Failing to plan ultimately means planning to fail.

While it is true that investment outcome can be very unpredictable, planning is still better than none. Tomorrow belongs to Investors who prepare for it today. Consider these WARM principles.

When to Enter and When to Exit

Is it possible to make good investment return on bad stocks? Absolutely!

Investing in the stock market is about selling companies’ shares at relatively higher price than the cost of buying them.

A Company may perform quite badly in their operations, i.e. losing money. Yet, its shares can still piggyback on bullish stock market. Buying at bearish market and selling at bullish market is one strategy that applies to most stocks.

This is not an encouragement to get into bad stocks; just highlighting how crucial it is knowing when to enter and when to exit an investment.

Allocating investment portfolio

Plenty of investment assets to choose from: properties, stock market, deposits, bonds, crypto’s, etc.

An Investor should be disciplined in allocating where to invest and how much portion (percentage) from overall investment.

Be mindful of cashflow, i.e. how much goes out and how much goes in periodically. Investment often fails because of cash issue to maintain liquidity [e.g. Archegos Capital Management].

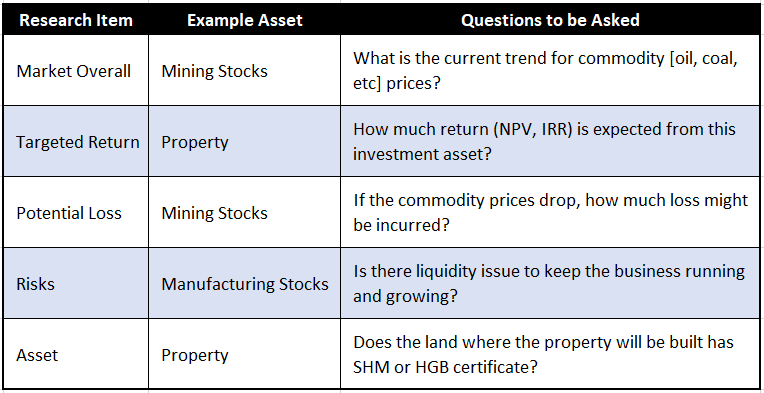

Research

Nothing is worse than investing in assets that the Investors are not familiar with. Research is a pre-requisite prior to making decision whether to invest or not.

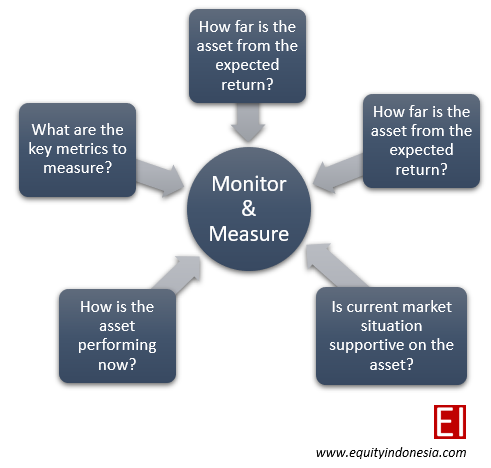

Monitor & Measure

One common mistake in investing is not monitoring & measuring the performance of the assets.

Needless to say this; if you can’t monitor & measure an asset, you can’t improve it.