In the early 2023, many believed that the year would become a cornerstone for better life and economy.

Some made it as they thought it would be for them. For some (maybe majority), not so good as they expected.

Hedging against Inflation

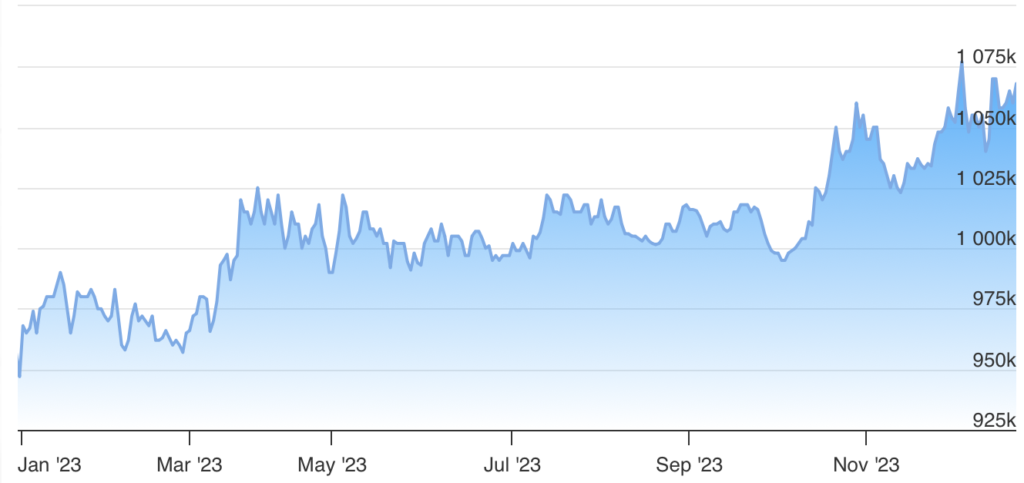

Against backdrops in the debt and stock market, more Investors pour into assets that hold value against inflation.

Golds once again become a safe haven for some. 11% gain so far, beating the returns of most Mutual Funds, Stock Markets, Deposits, etc.

Working Hard and Save

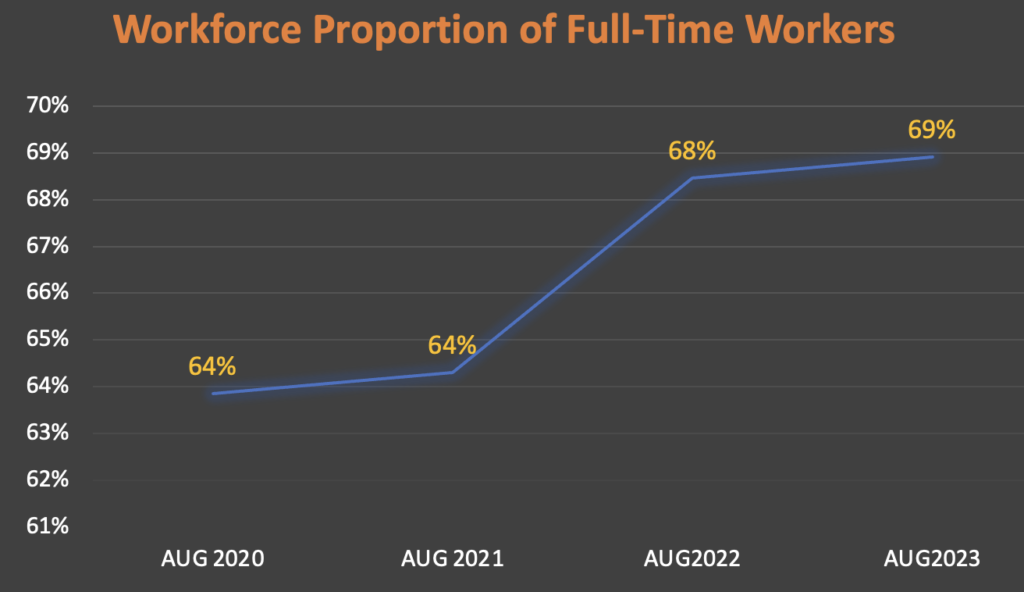

Younger generations that seek flexibility and perks from their workplace are coming to terms that they might have to work harder to safe more and secure their future. Not work less, but work more.

This is evident in the increasing number of workforce entering full-time employment than ever before. On the positive side, more full-time employment is good for the economy.

Lacklustre Stock Market

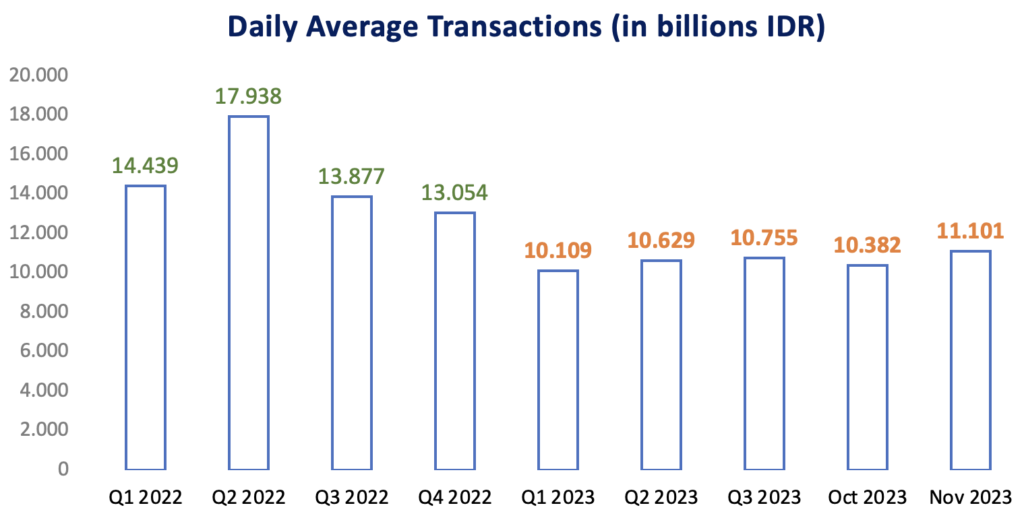

The average trade volume plunged by 28% from 2022.

Some put the blame on transparency, especially when the broker activities are no longer made live to the public. Others believe that it is due to low liquidity offered by Market Makers.

One thing for sure. There is lack of good news in the market this year, making it less appealing to trade.

Winners are the Banks

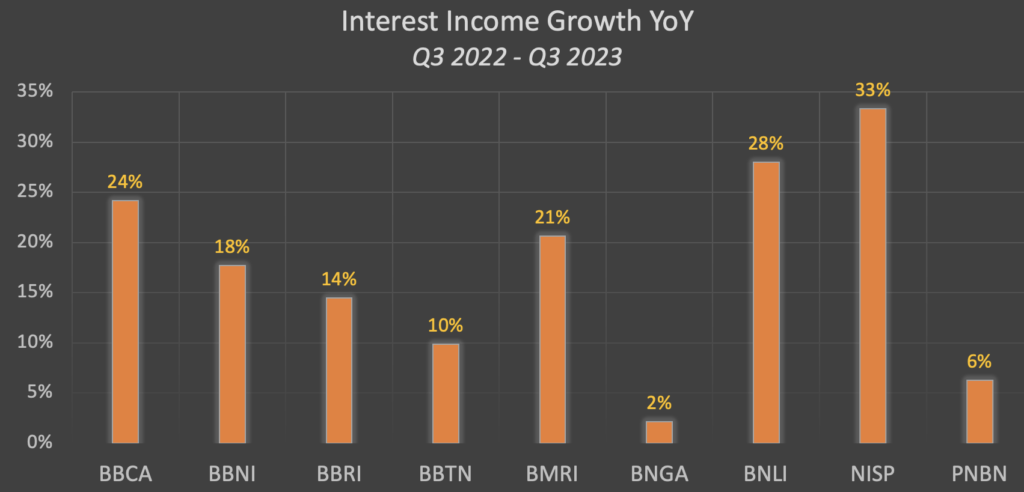

Hardly can go wrong for the banks in the modern economics. Even Warren Buffet once quoted, “Banking is a very good business if you don’t do anything dumb.”

The country proves to be very attractive for banking businesses. It has one of the highest Net Interest Margin in the region.

While nearly half of LQ45 Companies are making less money, the big banks keep breaking their profit records.

In fact, most of big banks witness double digit growth in their Interest Income.

Year 2023 is a year to remember for Investors. Not for its financial losses or gains, but for its learning experiences. Financial losses become knowledge gains.

“The best thing a human being can do is to help another human being know more.” Charlie Munger

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.