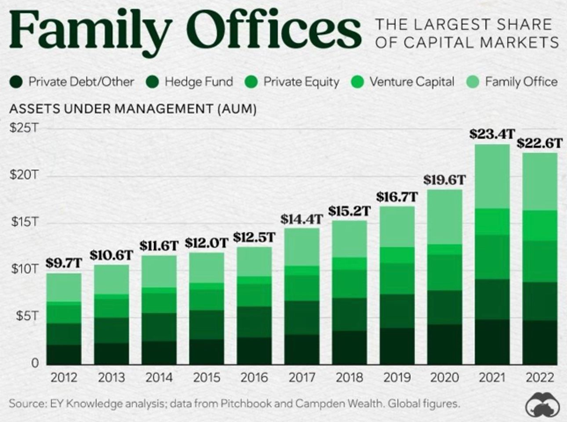

There have been talks of setting up a scheme that encourages the establishment of Family Offices in the country.

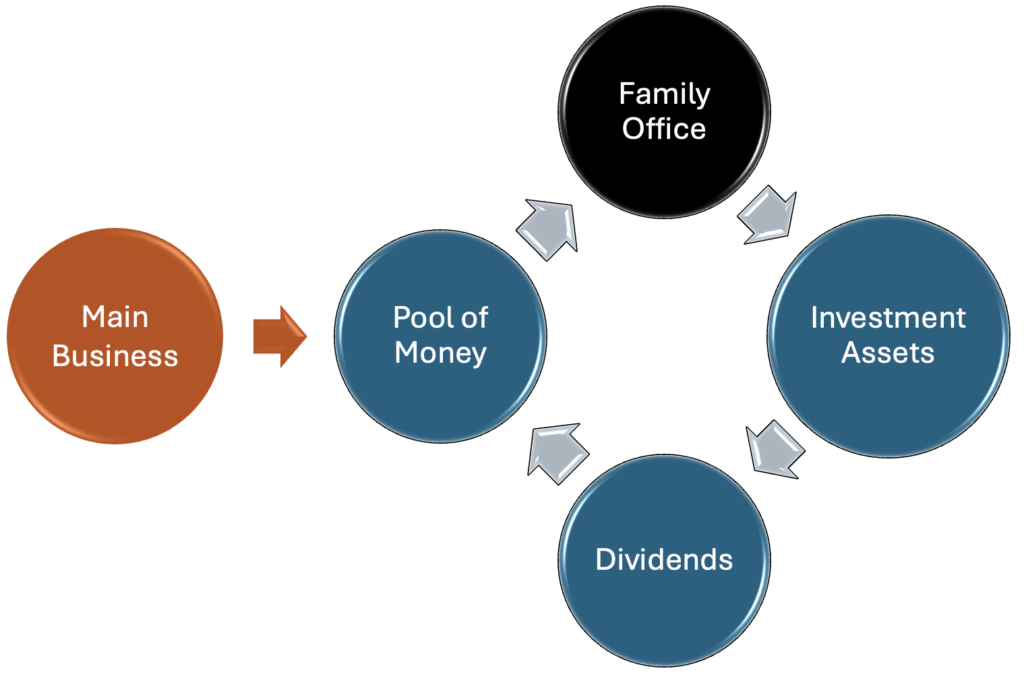

A Family Office is essentially an entity that manages the family’s wealth accumulated from its main business(es). Typically, the money is invested in financial products directly or indirectly (e.g. hedge funds, private equities).

The Question is, how is the domicile of a family office affecting a country?

Currency Exchange Rate

Bringing in capital into the country should benefit local currency exchange rate, depending on how much is converted into the local notes.

Note that current policy necessitates the use of IDR for most transactions within the country, although there are some exceptions such as government’s obligations (bonds) issued in foreign currency.

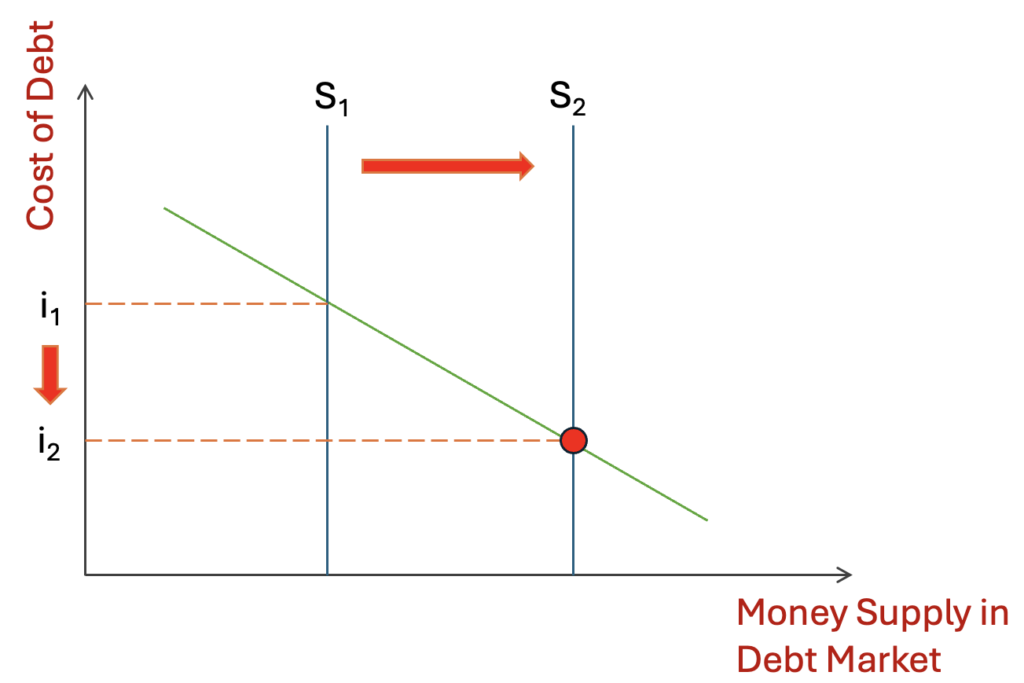

Debt Market

The government and private companies should benefit from the enlarged capital market, putting them in a better position to negotiate lower interest.

Job Opportunities

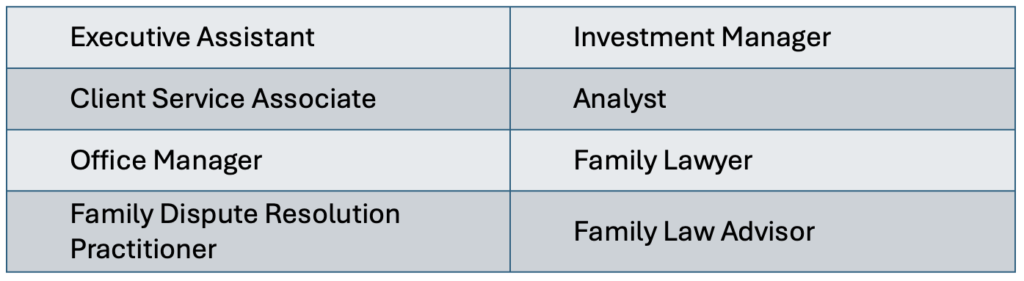

Due to its distinctive business model, the job opportunities are quite specialized. It should attract highly skilled individuals from within and across the border.

Typically the roles include:

Philanthropy

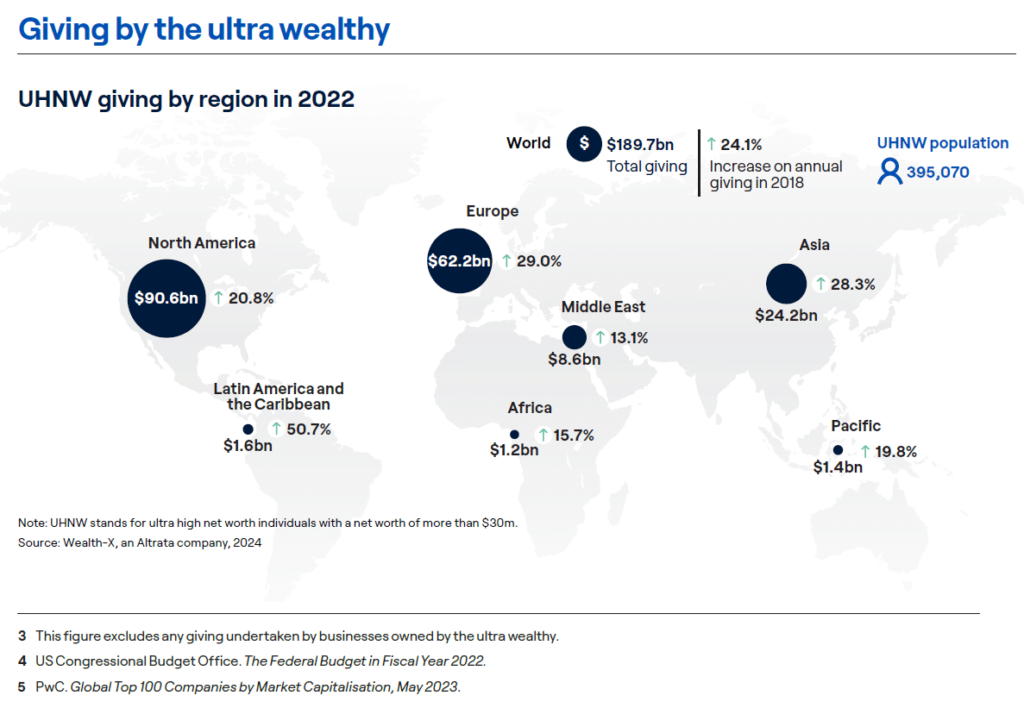

Worldwide, majority of Ultra-High-Net-Worth (UHNW) Individuals & Family Offices do get involved in philanthropic ventures directly (charity & NGO donations) or indirectly (impact & sustainable investing).

Despite the pandemic, economic and geopolitical conditions, the UHNW givings in 2022 have actually grown by the average 24,1% compared to 2018.

It remains to be seen whether the nominated city (e.g. Bali or Jakarta) can compete with the likes of Hong Kong, Singapore, Beijing, Tokyo, Dubai, Geneve, London, New York, etc. for a slice of Family Offices.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.