For some Investors with short term view on stock trading, Technical Analysis (TA) is commonly used as a tool to identify opportunity to enter and to exit.

This methodology studies historical market data to predict future movement of stock prices.

Nevertheless, there are pitfalls of relying on technical analysis to invest in stocks.

1. Overanalyze

Similar to some academic studies, TA sometimes deploys technical tools (e.g. Bollinger Bands, Stochastic Oscillator) that are just irrelevant. Or simply, one does not know how to use these tools properly.

If any, historical data used by TA does not accurately predict future movements at all.

2. External Factors

There are numerous external factors that can directly affect movement of stock price, namely:

- Broad stock market movement

- Currency exchange movement

- Competitors’ corporate action

- Central banks’ interest rate movement

- Natural disasters

- Supply and demand movement

These external factors often overweigh technical analysis that relies purely on historical data. For example, recent global energy crisis has improved several coal stock prices by the order of 50-100% in 2-3 weeks, which is most likely unforeseeable by Technical Analysis prior to that.

3. Oversight of Company Performance

TA is not fundamental analysis of a Company.

At any stage, TA may produce negative indicators on a Company which has double digit growth, negligible debt, and profitable.

Purely relying on TA without fundamental analysis warrants an opportunity loss.

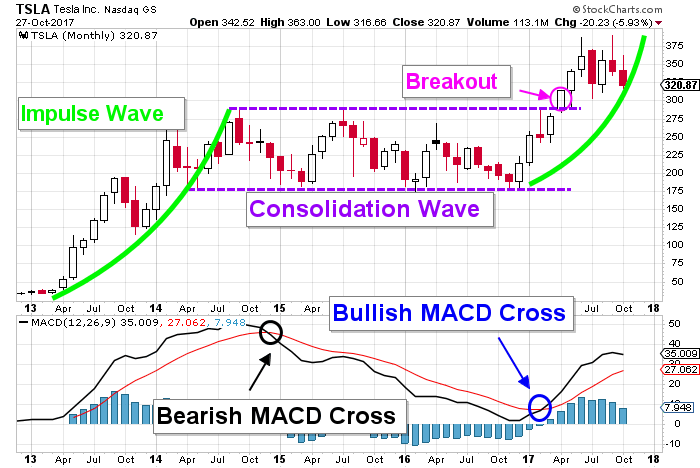

An example is a TA on Tesla stock (NASDAQ: TSLA) back in year 2017. This TA ignore potential growth of Tesla company. An Investor who rely on TA (to buy and sell several times) might have missed the opportunity of making over 1,000% return in TSLA stock by year 2021.

Still, TA can be a powerful tool for those Investors that know how to use it and when to use it.