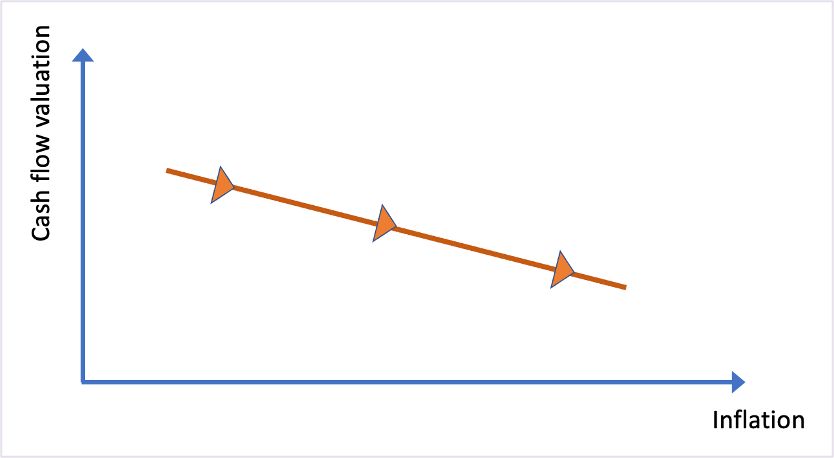

Inflation. Is it a big deal? Definitely. Previous article has covered a bit of this issue.

Other issues that could arise from high inflation:

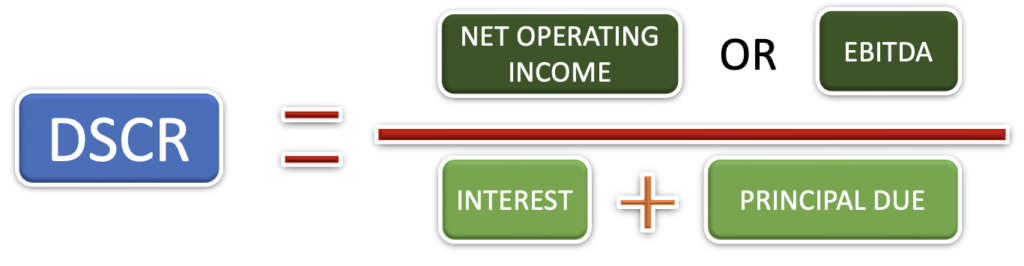

Cost of Debt

Interests on debts taken by individuals and corporations might accelerate up, leaving some unable to service their debt.

This is where DSCR (Debt Service Coverage Ratio) becomes very critical for Companies.

DSCR > 2.5 is desirable. Even better, there are Companies with negligible debt compared to its assets & cash generation.

Currency Movement

In times of crisis, major currencies such as USD tend to strengthen. This would induce higher cost for importing goods & services.

Nonetheless, it not a big concern for now; considering the IDR currency is quite stable as evidenced during pandemic period. During those time, the currency stayed mostly within the comfort zone (IDR 14000 – 15000 range).

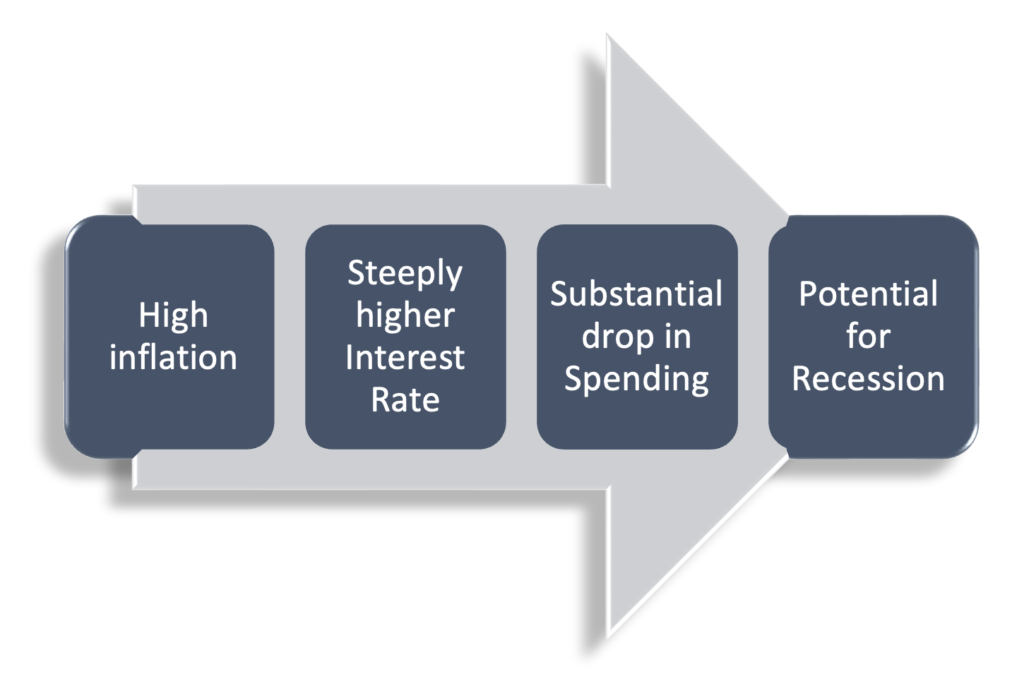

Recession

Even the economic superpowers are not immune to recession in the past. Higher interest rates are used to counter inflation, resulting in lower spending.

However, there has been no indication that the country will plunge into recession; with recent decision to hold 7-Day Reverse Repo Rate at 3.50%.

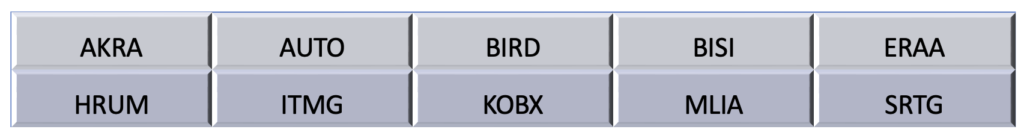

One remaining question. Are there still opportunities in this bear market? Yes, if carried out cautiously.

1. Buy the dip

As most people would do, a good deal is when a valuable item is sold at bargain price.

Notwithstanding that the asset price may still decline; the potential upside of buying the asset should still outweigh the downside risk. It is a matter of research and due diligence on finding those quality assets.

2. Focus on assets that might benefit from this bear market

Bear market is depicted in lower consumer spending on unnecessary goods, and more savings.

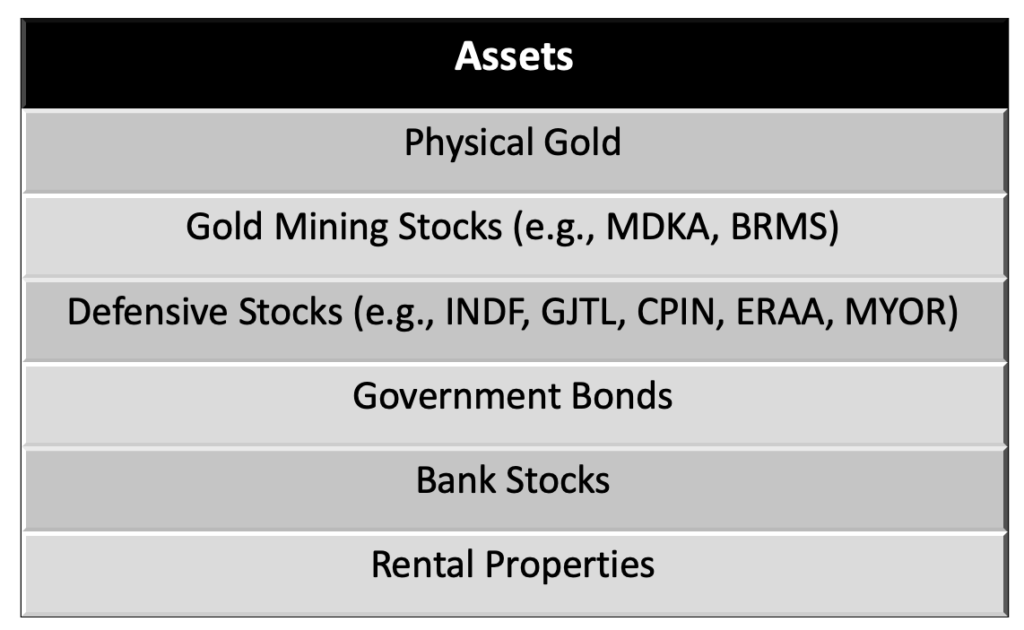

Some assets for consideration:

Even modest return of 2-5% should be generous enough for current market condition.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.