One measure of a healthy economy is when Businesses are doing well. Despite challenges arising from weakening global economy and trade war, local Companies perform solid as ever.

Let’s take a snapshot from the Q1 results of LQ45 Companies.

Basic Materials

With the exception of AMMN and SMGR, most Basic Materials Companies have performed strongly relative to Q1 2024.

Understandably, AMMN is progressing through the next phase of mine. It could take months before the money kicks in.

As for SMGR, it is adversely affected by lower spending in infrastructure and buildings construction.

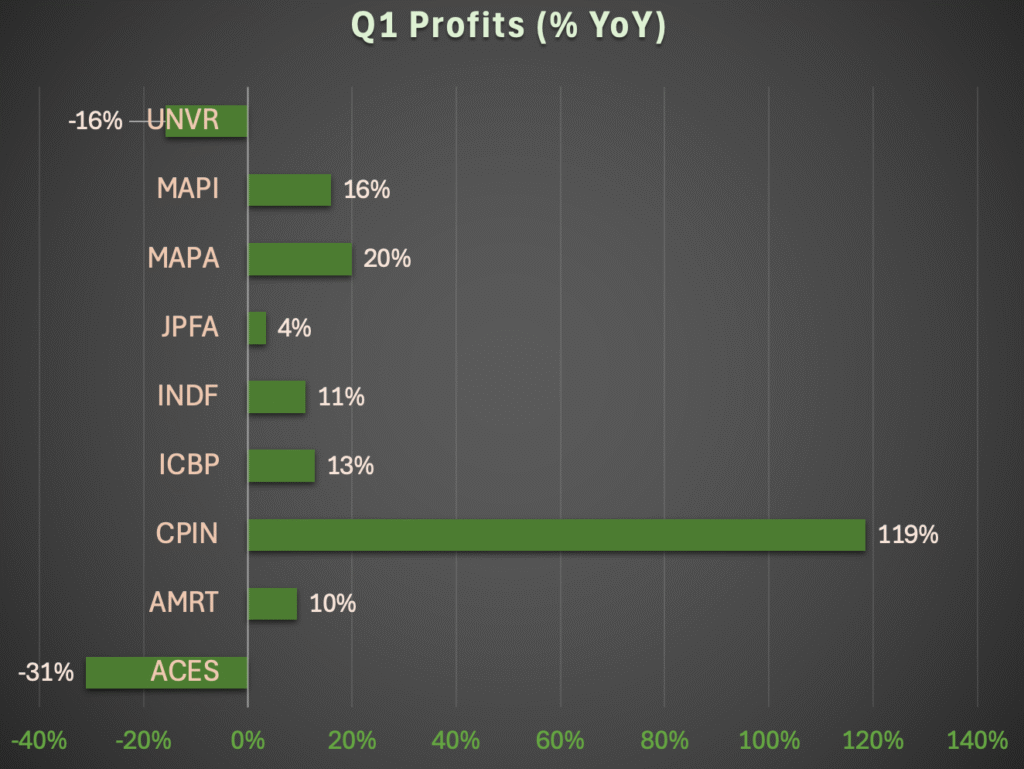

Consumer

Despite all the talks about sluggish consumer demand, it is not shown in the profitability of Consumer Companies.

6 out of 9 Companies reported double [to triple] digit growth in profits.

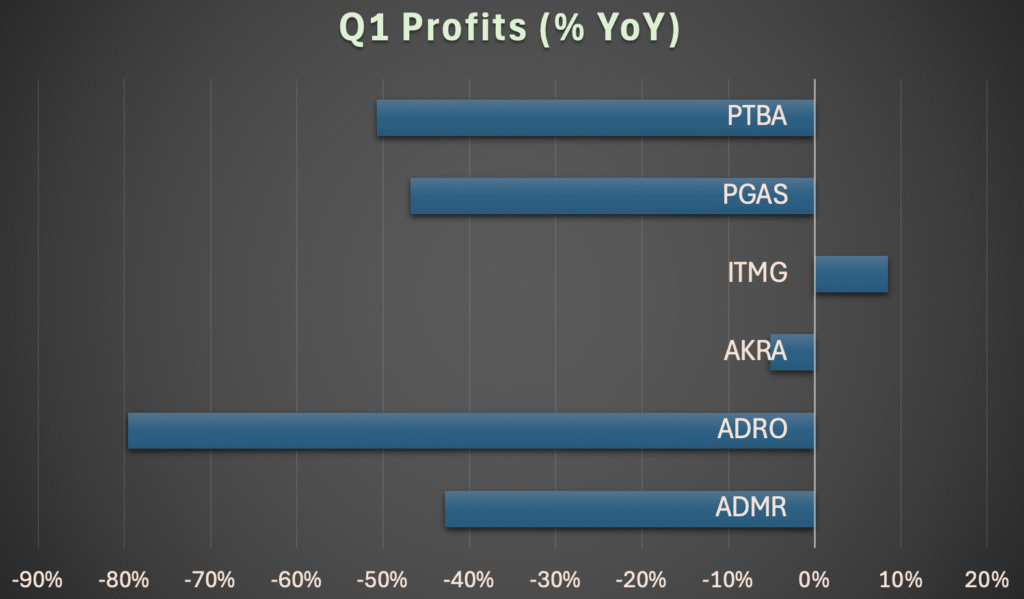

Energy

Considering how much energy prices have dropped in the past few months; it is no surprise if the Energy Companies see their numbers dropped significantly.

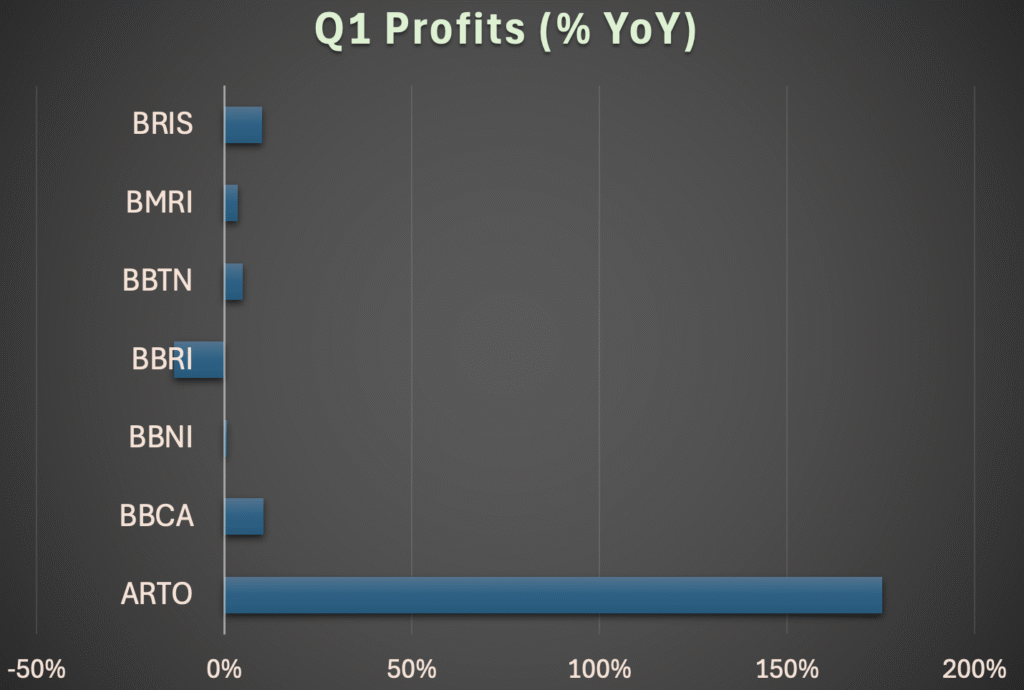

Financials

Although credit growth in mortgages have slowed down, most Big Banks are surfing through.

Remarkably, BBCA still reports double digit credit growth in all segments (corporate, commercial, SME, consumer, and mortgage).

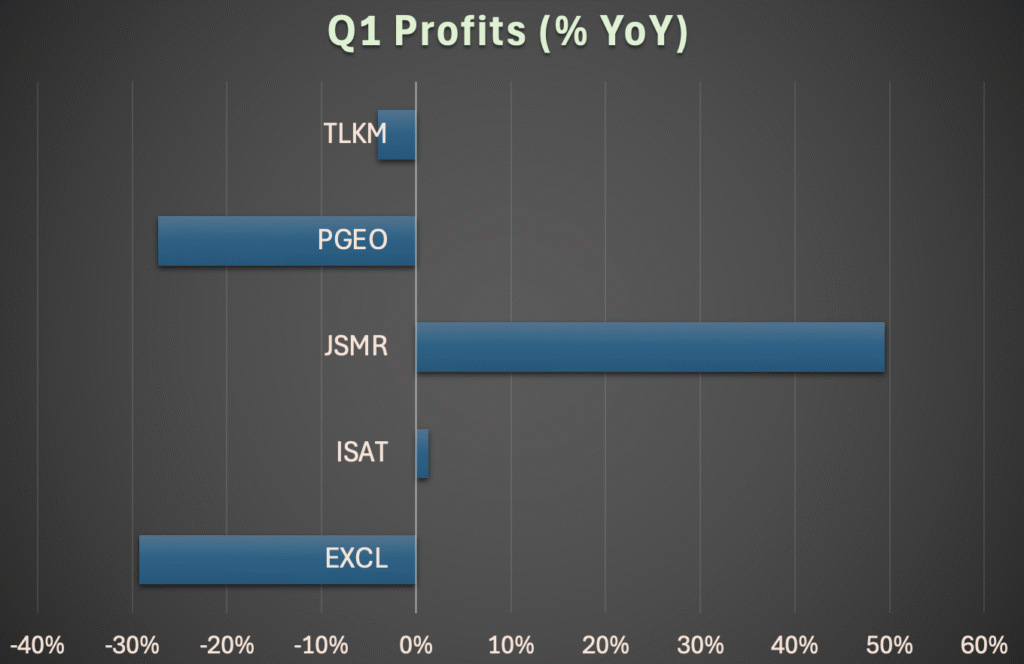

Infrastructure

Spending on infrastructure has not picked up as budgets are being shifted to other sectors.

Yet, revenues and profits have been holding up with little changes.

It appears that most large [LQ45] Companies are shielded from geopolitical volatility, owing to resilient domestic demand.

As the Q2 is halfway through, the economy will only improve from hereon after the decision by Central Bank to drop the Interest Rate by 25 basis points.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion ONLY. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification as deemed necessary.