Year 2022 commenced with high expectation in the equity market. The pandemic was about to subside, demand was about to rebound.

Midway through 2022, the expectation turned sour, due to inflation and geopolitical situation.

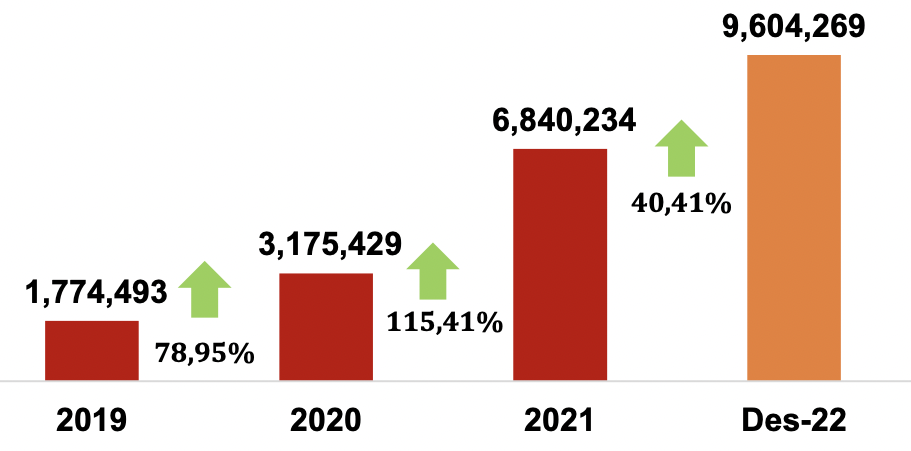

AUM and Investor Growth

More Investors joined the Mutual Funds, jumping by 40% within a year.

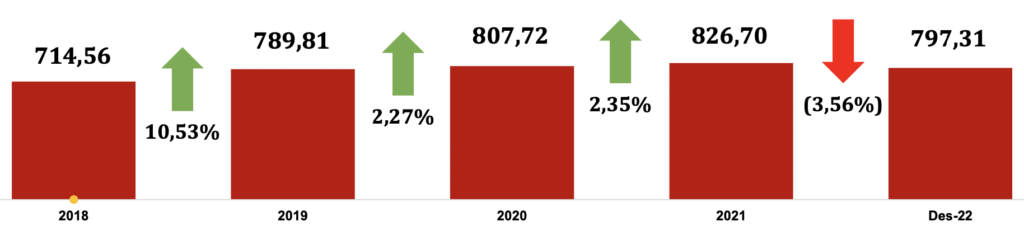

Despite the encouraging growth in Investor number, unfortunately the total AUM (Asset Under Management) is rather stagnant.

One main reason is due to underperformance of Mutual Funds. Another could be due to low confidence in third party managed funds after several infamous cases where Investors are unable to bail out (cash out) of their investments.

Mutual Funds Return

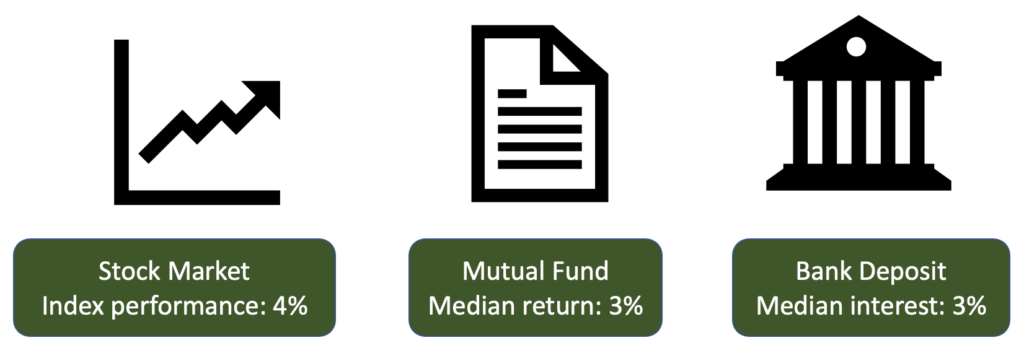

Year 2022 returns were not as good as the 2021. The median return was mediocre at 3%.

This figure is roughly the same as bank deposits’ interest. This just proves that higher risk does not necessarily produce higher return.

Not great return, but enough to keep up with inflation.

What to Expect in 2023

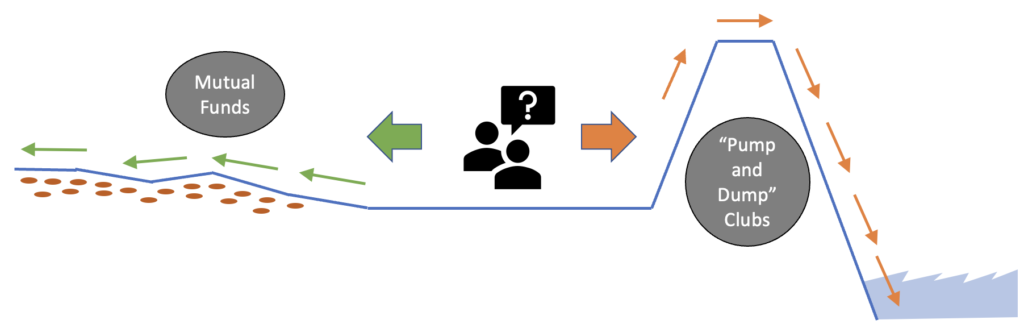

If the trend continues, more retail investors will join Mutual Funds while “high asset” investors could leave. Shy return is one reason for some to depart.

For most Starters in investment domain with little financial knowledge, Mutual Funds offer a better risk management than joining some “pump and dump” clubs.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.