A Valley and a Canyon have similarity in the sense that both are declines of landscape.

The difference? One (Canyon) is steeper and deeper than the other one (Valley).

Almost everyone agrees that the market is in the state of decline. The question is how deep it will be.

Window Dressing

December has been recognized as the time when the index goes up. It has been evident since the turning of 21st century.

Sadly, all good things must come to an end. The index was down by more than -3% in Dec 2022.

For the last one (1) month, net foreign sell reached IDR 16 trillion. This might explain why the market has been sluggish.

Cost of Debt

Along with the hikes in central banks’ rates, it becomes more expensive to borrow money to invest.

To use debt (loan) as capital means an Investor must expect higher (capital + dividend) returns than their loan interest. Small chance of success.

Margin Play

For some Investors or Traders that use margins or leverage to invest, it becomes harder to chew as stocks dip.

Margin Call and Forced Sell apply. This will drag down the small to mid cap stocks even further.

ARB Rule

There is a possibility that the ARB limit could return back to the pre-pandemic level, i.e. symmetric to ARA limit.

The impact could be insignificant to the whole index. Nonetheless, it could be completely different story for (pump and dump) penny stocks once the new rule applies (if ever).

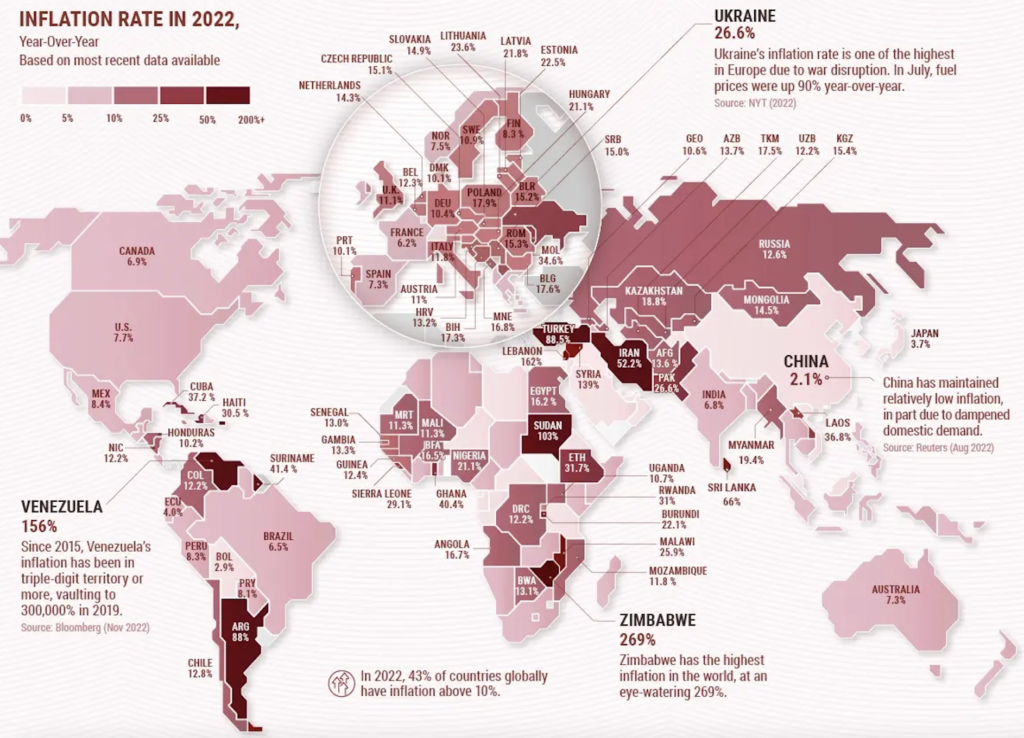

Inflation

Unlike other countries with double digit inflation, the inflation here is not as high, i.e. at 5.51% YoY.

Despite modest inflation, households are still impacted by the increasing food prices, transports, etc. Paying more for essentials mean less savings available for investment.

Will it be a Valley or a Canyon in 2023? Either way, there’s more rain ahead before the sun shines.

For a few meticulous Investors, it is such an exceptional opportunity to accumulate stocks that have been sold down well below their intrinsic value.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.