Electric Vehicles (EV)

As the younger (future) generation becomes more environmentally minded, there is ever increasing demand for electric vehicles (EV).

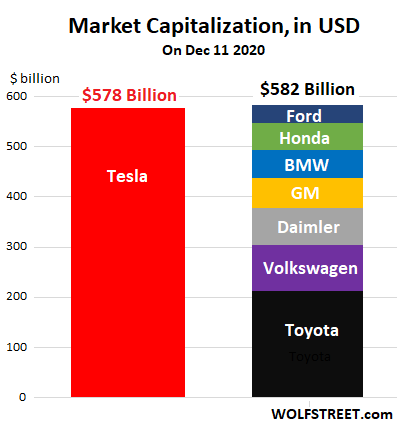

Although globally there are dozens of electric vehicle (EV) manufacturers, the largest one (Tesla) has higher market capitalization than most established vehicle manufacturers.

As a matter of fact, Tesla is currently valued (USD 578 billion) as much as Toyota, Ford, Honda, BMW, GM,Daimler, and Volkswagen combined.

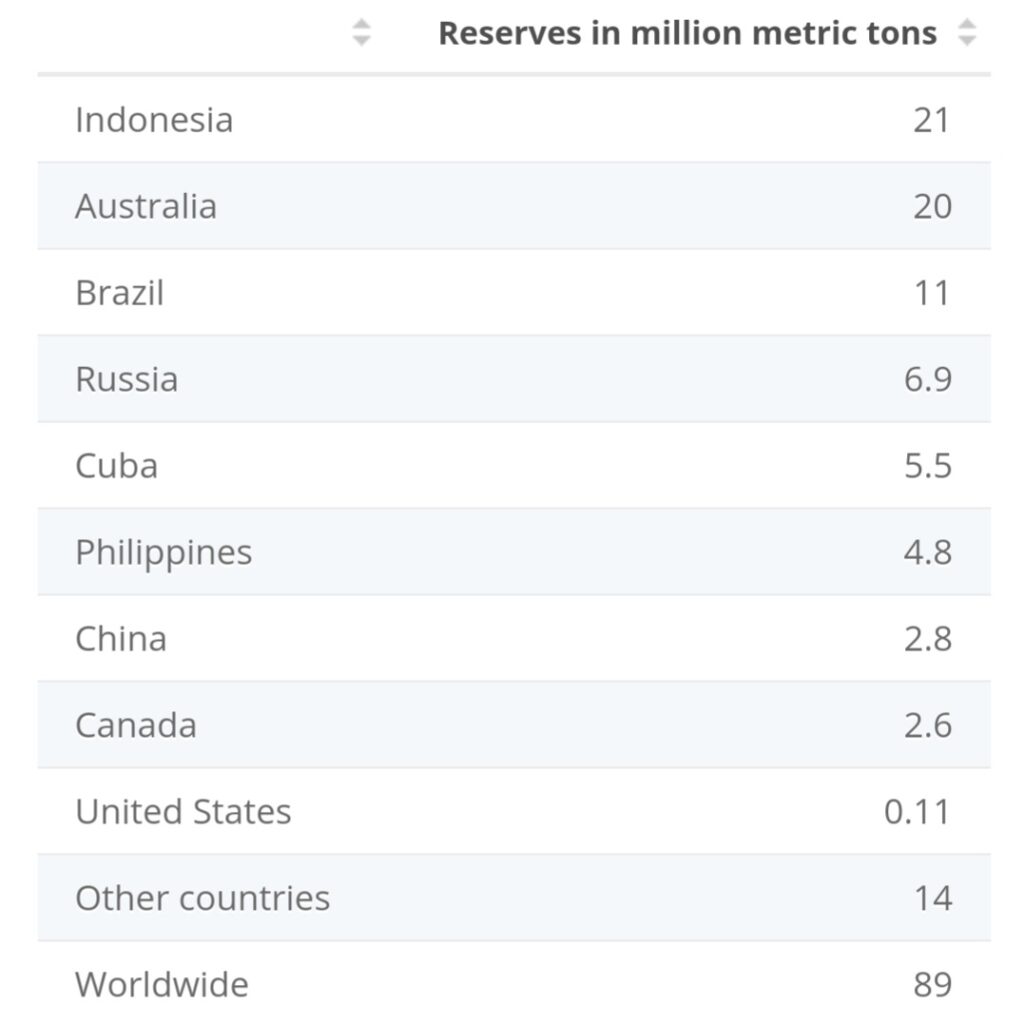

Indonesia currently holds the largest nickel reserves compared to other countries.

Antam (ANTM)

Other than gold (72% of revenue), ANTM is also a major producer of nickel (18% of revenue). As part of IBH (Indonesia Battery Holding), it recently signed separate agreements with global battery producers CATL (China) and LG Energy (South Korea).

The value of these agreements could be in the order of above USD 10 billion over the next few years.

Harum Energy (HRUM)

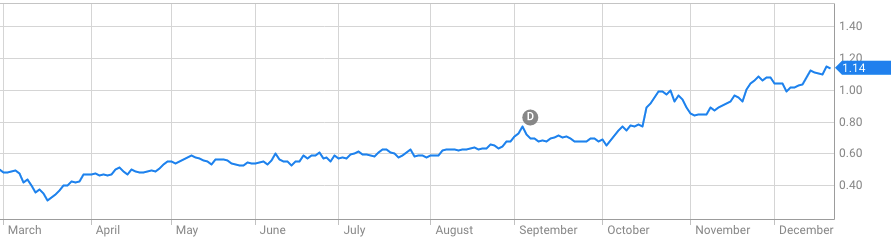

As part of diversification strategy, HRUM has added nickel business significantly to its portfolio. It recently added shares in Nickel Mines (ASX: NIC), making it one of major shareholders (4.88% of total shares issued).

Nickel Mines itself is in the process of acquiring an additional plant that will eventually double its production capacity, hence significantly improve its profitability.

As of 30 Sept 2020, HRUM has healthy balance sheet, with over USD 230 million of cash and cash equivalent. More acquisition or dividend could be in the pipeline.

Furthermore, as the share price of Nickel Mines increases more than 120% since it was first bought, HRUM’s net profit (2020) will be much higher than last year (2019).

Vale Indonesia (INCO)

INCO is owned by Vale (Canada), Inalum (SOE Indonesia), Sumitomo (Japan), and public. It operates some of the largest nickel mines and processing facilities in Indonesia.

In the first 9 months 2020, INCO generates over USD 570 million in revenue. Another nickel smelter is being planned, estimating to cost around USD 2.5 billion.