In a period where many analysts expect the economy turns sour, there is a glimpse of hope for some assets.

Against all odds, these assets are surprisingly resilient in their valuation so far.

Property Prices

Property price is one main contributor to inflation. Higher interest rates were meant to hold price from escalating further.

Nonetheless, the residential property prices continue to grow (2% YoY, 1.79% QoQ) [source: www.bi.go.id]. This happens despite lower sales on all (small, middle, and large) size properties.

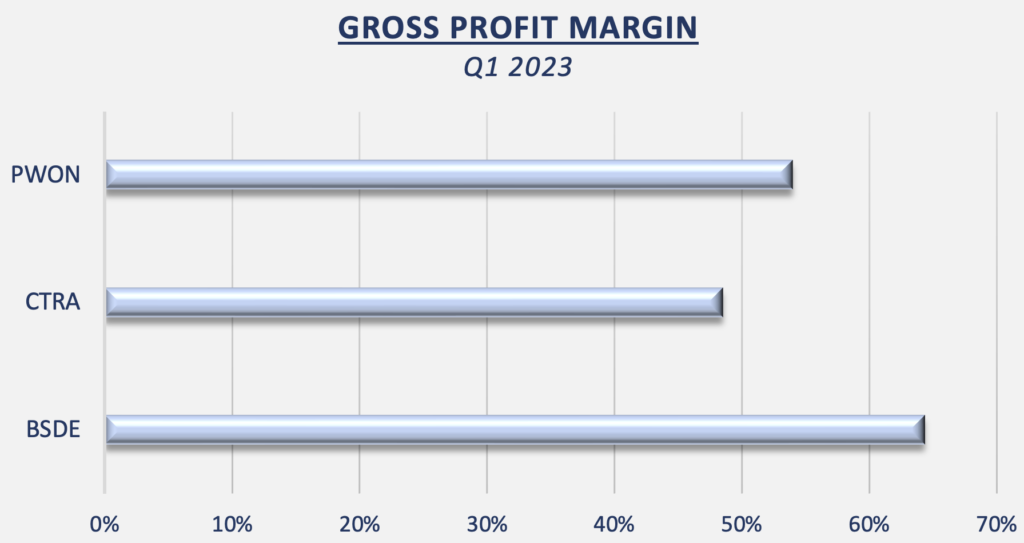

Profitability among developers is quite solid. Biggest developers have managed to maintain healthy margin on their property sales.

Energy & Commodity Prices

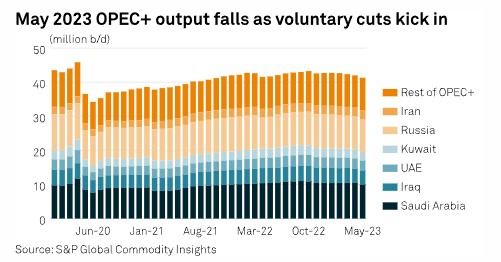

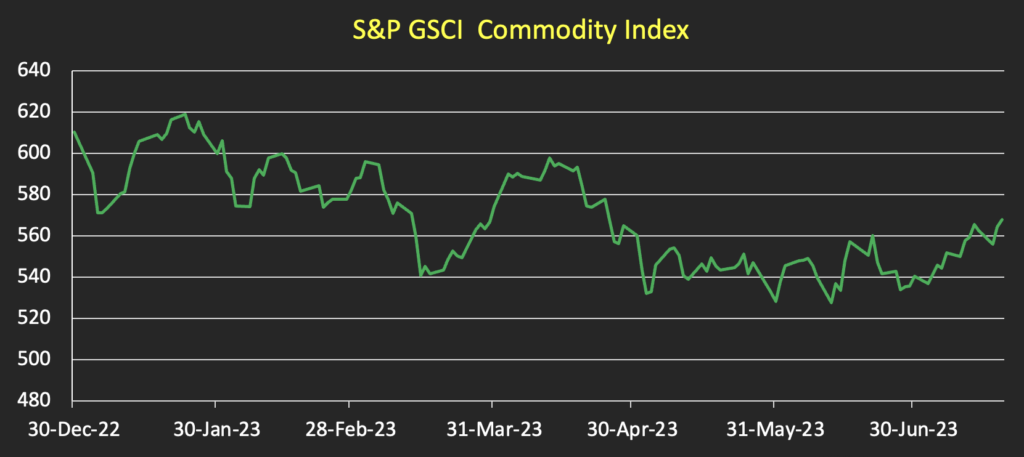

As energy & commodity supply recovers from pandemic and geopolitical tension, the energy prices plunged from their peak.

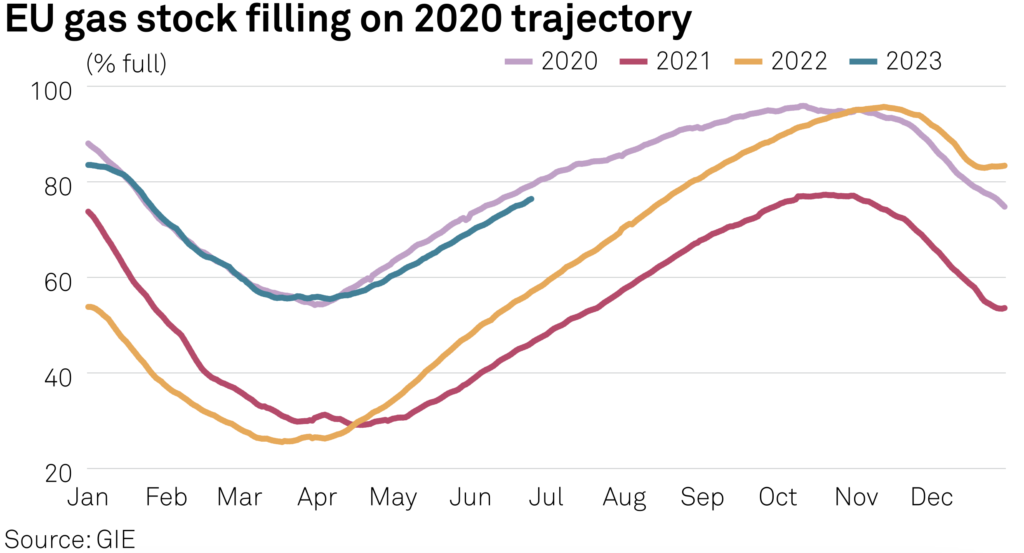

Since then, the energy prices have been quite stable. Ample gas storage in Europe & US is countered by sustained cuts by the OPEC+ producers.

Generally speaking, the commodity market is becoming less volatile.

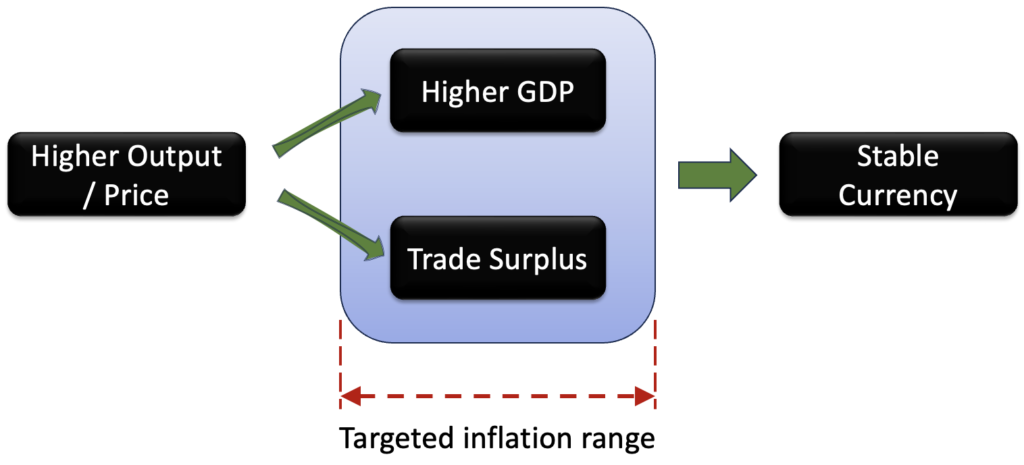

Currencies

Highly indebted economies were at risk of falling currencies. Indeed, some were under pressure at the start of the year.

Fortunately, the latest inflation data may put an end to the rate hikes sooner rather than later.

Specifically, some exporting countries with strong manufacturing and commodity industries will be best positioned to uphold their currencies.

Essentially, some quality assets remain very much attractive to invest in despite confounding economic sentiments. Maybe not for their returns, but for hedging and diversification purpose.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.