Banking industry has long been considered as the main pillar of the economy, along with manufacturing and mining industries.

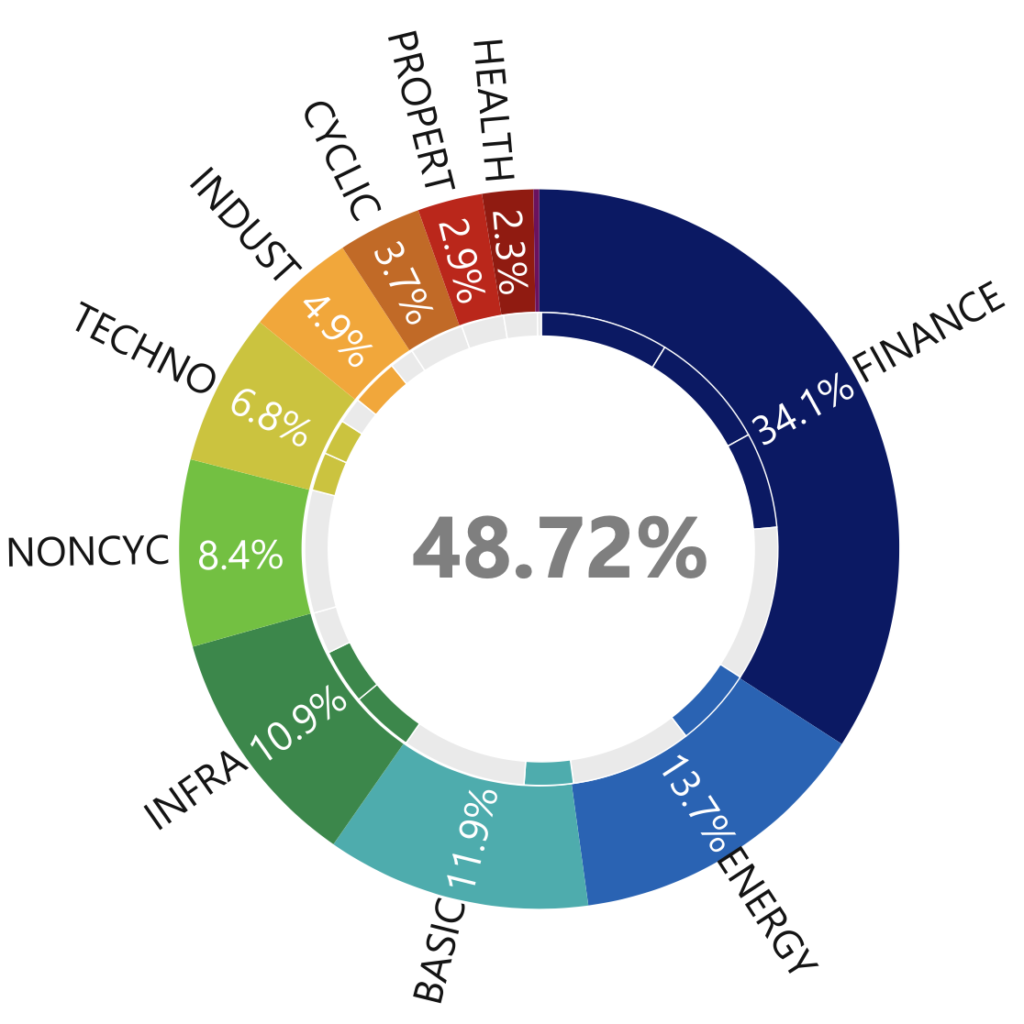

Even the IHSG index is heavily supported by the financial sector, in which the top three Bank Stocks alone (i.e. BBCA, BMRI, BBRI) hold 23% of index weight.

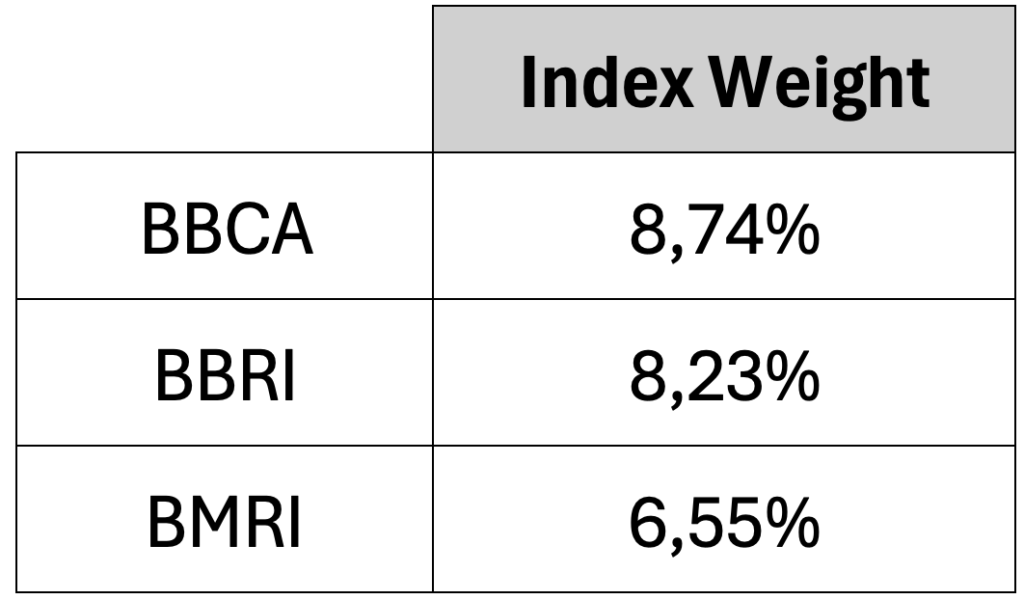

Global market uncertainties due to trade war have decimated the local Stock Market. Bank Stocks are no exception.

Have the Bank Stocks reached their bottoms; or are they already underpriced?

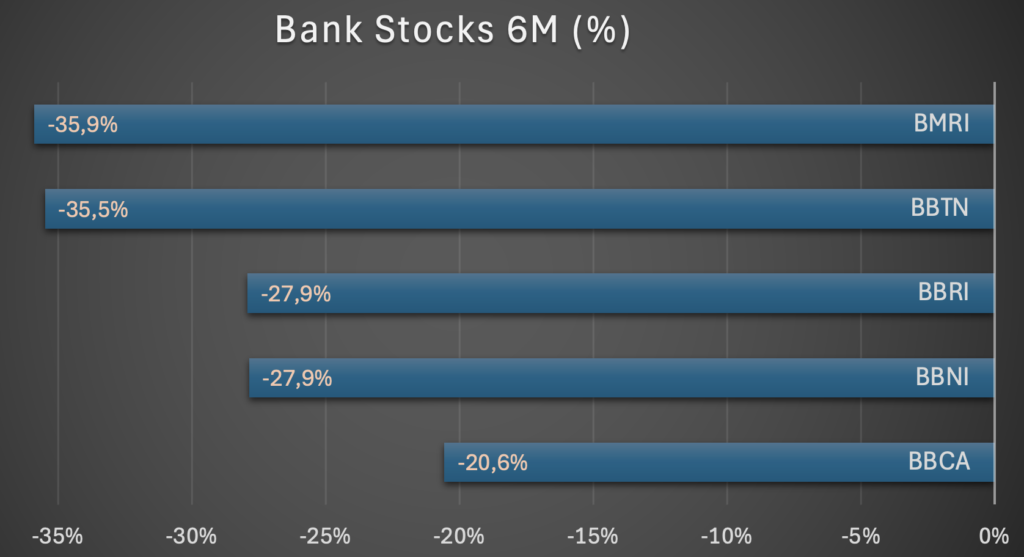

PER Comparison

Comparing with other blue chip & dividend Stocks (mining Stocks especially), the Bank Stocks look pricier in terms of Price Earnings Ratio (PER).

The higher PER indicates that Investors perceive Bank Stocks as less risky compared to other Stocks.

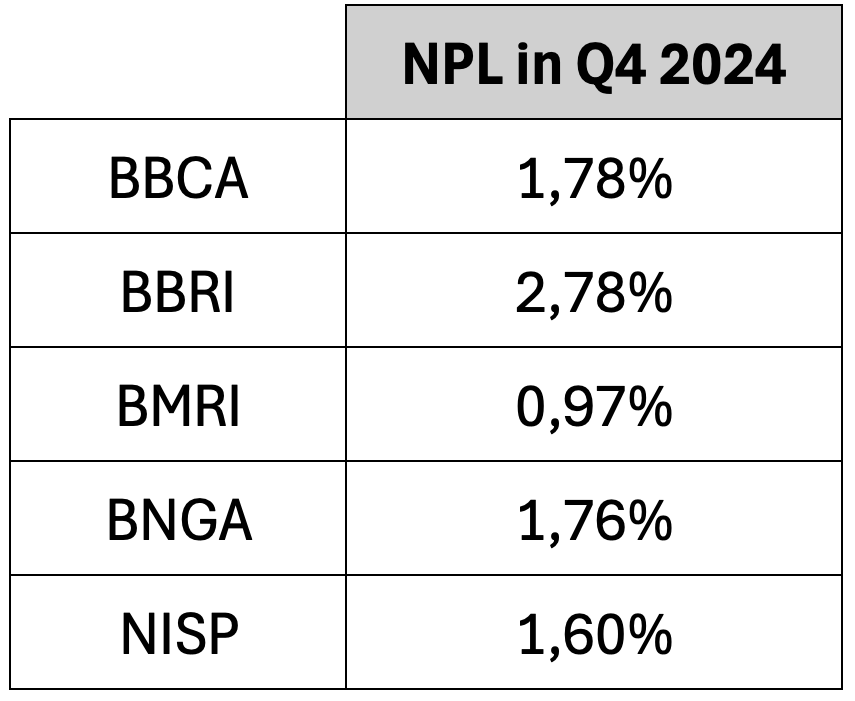

Non-Performing Loan (NPL)

Some may find it odd that NPLs of some big Banks have not been adversely affected by the economic downturns. The figures appear solid, at least for now.

If these figures hold true, no problem then. However, it becomes an issue when Banks start rolling over huge number of loans or modifying the loan terms (e.g., reducing rates, extending maturity terms).

One thing for sure. Banks, just like most businesses, need to maintain their cashflow (i.e. more cash going in than going out) for survival.

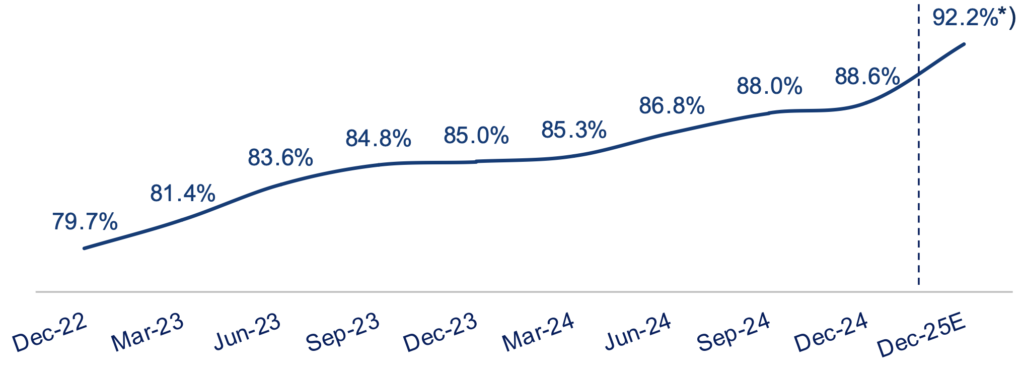

Liquidity Crunch

Some of big Banks are struggling to grow their Third-Party Funds (DPK) as more households run down their savings rather than saving up.

As a result, their Loan to Deposit Ratio (LDR) become tighter than ever.

One way to improve their LDR is by increasing the interest rates offered to households and businesses that deposit their money. However, this will come at a cost, i.e. lower Net Interest Margin (NIM).

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion ONLY. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification as deemed necessary.