Diversification is often mistaken as spreading into as much investment assets as possible, as evenly as possible.

Here are common mistakes made.

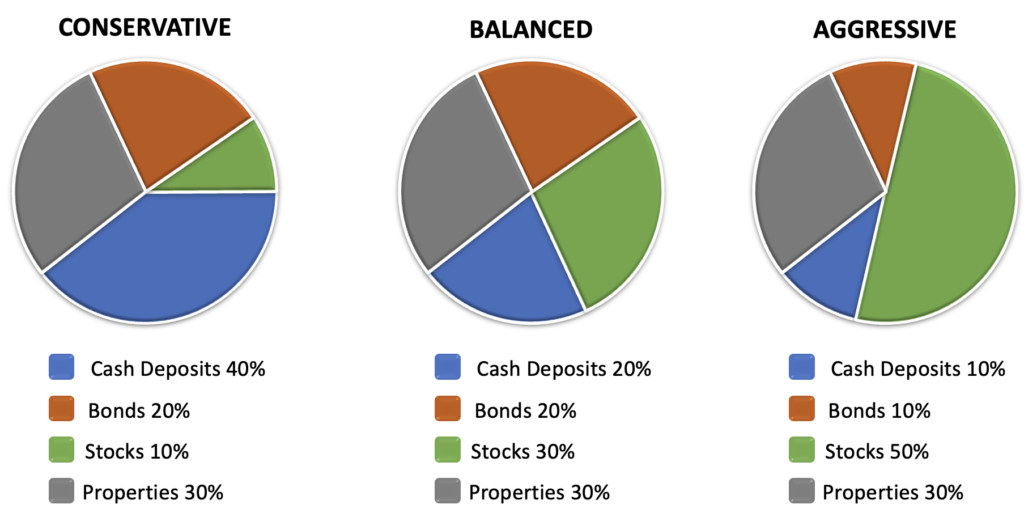

1. Diversification without a strategy and purpose

Having a strategy and purpose enhances quality of diversification.

For instance, some assets are meant to generate cash flow which will provide steady income during recessions. As for other riskier assets, it can pay dearly if successful.

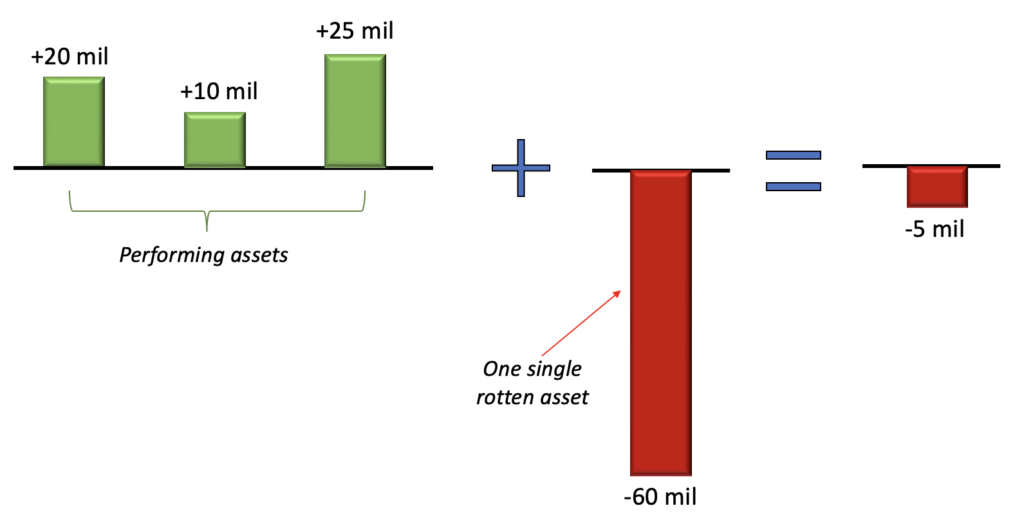

2. Diversification without knowledge

One could argue that an underperforming asset will be compensated by other performing assets, through diversification. Not wrong to think this way.

The question is, was due diligence conducted into the underperforming asset prior to investment decision? One single rotten egg could ruin the whole basket of eggs.

3. Diversification without management

Every single asset needs to be managed. Opportunity cost may arise due to mismanagement of assets.

A simple example, an interest-bearing deposit must be re-examined as maturity date approaches. There could be alternative deposit terms from the same bank or other banks that offer higher interest rate.

4. Excessive diversification

Over-diversification can lead to muted return. The point of diversification is to optimize returns at acceptable risks, not to eliminate the risks entirely.

Simply, no risk = no return.

5. Equal-weighted (evenly distributed) diversification

Every single Asset carries different risks to one another. For instance, a Consumer Stock may be less risky compared to a Technology Stock.

It is prudent to focus more on low-risk assets, especially at current macroeconomic condition.

Allocating equal weights on every single asset (regardless of risk profile) defeats the purpose of diversification.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.