In a slow economy, Investors tend to put their money more into fixed income assets such as deposits or fixed-interest bonds.

Yet, putting all eggs into one or two baskets come with their own risks. Low-risk deposits do not mean risk-free. Which is why for some Investors, diversification by maintaining their position in the Stock Market is necessary.

Defensive stocks are usually preferred due to their low-risk profiles.

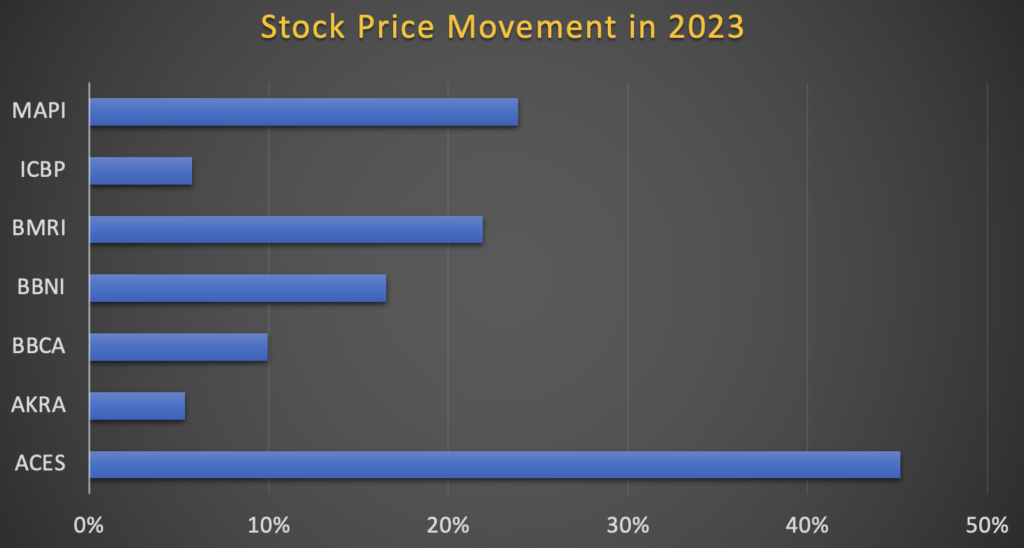

Stock Performance

Some Defensive Stocks have outperformed the sluggish stock market in 2023.

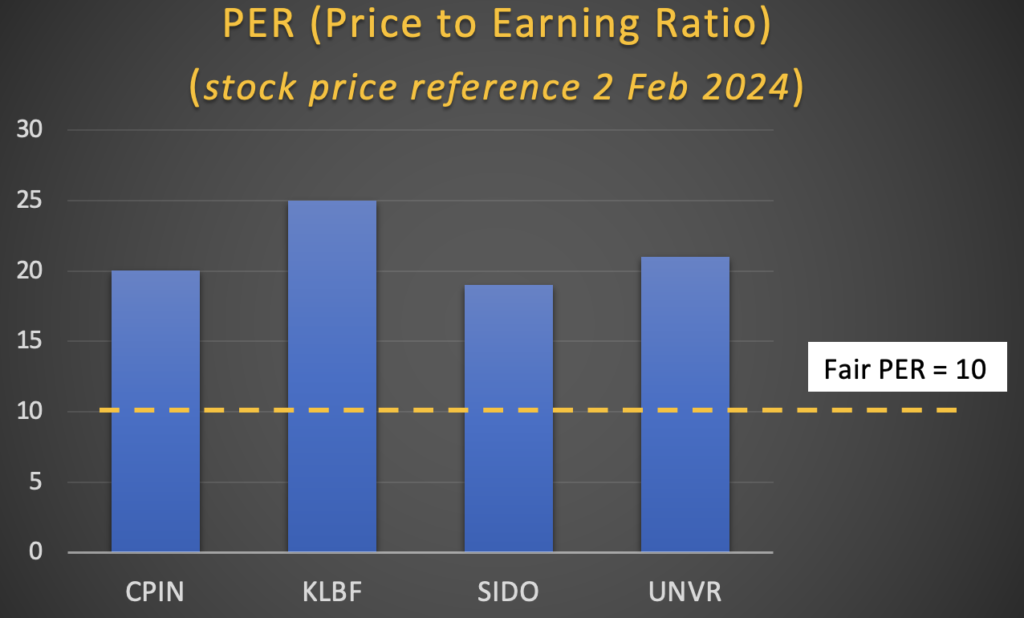

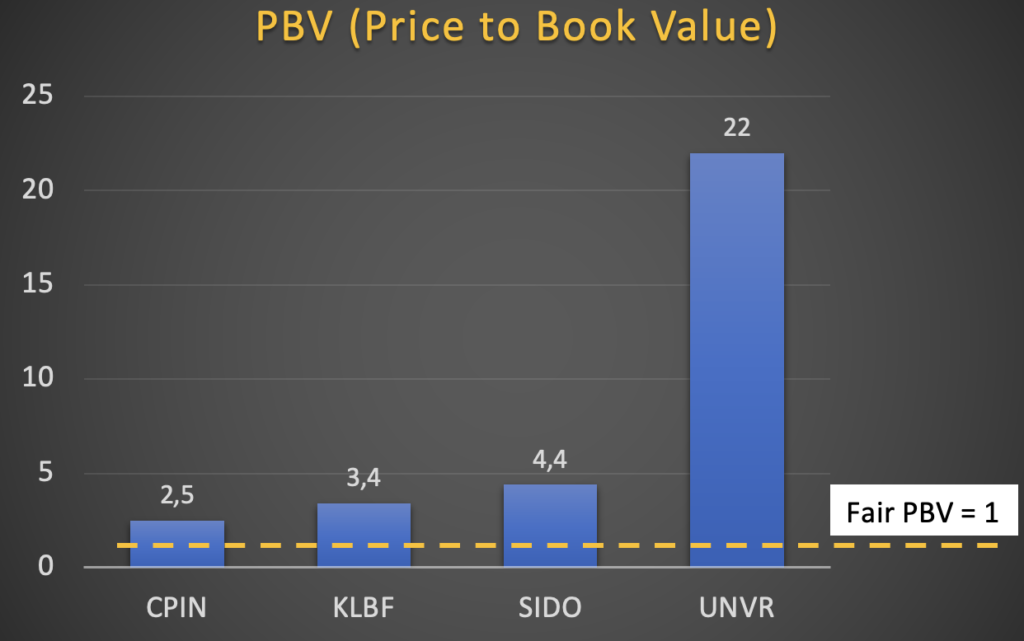

For those Defensive Stocks that underperformed, it is simply due to correction from their high PER / PBV ratio (i.e. overpriced in the beginning). Even after experiencing some drops in their stock prices, these stocks remain overpriced considering current environment.

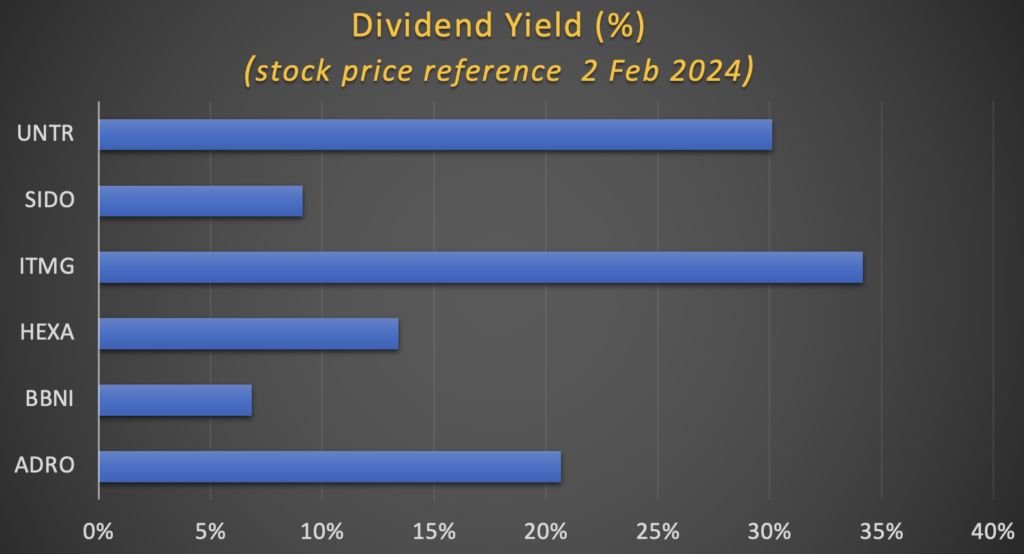

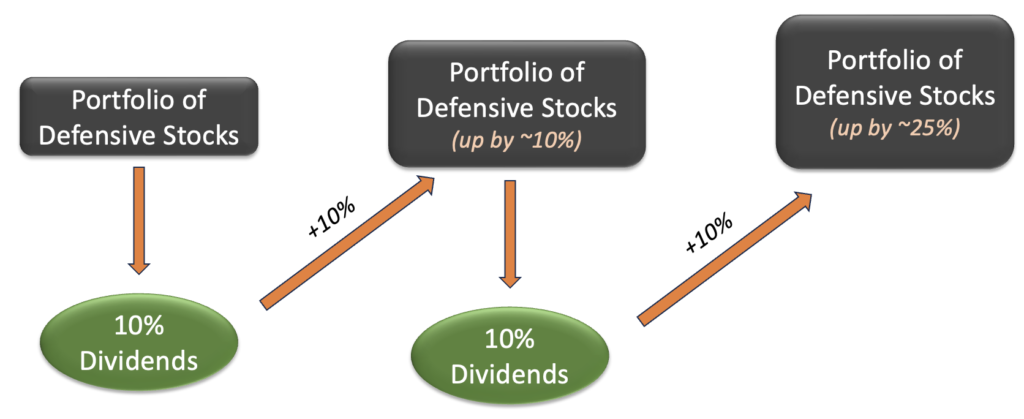

Dividends

Regardless of market condition, dividends still serve as icing on the cake for most.

It also enhances cash flow and return on portfolios. The additional cash from dividends can be useful tool to accumulate Defensive Stocks below their fair value.

Positioning

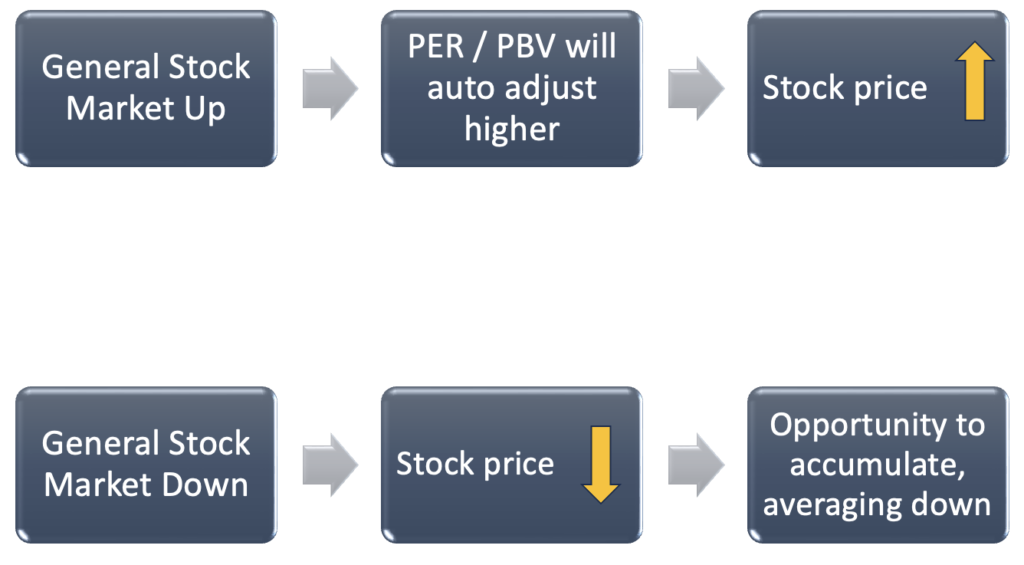

No one can predict the direction of stock market at any time, whether up or down. Investing in Defensive Stocks offers comfortable position for future movements.

If the general stock market goes up, the PER / PBV of Defensive Stocks should increase along. If the general stock market goes down, good opportunity to average down.

Being defensive does not entirely mean allocating the money into defensive stocks straightaway. It requires the right mindset as well, i.e. patience and timing.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.