The market has been lackluster so far in 2023. It applies to most assets, including the stock market.

Wait and See

This is a common strategy that most Investors deploy for now. It’s not due to liquidity crunch. Not because there are not enough quality assets. It’s about securing those assets at lowest possible price.

It is a buyers’ market. Buyers determine the price of an asset for a transaction to take place.

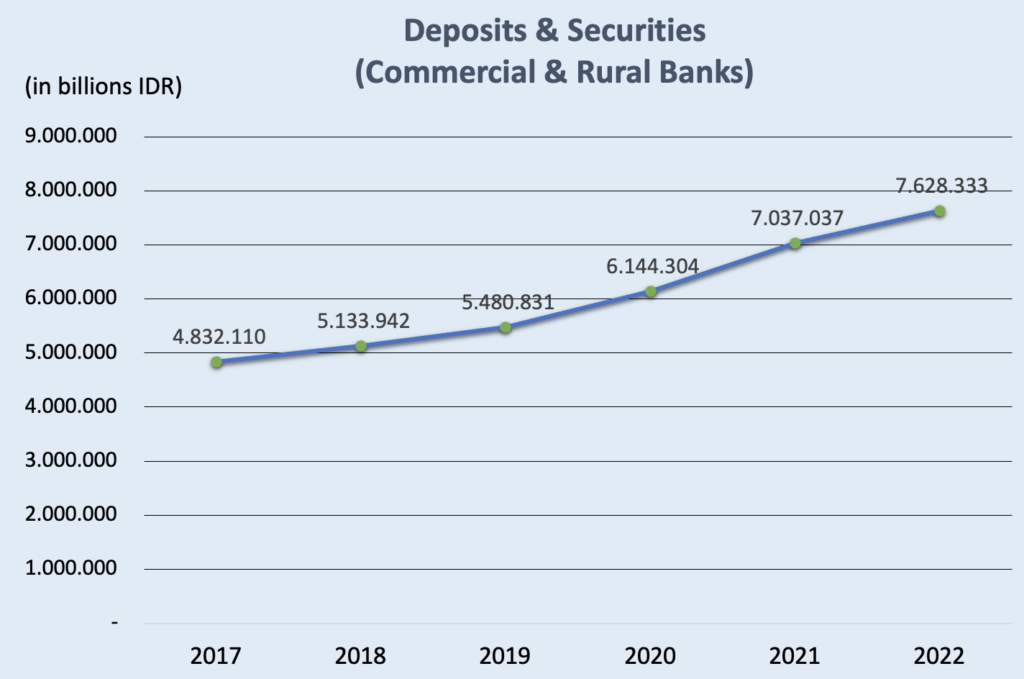

Investors with abundant liquidity simply sits on pile of cash reserved in bank deposits and A+ obligations. Within the last 5 years, the Deposits and Securities held by the banks increased by 58%.

Is it Good for the Economy?

YES and NO.

YES, because in the short run, the price of an asset will not increase much. Inflation will be kept at bay. Thus, the economy may recover faster.

NO, because at some point, recession could happen if Buyers’ bargaining power amounts aggressively. Needless to say, it is compounded by potential systemic risk arising from banking crisis overseas.

Fortunately, the chance of recession here is quite low, thanks to the exceptional fiscal & monetary discipline.

When Is a Good Time to Buy?

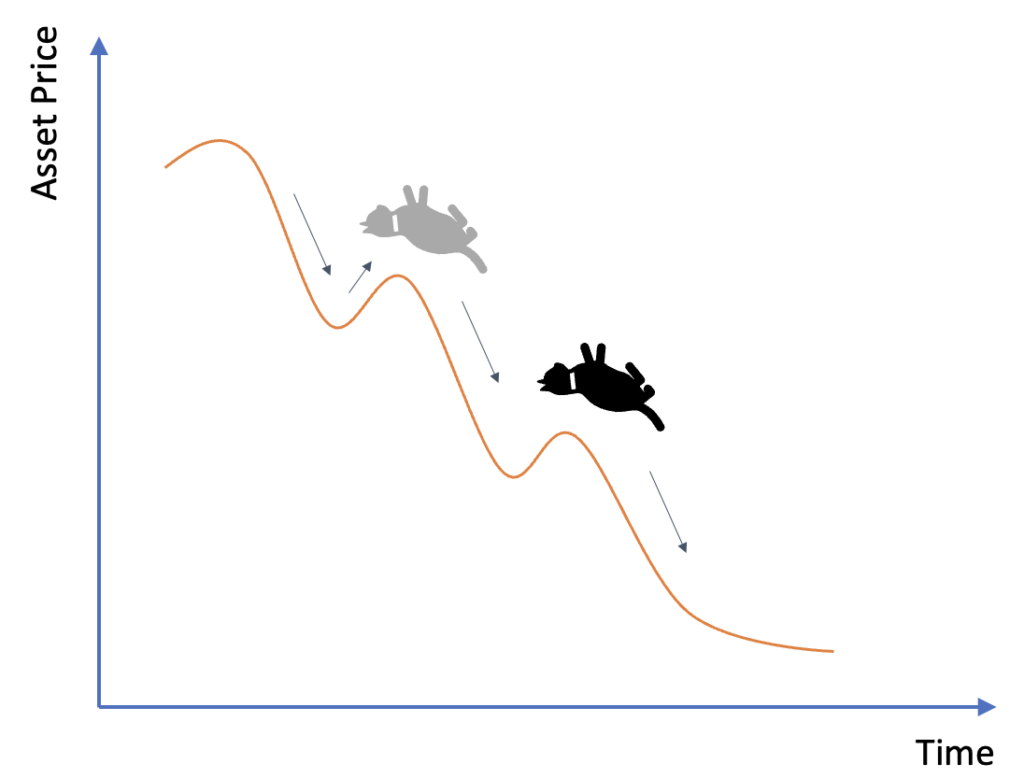

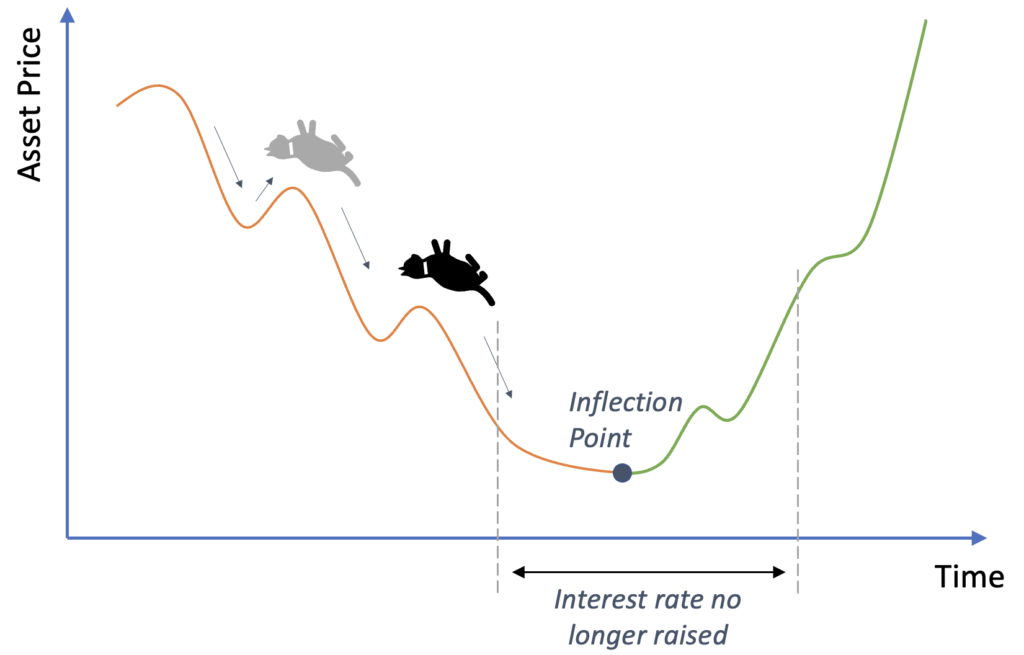

It is ideal that an asset is purchased at the bottom of the market. The challenge is identifying when the bottom will occur, i.e. the inflection point.

A minor rebound can be mistaken for an inflection point, which can turn out to be DCB (dead cat bounce).

For Investors playing it safely, they tend to wait for a cue from the Central Banks’ interest rates. When the interest rates are no longer raised, it could be a good entrance point despite potentially missing out on the inflection point.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.