The economy is doing fine, but not great. The future looks alright, but not bright.

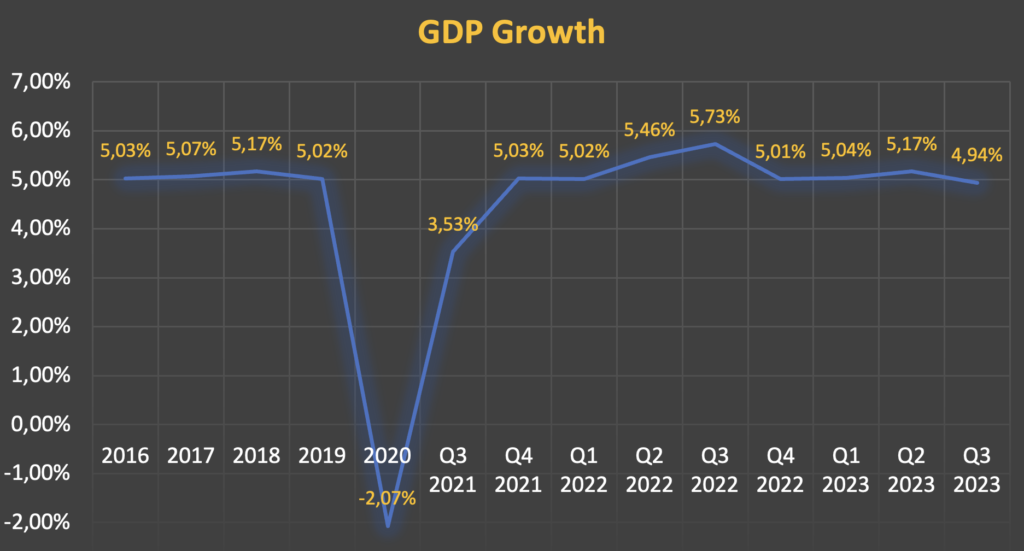

Although the inflation (except food) is under control, the GDP growth dips slightly under 5%, a rare occurrence except during pandemic.

Softening Commodity Prices

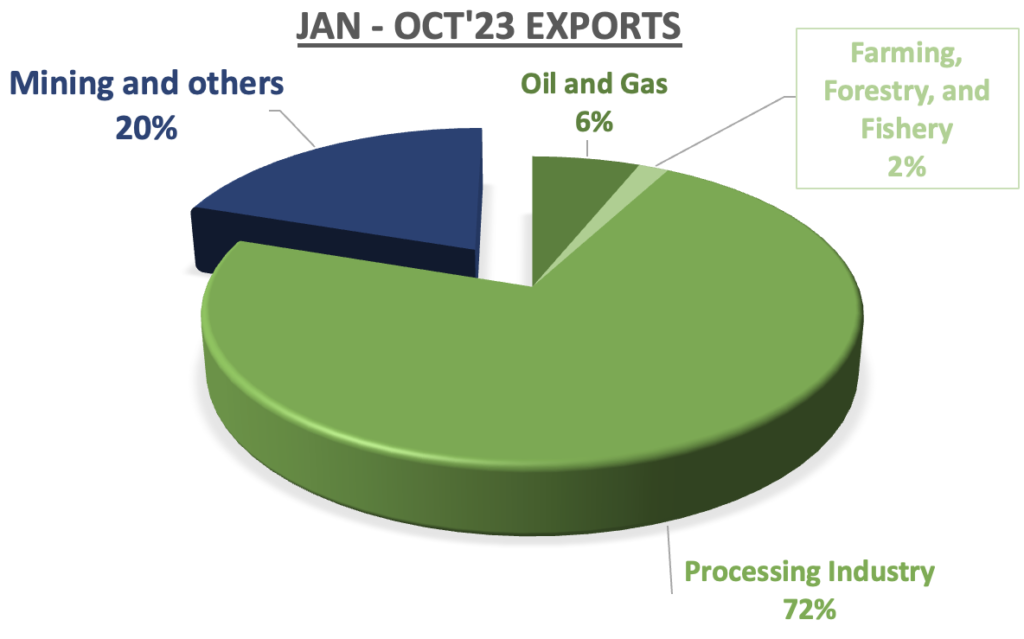

Mineral (coal, metals, etc) exports accounted for 20% of total exports for the first 10 months this year.

Despite realizing more export tonnage this year, the total mineral export value dropped by USD 11 billion.

This is due to to waning demand in the global market; hence prices are falling. It impacts not only Companies’ profitability, but also tax receipts and the current account balance.

Currency Depreciation

The IDR currency, like many other currencies, depreciates over long period of time against the USD. High interest rates and capital outflows are the main drivers for now.

The challenge here is how to slow down the decline, such that it does not impact the livelihood of people.

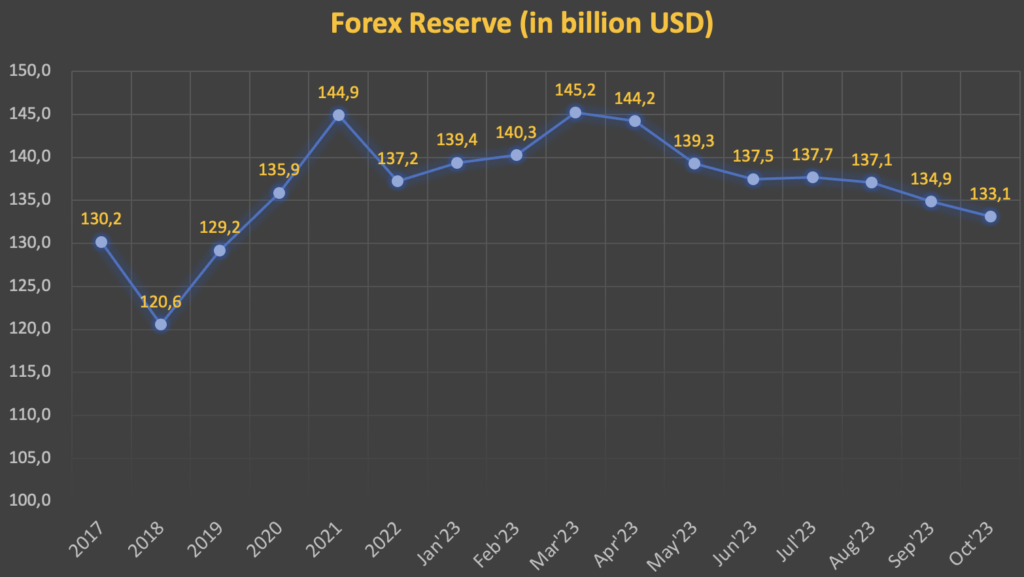

Positively, the Central Bank is dealing quite well with this. Whenever there is sudden foreign capital outflow [e.g. pandemic, geopolitical tension], the Forex Reserve is used to intervene to stabilize the currency.

However, there is limit on how much the intervention should be, in order to maintain sufficiency for imports and foreign loan repayment. Currently, the Forex Reserve is already close to the-pre pandemic level.

To counter the declining reserves, the Central Bank issued a new Foreign Exchange Proceeds (DHE) policy that will boost the Forex Reserve by 60-100 billions USD each year.

High Interest Rates

Falling inflation does not stop the rise in interest rates. The Central Bank recently raised another 25 basis points to 6% rates.

Higher interest will add more pressure on businesses, especially small ones that rely on bank loans. Debt refinancing is one option, but loan interest would be higher.

On the consumer side, Property owners / Investors also feel the heat from higher mortgage (KPR / KPA). Should this condition persist, expect more delinquencies on mortgage repayment.

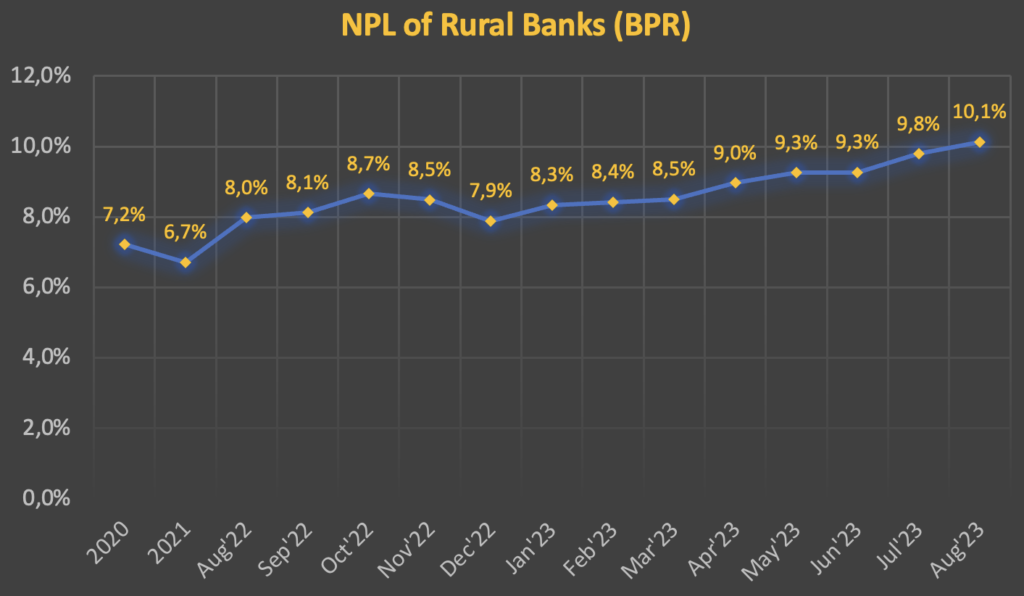

The Commercial Banks are managing their NPL quite well. Not so with the Rural Banks (BPR).

The new incentive to eliminate VAT (PPN) tax may stimulate the property sector. But, could it have negative effect by prompting some aggressive Investors to take more risks by borrowing more to invest on new ones?

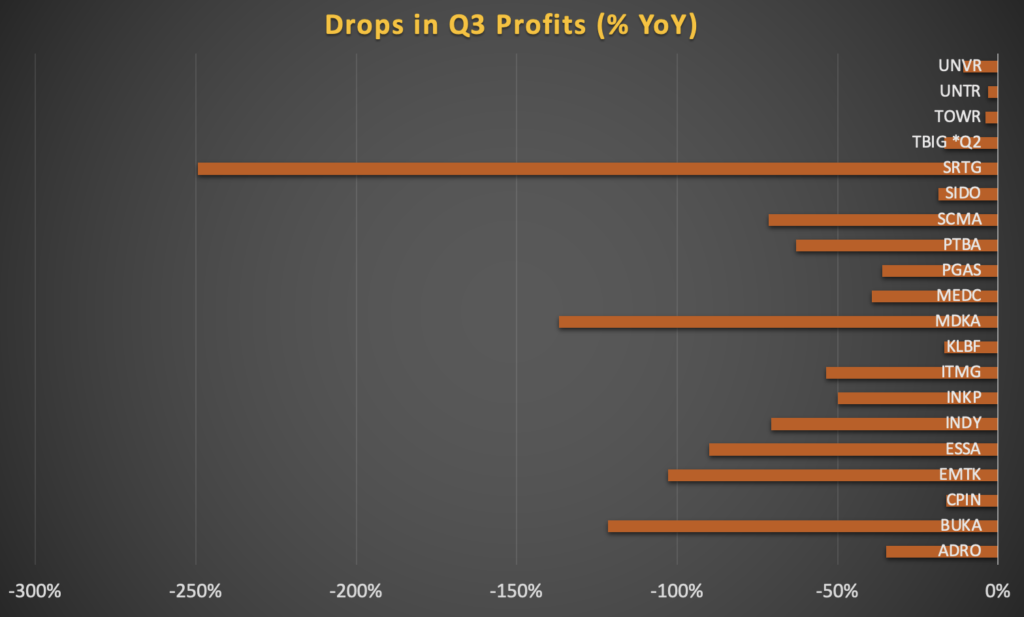

Company Profitability

In the latest Q3 results, many Companies experience drops in their profits. 20 out of 45 Companies listed in blue chip LQ45 recorded drops in their earnings.

This adversely affects the confidence in the stock market. Any hope for better one next year needs rock-solid reasoning, otherwise it remains just a hope.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.