Months ago, it was unthinkable that the interest rates would stop increasing, or at least left as is.

That’s not the case anymore. Wishful thinking for lower rates might come true this year.

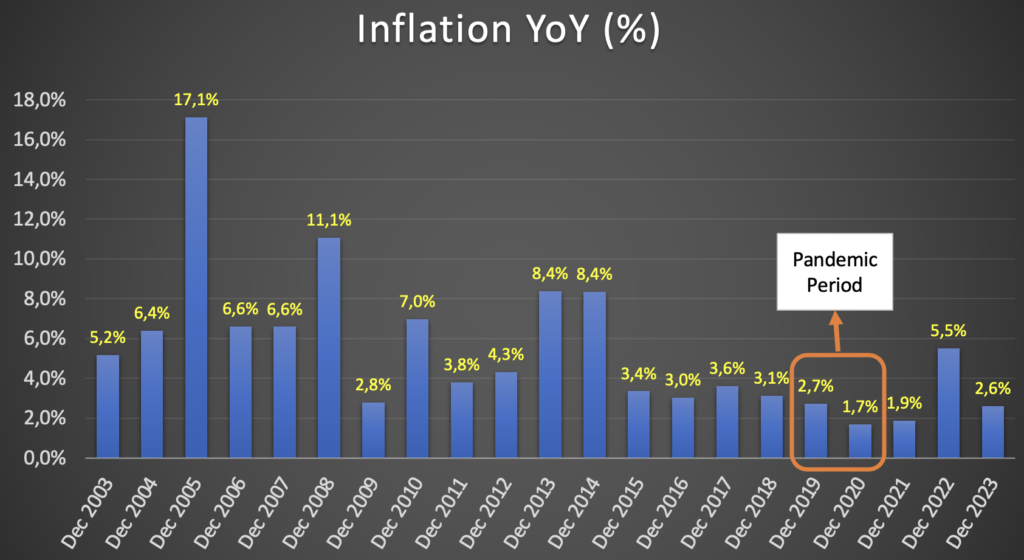

Inflation Rate

Despite increasing food inflation, overall inflation is consistently coming down. At 2,6% YoY, inflation is at its lowest point for the past 20 years [excluding the pandemic period].

The figure is well within the Central Bank’s inflation target of 3+1% for 2023.

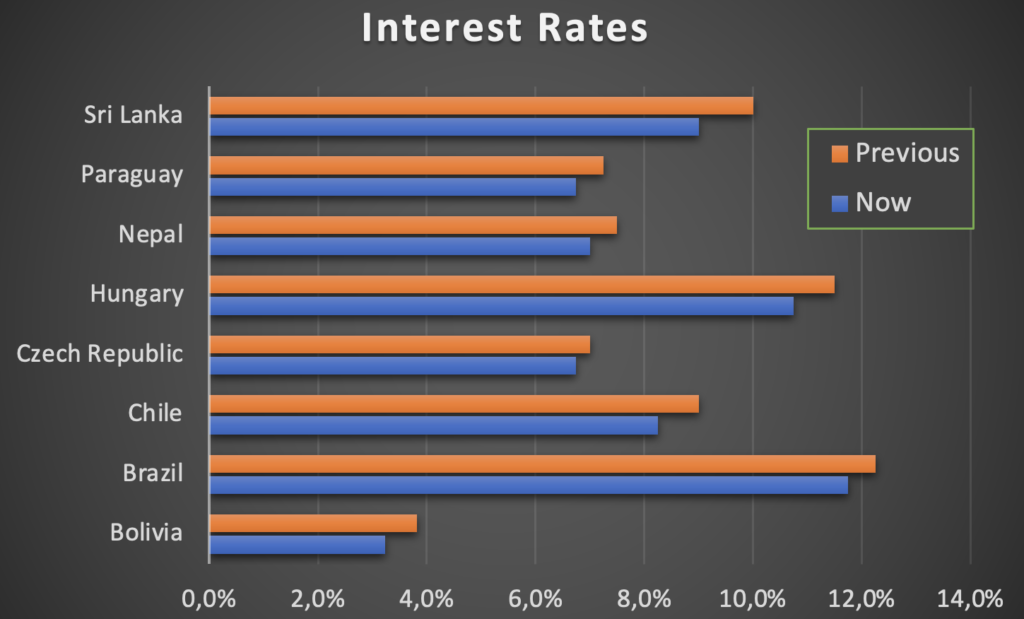

Global Interest Rates

Other economies have stopped increasing rates. Some even started trimming down their rates.

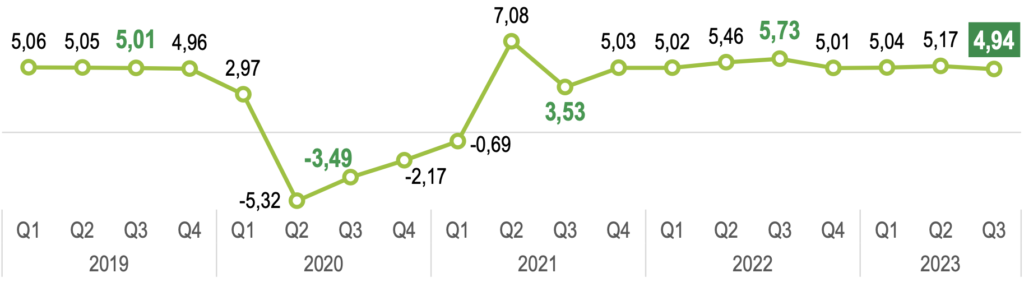

Economic Growth

The economy is slowing down. The latest GDP growth of 4,94% YoY in Q3 is below 5% for the first-time post pandemic. Slight dip only, but it may be an indicator on what’s to come.

This decline happens despite consistent growth in credits channeled by the financial institutions.

The economy does not seem to get as much benefit as the amount of money being put in.

All the above point to potential rate cut(s) this year, maybe in few months time. The question is, will the Banks pass on the rate cuts in full to the consumers if the Central Bank decide to trim down the rates?

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.