Sky is the limit for some Miners. Some publicly listed Companies have been increasing its presence overseas.

DSSA (Dian Swastatika Sentosa)

It acquired Stanmore Coal (ASX:SMR) back in 2020. In turn, SMR is about to complete its full acquisition of SMC / BMC, a tier 1 asset from mining powerhouse BHP & Mitsui.

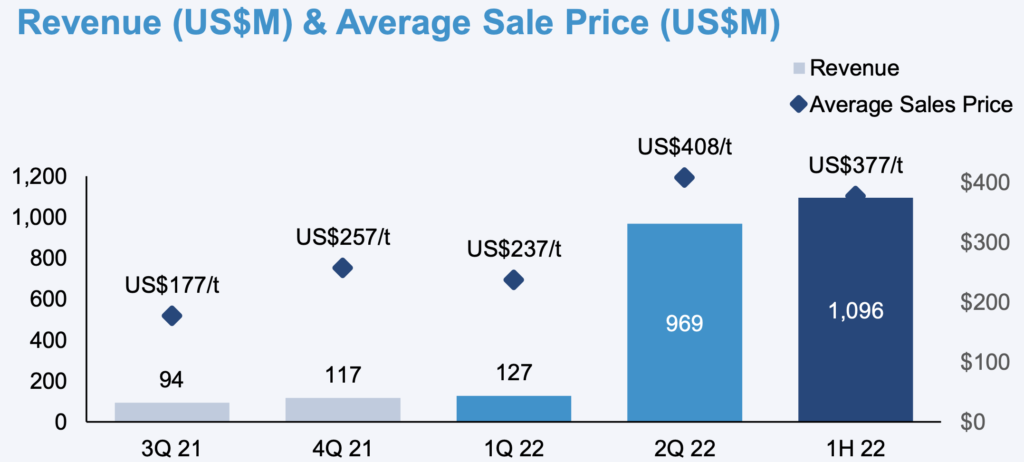

In H1 FY22 alone, SMR generated more than USD 1 billion in revenue.

DOID (Delta Dunia Makmur)

Possibly the only mining contractor that diversified to overseas operations. It acquired ‘Open Cut Mining East’ asset (coal mining contractor) from Downers (ASX: DOW) in 2021. It was later renamed as BUMA Australia.

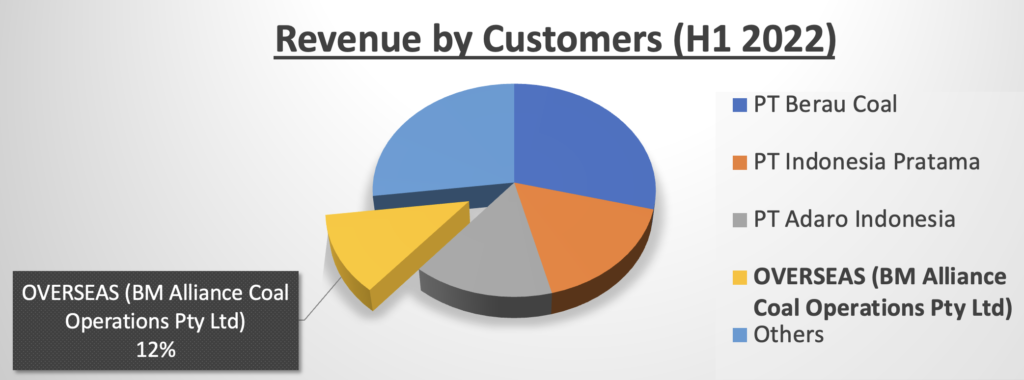

So far, DOID’s overseas business constitutes 12% of revenue in 1H 2022.

HRUM (Harum Energy)

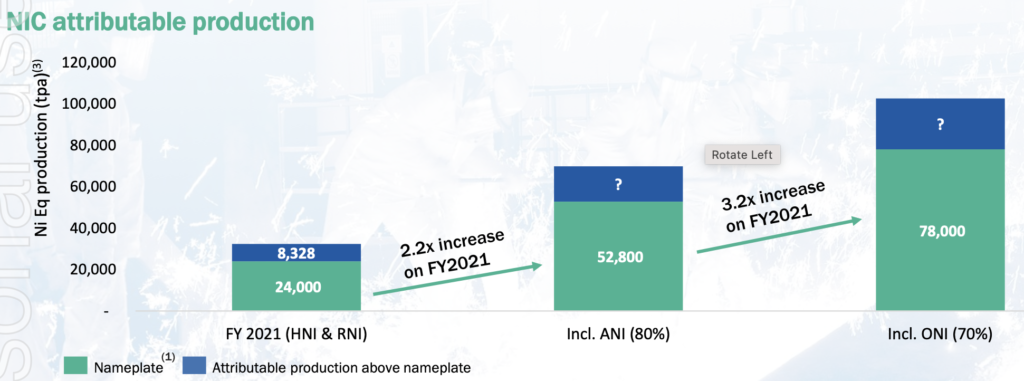

Cashed up from its coal mine operations, it gradually increases its investment in Nickel Industries (ASX: NIC) since 2020. Nickel Industries itself is a major player in nickel processing facilities in Indonesia.

NIC currently operates 4 RKEF lines and will expand into 12 RKEF lines. The past year has witnessed 50% growth in EBITDA.

ADRO (Adaro Energy Indonesia)

Being the largest coal miner in the country, it does not stop there. It acquired 80% shares in Kestrel Coal Mine back in 2018.

Although Kestrel’s contributes less than 15% of Adaro’s overall production; this asset generates close to USD 1 billion in revenue and gross profit close to USD 500 million in FY22.

Other acquisitions / expansions are not mentioned here since they are not publicly listed Companies.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.