A common understanding is that in a bearish stock market, always revert to the fundamentals.

Fundamental analysis can identify whether a company stock is cheap enough to accumulate. If only it is that simple, however.

What can go wrong with fundamental analysis?

1. Selling pressure

Most stocks are in the red compared to last year. There’s no sign of easing in the economy as yet. For some Investors that need some cash to carry on with their lives or businesses, they had to sell at loss.

Unfortunately, there is no exception with stocks that are fundamentally strong (in numbers). The selling pressure will eventually lower these stock prices even more.

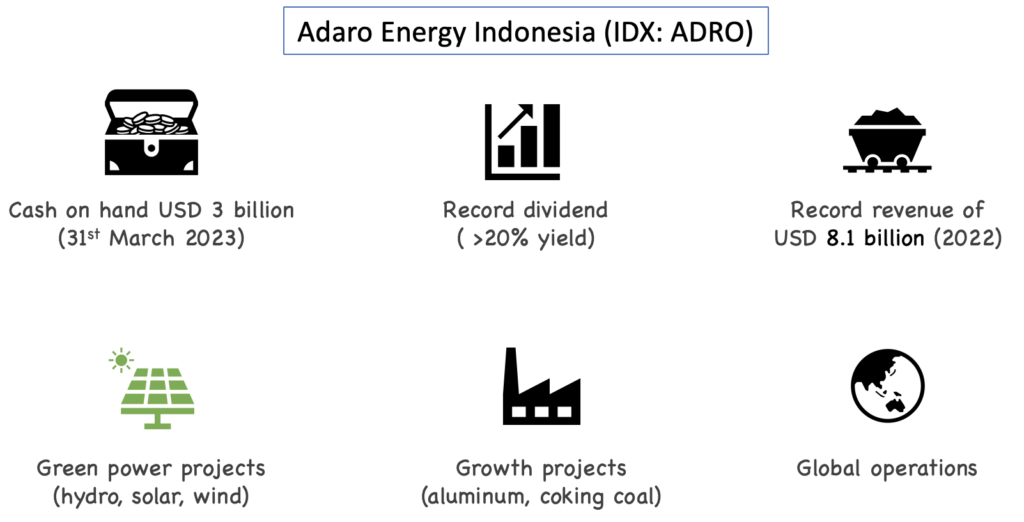

Another pressure could be due to shift in major investors’ policies. Wealth funds are moving away from fossil-fuel investment. Stocks like ADRO and ITMG are being offloaded from their portfolio, despite having over 20% dividend yields, billions USD of cash, PER < 3, green projects in the pipeline, etc.

2. Poor liquidity

Stocks’ liquidity is necessary to maintain price stability. Just a small number of transactions (<0.01% from total float) can either spike up a stock’s price by over 100% within a week, or it can sink by 50% within a week.

3. Lengthy payoff period

A stock can be underpriced yet moving sideways for reasons not known to retail Investors.

One or more major Investors might be accumulating their positions in the stock at low price. Only when the accumulation target is achieved, the stock price will move upwards to its fair price.

The question is, how long [months, years] the sideways will be, while retail investors painfully watch other stocks moving up in a bullish market.

Despite all the above, Investors with long term view and huge capital to park their money other than the banks, might still view these as an opportunity not to be missed. Where else can an Investor find consistently profitable stocks paying double-digit dividends each year?

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.