Big economies (e.g. US, Australia, South Korea, and India) have been trimming their Interest Rates, as inflations cool down.

The country is not immune to what is happening worldwide. In January 2025, the Central Bank trimmed interest rate by 25 basis points.

Expect more cuts coming in. What’s the reasoning behind it?

Growth Target

To achieve the 8% economic growth as targeted, huge stimulus measures are needed. One way is by lowering the cost of fund (e.g. business loan) to finance the economic activities.

Consumption Driven

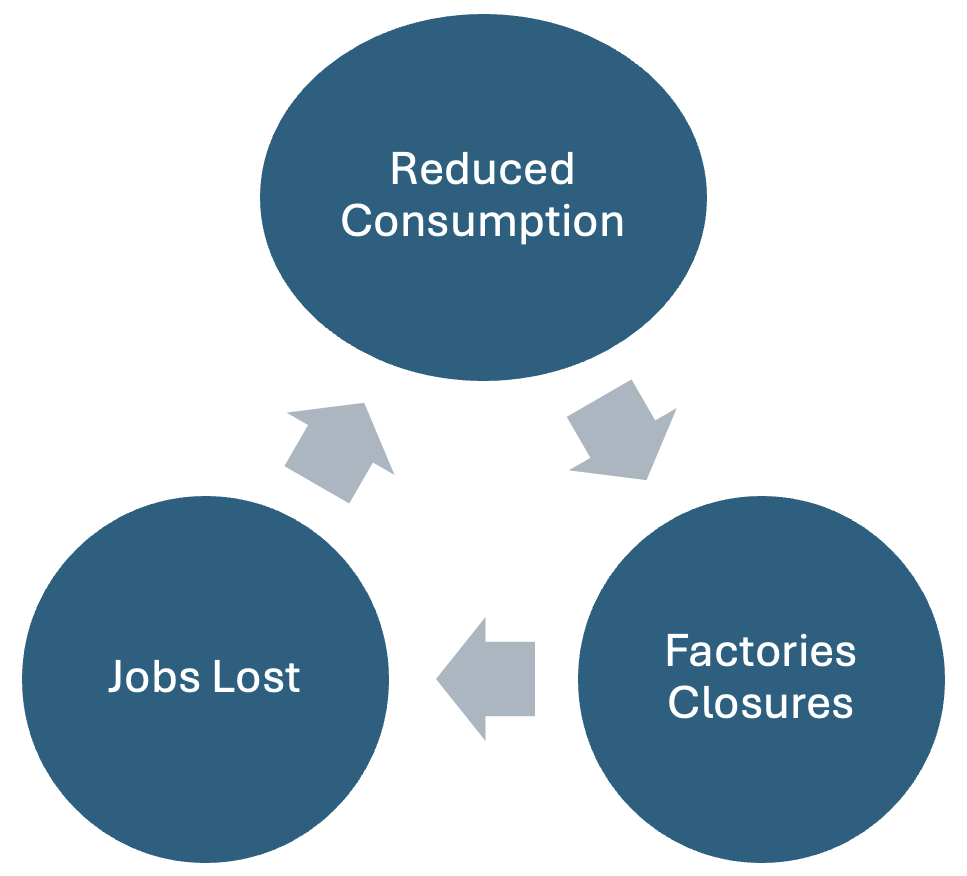

The past few years have witnessed a slowdown in consumption, even for necessities such as food. This has been adversely impacting factories, small businesses and families.

The economy relies heavily on consumption expenditure, i.e. roughly 60% of GDP. Without any meaningful Rate cuts, more jobs could be lost, eventually turning into vicious cycle.

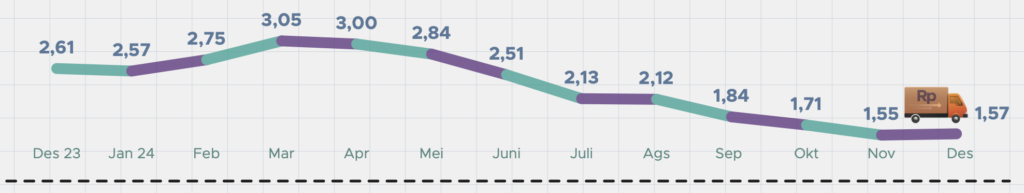

Inflation Cooling Down

High interest rates, coupled with ailing economy, is already pushing down Consumer Price Index (IHK) to deflation i.e. at -1,24% MoM and -0,09% YoY in Feb’25. It is the lowest ever recorded in the past 25 years.

Considering the inflation is already contained to the extreme, there is no reason to keep high Interest Rates for longer than necessary.

Foreign Investment

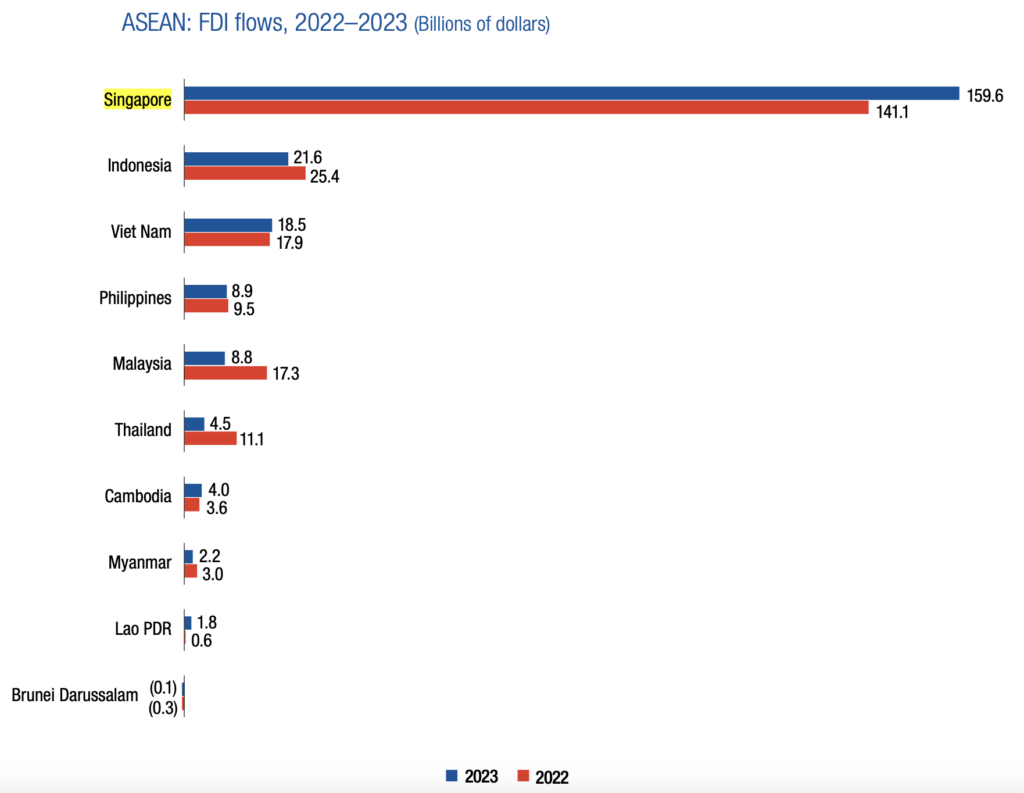

Some may falsely think that low Interest Rate will weaken the local currency and deter Foreign Investments.

Not necessarily the case. For instance, Singapore with its low Interest Rates of 2-3% has seen its currency (SGD) appreciated, supported by increasing Foreign Investment into the country.

Stock Market Liquidity

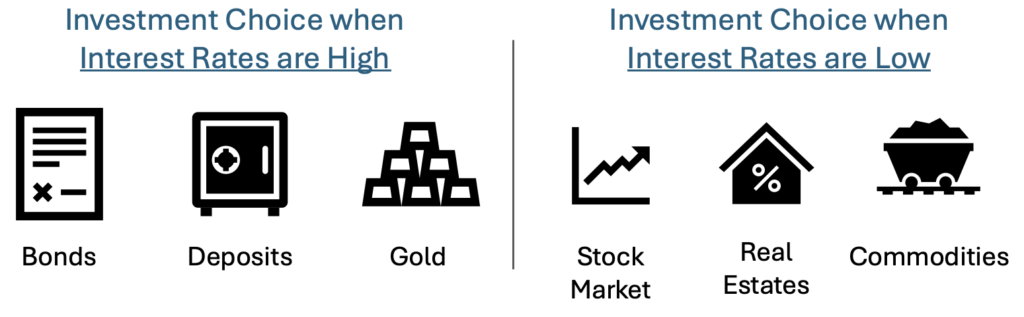

As foreign investors withdraw their money from the country, the local Stock Market is experiencing liquidity issue.

The local Institutional Investors are also more inclined to put their money into Bonds, Fixed Incomes, Deposits, Golds, etc.

Some argues that the incoming Short Selling policy will improve liquidity. However, it can also amplify volatility in the Stock Market. Not a good move.

With lower Interest Rates, more money will be shifted from Fixed Incomes (and other instruments) into the Stock Market, boosting liquidity.

Regardless of what will happen to the local currency in short term if the Interest Rates are trimmed; eventually the economy will recover as people spend more, business cost reduces, foreign investors’ confidence improves, and more money circulates around.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion ONLY. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification as deemed necessary.