Finally, the most anticipated blockbuster IPO is coming to realization.

Yet, the timing of GoTo IPO couldn’t be more challenging. Some global tech stocks’ prices have plummeted from their peaks recently (e.g. Grab, Sea Group, Bukalapak).

There are several reasons for optimism, however.

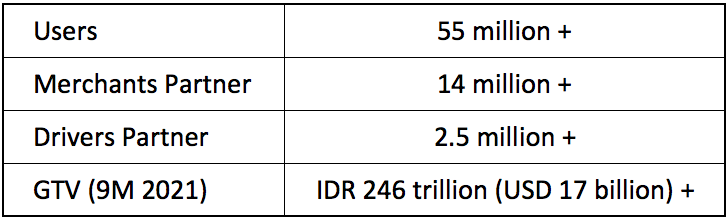

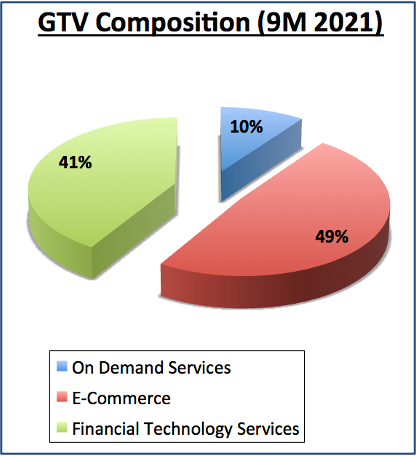

Market Leader

Winner takes all, as the saying goes. GoTo is the market leader in the country. Its nearly perfected ecosystem is second to none.

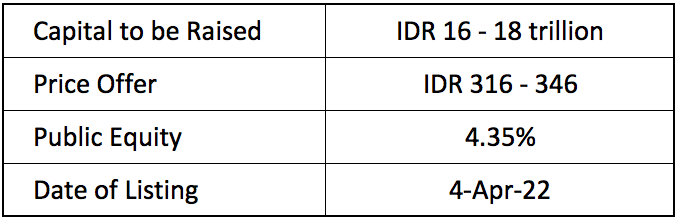

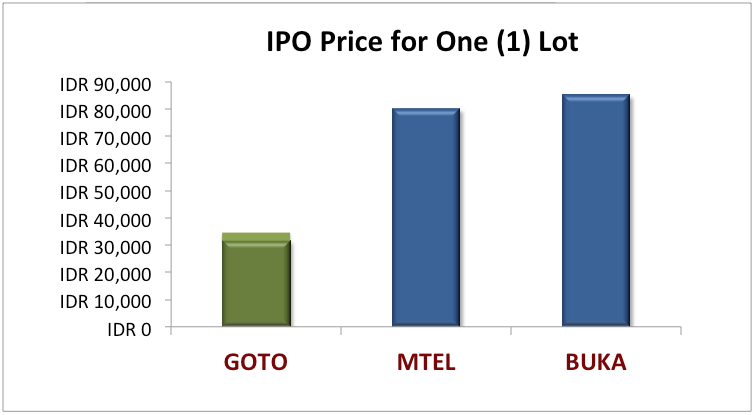

IPO Price

The pricing of IPO (316-346) is quite moderate compared to other mega IPOs such as BUKA (IDR 850) and MTEL (IDR 800).

Low IPO price means it is more accessible for many Investors with little savings to invest in; and hence also improve liquidity.

Amount of Capital Raised

IDR 16 – 18 trillion to be raised might sound a lot, but it is little compared to its soon to-be market capitalization of over IDR 400 trillion.

Some might argue that the cash raised could be gone within a couple years due to operational losses.

Yet, others could also argue that the Company is quite confident that they can seek more cash from debt markets, without diluting existing shareholders. Who knows, profitability is also in the horizon.

Distribution

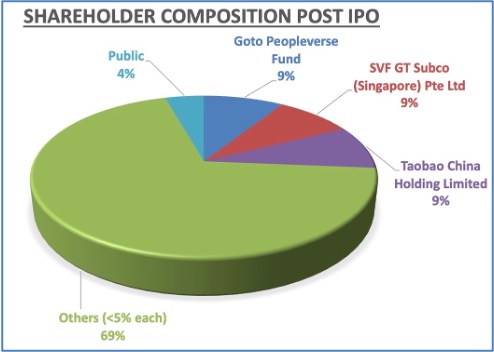

Compared to other IPOs, GOTO is widely distributed across major (controlling) and minor shareholders.

Major (controlling) shareholders own less than 10% each, and less than 50% in total.

Its Partnership Program will also ensure that up to 600,000 Drivers will be offered to participate in the IPO.

The success of this IPO will be a showcase for the country’s financial strength, attractiveness as capital market, and technology advancement.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.