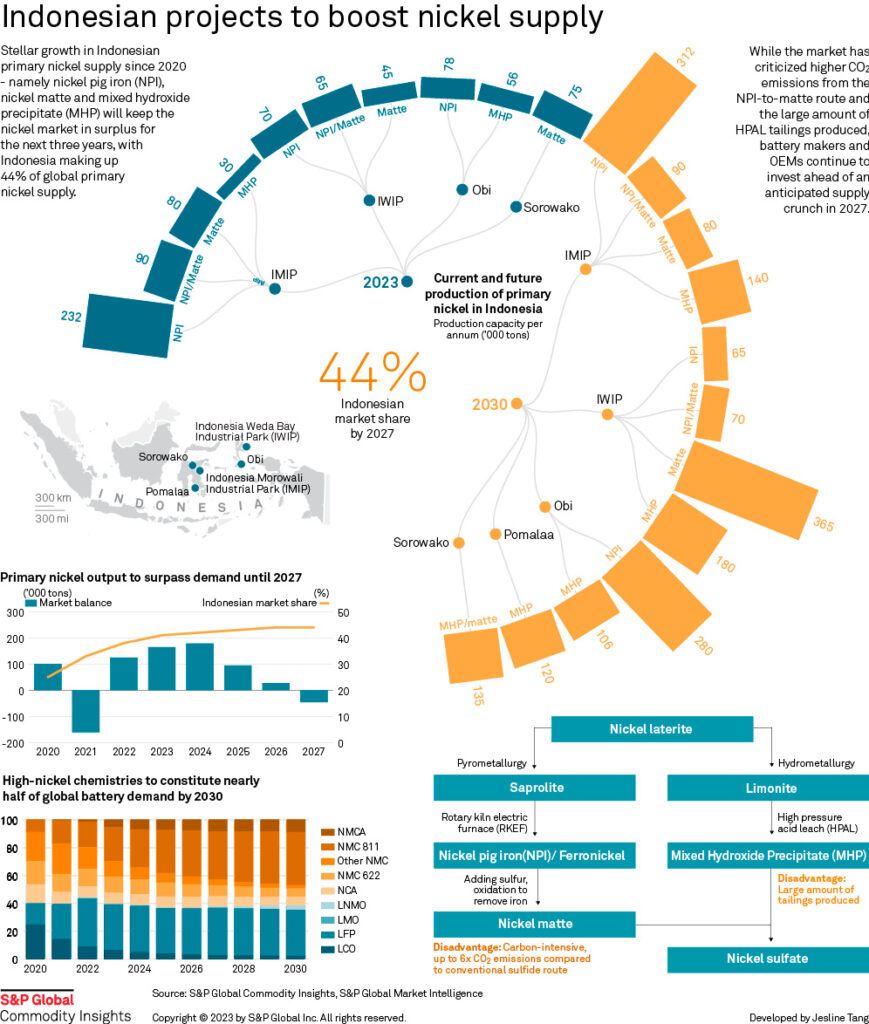

In 2021, the country already has 37% share of nickel mine production globally. By 2027 the market share will grow up to 44%, with new projects coming online.

Back in 2022, the potential oversupply seemed to be anticipated, when a huge short position was made by a leading nickel producer leading to a fiasco in the LME market.

Environmental Policies

Policies for getting more EVs on road are inevitable.

However, the shift can be too hasty. Automobile companies obscurely rushed to secure EV batteries and some even went as far as sourcing the upstream raw materials (e.g. nickel).

This creates a boom in not only new, but also bigger nickel mines and smelters. As one [Reid Hoffman] says, “first mover advantage doesn’t go to the company that starts up, it goes to the company that scales up.”

Alternatives

No commodity is indispensable. Nickel is not an exemption.

EV batteries

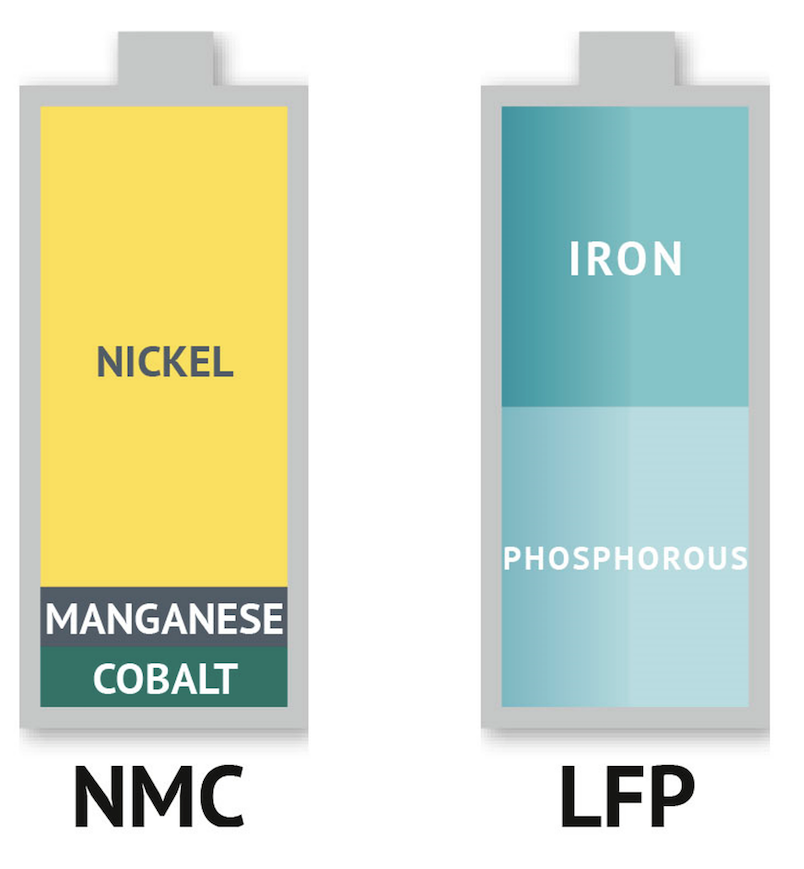

Production of EV batteries without nickel are possible, in LFP (Lithium Ferro Phosphate) type. As well, the LFP lifecycle costs are quite competitive compared to NMC type.

Stainless Steels

Stainless steel can still be produced with less nickel. Manganese and nitrogen can fully replace nickel for certain SS series in Austenitic Grades.

In fact, the SS’ Martensitic Grades (fasteners, pumps, automotive applications) and Ferritic Grades (kitchen wares, furnaces, water heating appliances) have nearly zero nickel in it.

Effect

At current price, a big chunks of high-cost nickel mines worldwide are becoming unprofitable to operate.

For those that hold on, they have to contend with lower profits and consider production cuts. In December 2023, the nickel export value dropped by 4% MoM and export volume dropped 14% MoM.

There may be some financial reprieves and incentives given to these companies, considering potential job losses from the nickel downturn.

On the positive side, customers should ultimately benefit from more affordable end-product [EV’s, steel] prices.

Eventually the nickel industries will consolidate and balance out. Still, it could take years for the full price recovery.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.