Residential Properties are losing its appeal as investment assets. Today, a Property is seen merely as an asset used to hedge against inflation, just like gold and foreign currency.

In the latest Residential Property Price Survey (Q2 2024) issued by the Central Bank, the Residential Property Price Index (IHPR) slowed down to 1,76% (YoY), and the primary house sales contracted by 12,8% (QoQ).

Population

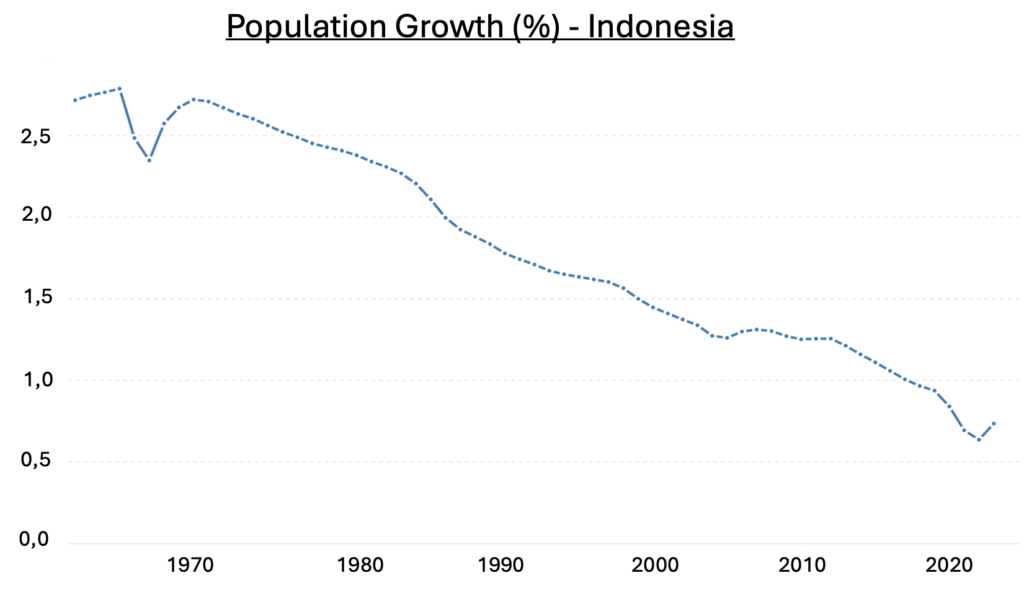

Since the turning of century, the population growth has been in decline.

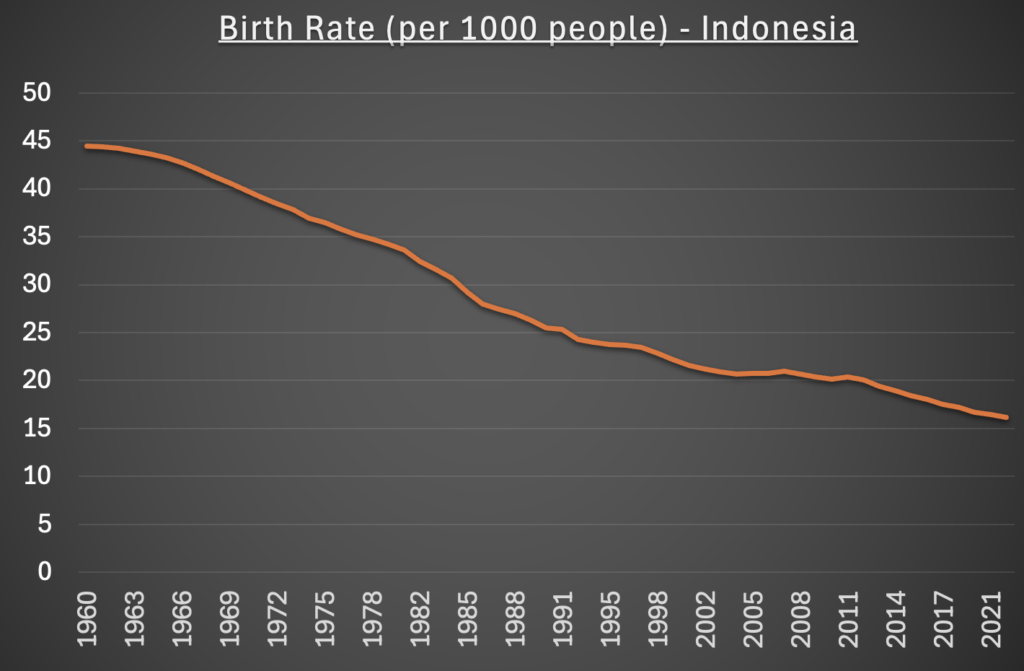

This is mainly attributable to the decline in birth rate (per 1,000 people).

Hence from the population standpoint, it is fair to say that the demand growth for housing is subdued.

On the Supply side, the Property Developers have more than enough landbank to continue building units with less red tapes nowadays. There is no supply shortage, assuming there’s enough demand out there.

Interest Rate

High interest rates make it less feasible for Property Investors to invest in. Assuming real capital gain is zero due to inflation, the rental yield 4-6% is much lower than the average floating mortgage rate of 11-14%.

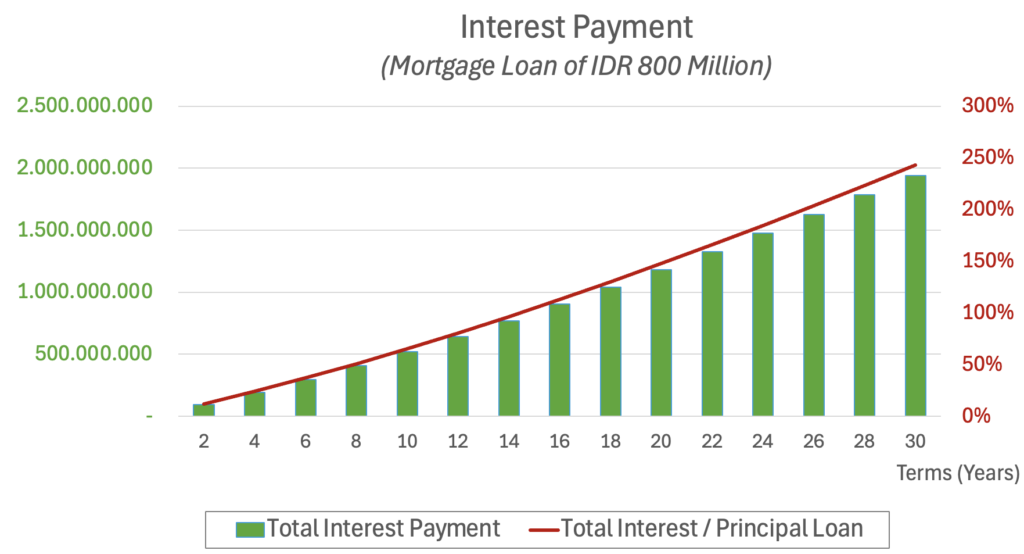

Even for Property Owner-Occupiers, some consider the Total Mortgage Cost to be prohibitive to own Properties. The interest payment can be twice as much as the principal owed.

Let’s assume a Property is bought at IDR 1 billion, with 20% as down payment, 80% mortgage at 11% interest rate.

Household Size

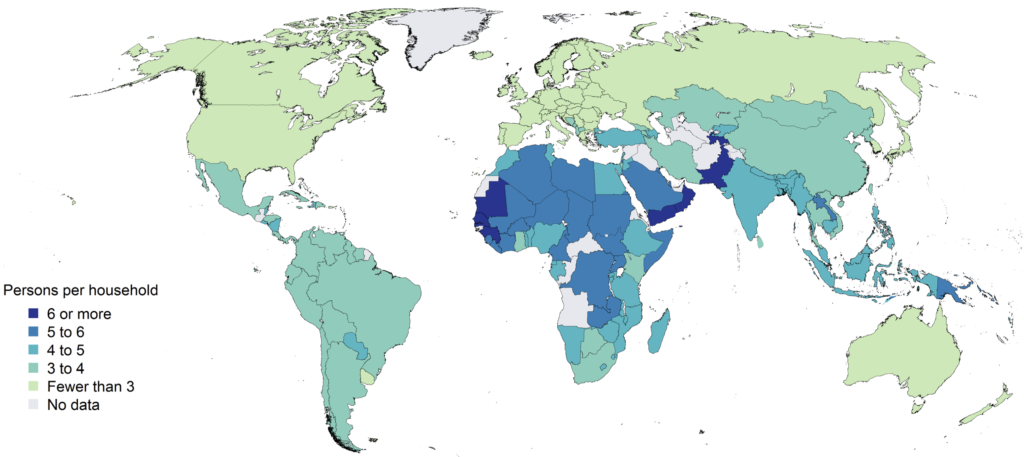

In general, household size will reduce when the economy advances. More working adults will move out from their parents’ properties to their own.

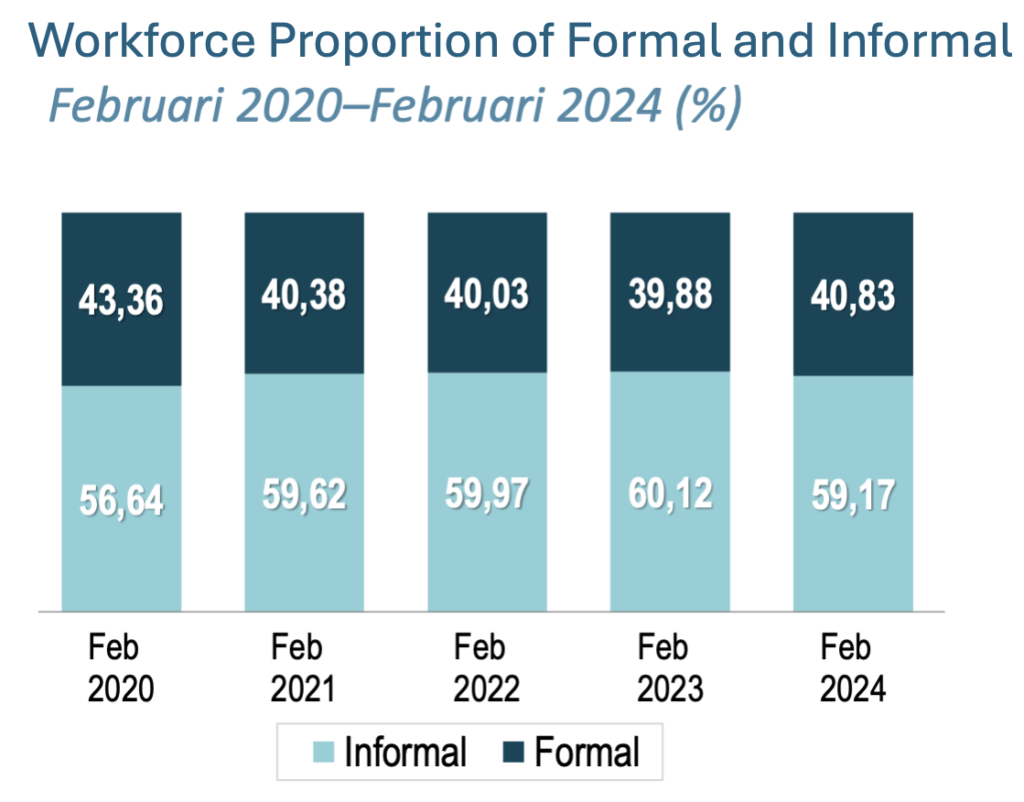

Unfortunately, the country is facing some economic challenges that hinder young generations to move out of their parents’ property. There is high unemployment rate among young generation (i.e. 16% as of Feb 2024), as well as decreasing number in formal employment.

Not to mention, the decline of middle class contributed to the demise of property sector.

It is only possible for the Property Sector to improve, so long as the mortgage rate is reduced considerably, and employment recovers.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.