Investing in the stock market can be thrilling for certain Investors.

Sometimes, these Investors push it a bit too far to the limit. No difference to walking on thin ice.

Buy at high price

Nothing’s wrong with buying a stock at high price (high PBV PER etc).

After all, there is a reason for the market to value that stock that high (e.g. market growth projection, strong cash flow).

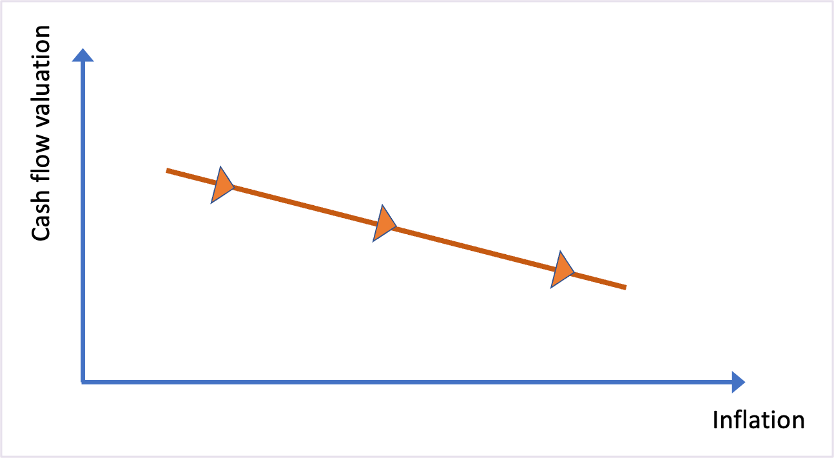

The problem arises when the market sentiment turns sour due to external factors, such as high inflation. Time value of future cash flows could be significantly lowered due to expected inflation; hence adjustment in stock price.

FOMO

It is conceivable that some new entrants to the stock market tend to invest based on FOMO (Fear Of Missing Out). Especially, those that aim for double-digit capital gain within short period.

This is the grey area between trading and gambling.

For some that become the victims of FOMO; their shares were either delisted, diving, or just stuck (sideways).

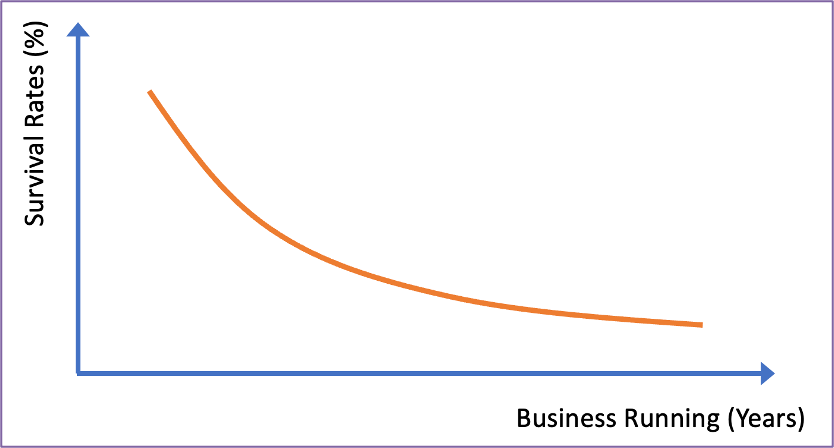

Business Survivability

Some stocks are just too risky to invest in. Just because their PER or PBV is low; it does not mean that the stocks are cheap and able to rebound.

Several factors are due to, for instance:

- The market segment is in decline.

- Poor corporate governance.

- Debt overdue.

Not every business will last for 10, 20 or 30 years. Without continuous transformation, businesses won’t last long.

Sky is NOT the limit. Don’t just look up, look down as well.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.