Obviously, there some hypes surrounding the expected Bukalapak (BUKA) IPO in August 2021. Yet, there are some questions remain.

- Are the early Investors seeking to exit this start-up business?

- Is the business still growing at sustainable rate?

- When will it stop burning cash?

- Is the IPO price fairly valued?

Possibility of Early Investors Exiting

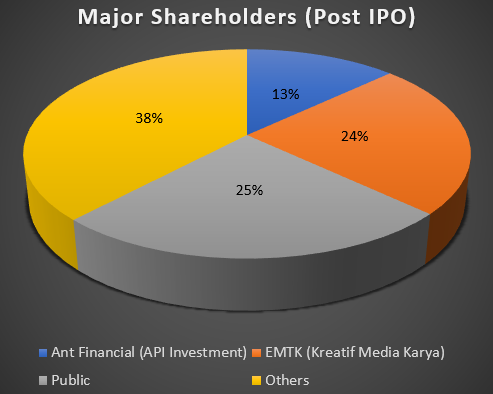

Elang Mahkota Teknologi (EMTK), through its subsidiary Kreatif Media Karya, has been the major beneficiary from the expected BUKA IPO. Its (EMTK) shares has surged nearly 500% in the past one year. Would it kill the goose that laid the golden eggs? Unlikely.

Ant Financial, as the other early investor, is in the process of restructuring. For Ant Financial with estimated market value of over USD 200 billion, BUKA is certainly not contributing much to its bottom line. At one point it might exit, but not now.

Growth Sustainability

There are plenty of rooms for e-commerce growth in Indonesia, not to mention in South East Asia if it choose to expand outside the country. Despite competition with the likes of Tokopedia, Lazada, Shopee; BUKA still managed to grow its revenue at the rate of 32% in 2020.

Indonesia remains the largest e-commerce market in SEA, with approx. USD 47 billion in GMV (Gross Merchandise Volume).

Cash Burn

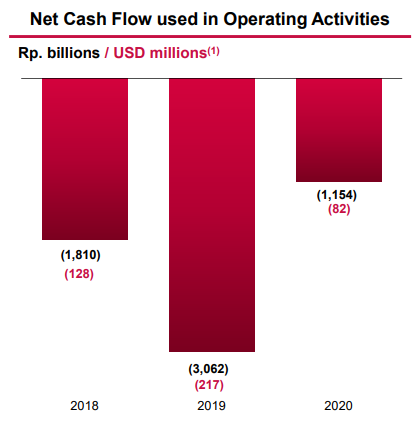

In 2020, it burnt through around IDR 1 trillion (USD 75 million) in cash. With around IDR 20 trillion (USD 1.5 billion) to be raised in the IPO, BUKA should have sufficient cash for at least 5-7 years to sustain their growth.

Whether it can be profitable by then, really depends on how much growth it is seeking and whether the e-commerce players can be consolidated (e.g. Gojek-Tokopedia merger).

IPO Valuation

At current price set in the pre-IPO roadshow, BUKA valuation is around USD 6 billion. There are several methods of valuing a tech IPO, each method might result in different valuation range.

However, some learnings from the previous tech IPO’s globally. After several years of IPO’s, tech stocks can either rise up over 1,000% (e.g. Amazon, Sea Ltd) or they can drop by 90% (or bankrupt / liquidated, e.g. Theranos, 1-Page).

Only time will tell which direction BUKA will move.