Inflationary pressure impacts on nearly everything. Property is no exception.

1. Construction Cost

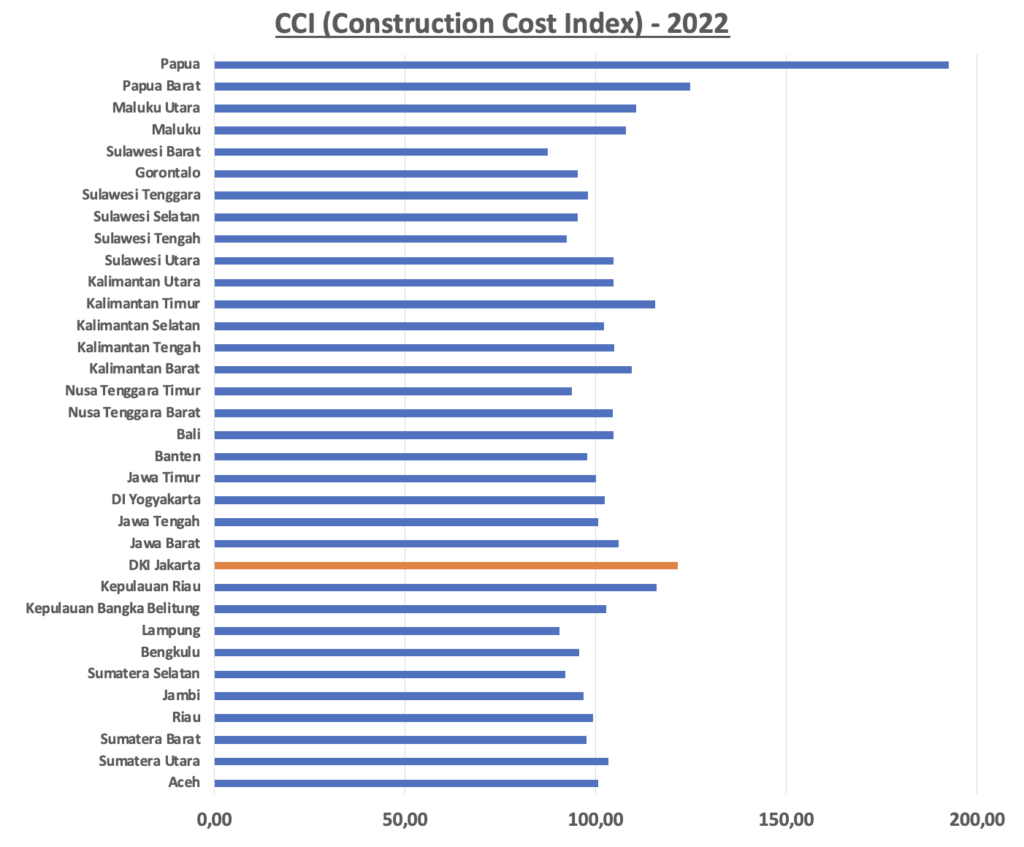

Construction cost varies among cities / towns. It is felt most in the capital province (DKI Jakarta), where the cost is the third highest in the country.

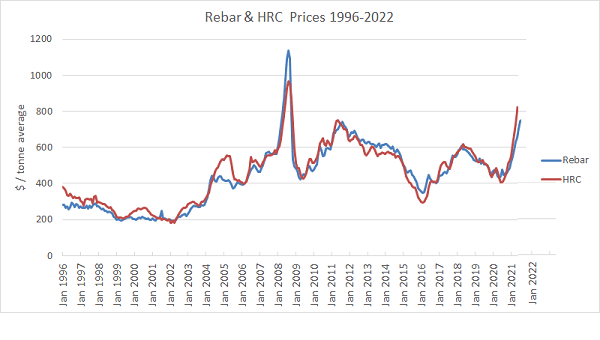

Doubling of steel price between 2020 to early 2022 (in addition to other materials cost such as cement) also contributed to the cost escalation.

2. Mortgage Rate (KPR / KPA)

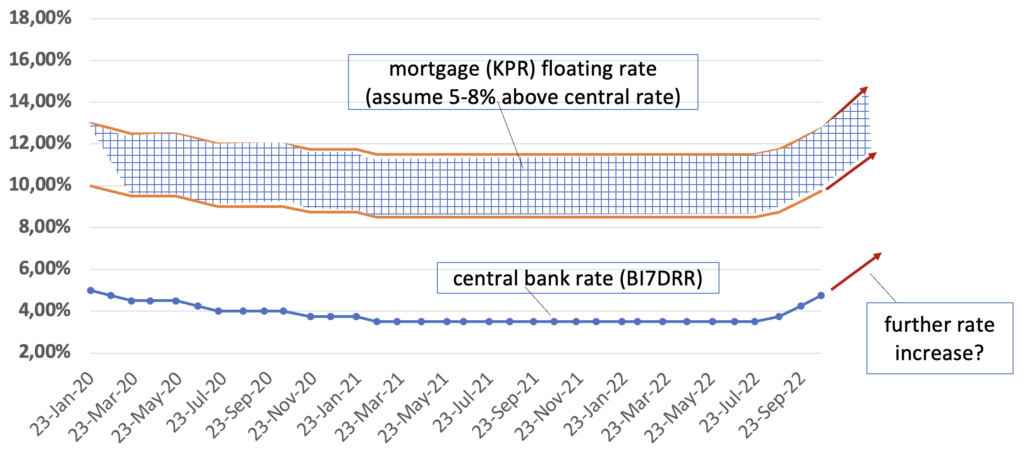

Across major lenders, the mortgage rates have increased in line with movement of the central bank’s interest.

Considering high interest margin charged by the lenders, combined with the expected increase in central bank’s rate (BI7DRR) for the coming months; expect some mortgage stress in the market.

Then, is Property Investment still attractive?

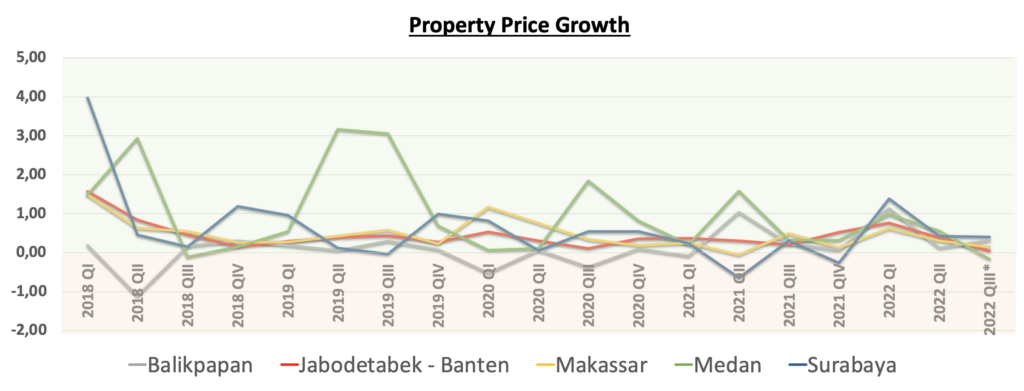

It appears that property price is still growing positively in major cities, although at a small margin only.

Still, from the point of view on investment worthiness, one needs to consider whether the overall return from capital price growth & rental yield is greater than the mortgage rates.

Whichever angle we look at it, high inflation and high mortgage rates are here to stay. One reason to keep faith in property investment is that it might be a safe haven compared to volatile stock market.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification as necessary.