Keeping cash in portfolio at certain amount can be considered a waste for some. Yet for others, it can be part of investment strategy that can deliver premium returns.

Consider how much cash that many investment companies hold at the moment. Even Berkshire Hathaway is sitting on $145 billion of cash stockpile as of March 2021. While, Softbank is sitting on $70 billion of cash in the same period.

Reserving some cash in the portfolio is not always about diversification or risk management. It can be an offensive tool at certain times.

Bargain (Long Term) Investment

The market never tends towards equilibrium. It either overshoots or undershoots. When a share price undershoots, an Investor can buy at bargain price (e.g. PER<5, PBV<0.7), knowingly that the price will eventually correct itself in the long run.

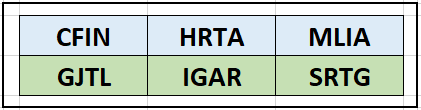

Several shares that are currently at bargain price:

Trade on News (Not Rumor)

Good news is always a main factor for share price movement in the country.

Having cash reserved that can be used instantly might entail sizeable profit for those who patiently wait for the right (news) moment to come.