The Stock Market is about to encounter with potentially the largest corporate action this year, i.e. ADRO spinning off its coal business (AAI).

The main idea is for the Company to focus on greener projects and to improve access to funding. As well, better allocation of capital that gives better ROI. This move was similarly implemented by global miners in the past, e.g. S32 spinoff by BHP in 2015.

Valuation

At current stock price before spinoff, ADRO is valued at USD 7.5 billion.

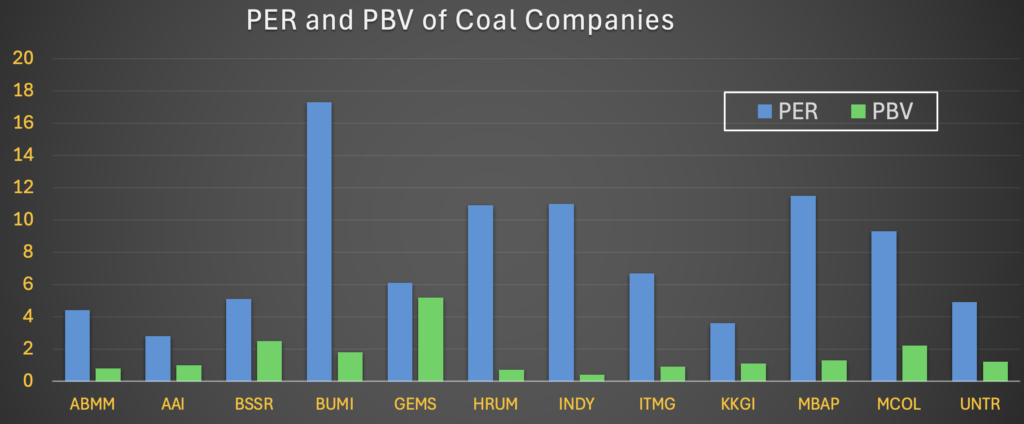

The spinoff AAI will be valued between USD 2.4 and USD 2.6 billion, at PER 2.6-2.8 or PBV of 1.

Some would argue that the AAI is significantly undervalued, considering it has been cash cow for many years. While for Others, it is considered a fair price if compared with other coal companies trading at even higher PBV despite having the lowest PER.

Dividends

Prior to spinoff, ADRO plan to reward Investors with special dividend potentially up to USD 2.6 billion. This will enable existing Investors to participate fully in the AAI offering.

AAI Controlling Shareholder

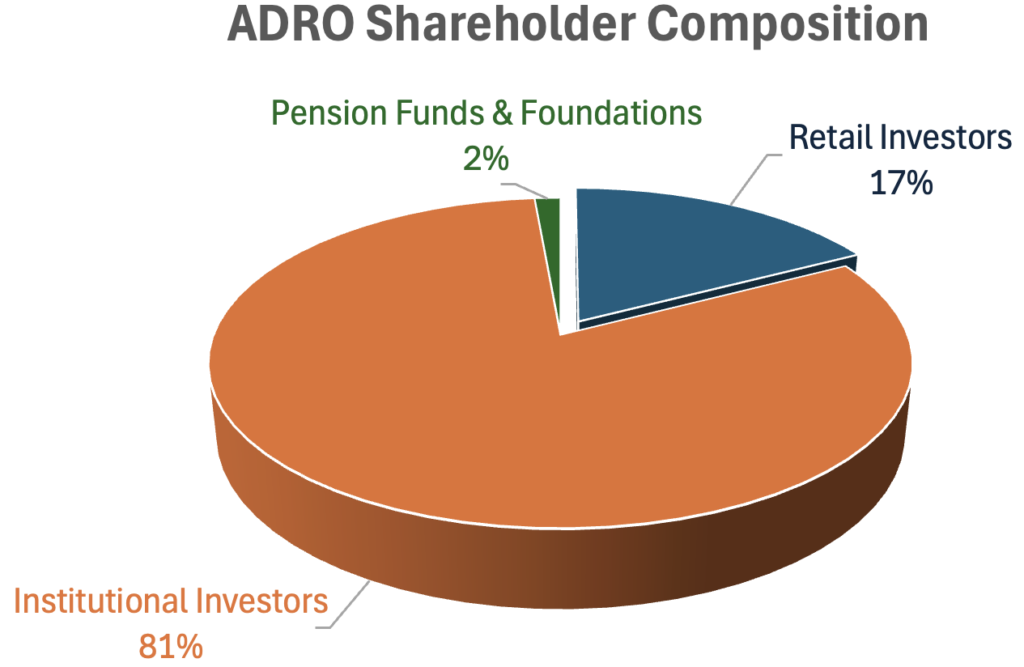

The question remains, who will be the Controlling Shareholder of AAI? If the existing Controlling Shareholders do not participate in the equity raising, then someone else will have to. Note, currently Individual Retail Investors hold only 17% of total shares issued.

There are only a few of international or local firms capable of spending billions to acquire majority of AAI’s shares, should the existing Controlling Shareholders opted not to participate in the AAI offering.

Making a Choice to Invest – AAI or ADRO

AAI

Majority of existing Retail Investors are expected to participate in the AAI offering for a couple reasons:

- They have no issue with holding coal stocks by being ADRO investors in the first place.

- Secondly, they expect high dividends which AAI may offer for at least another 3-5 years.

ADRO

On the other side, greener ADRO will attract international and institutional Investors.

Still, there’s no market consensus on how much the Company should be valued, considering it may take years to achieve positive FCF as projects are being developed.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.