Global stock market has been in bearish mode for months. There is little sign of recovery.

Despite the downturn, there is some comfort in Dividend Stocks. So why are they so appealing amid recession fear?

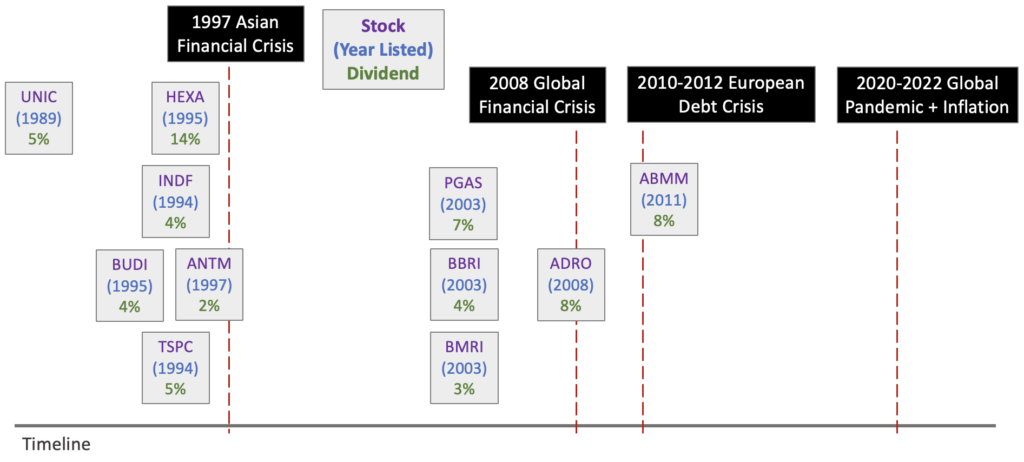

1. Proven business model

The strength of a company’s business model is tested through crisis. Some of these Companies have existed for decades and prevailed in worse circumstances. Even sometimes higher revenues, profits, etc. were recorded.

2. Risk management

Despite the bearish market, abruptly exiting the stock market might not be a good idea. Eliminating stocks from the investment portfolio (i.e. being less diversified) could actually increase risks for some Investors.

Hence, one option to manage overall risk while minimizing the downside is by shifting into Dividend Stocks.

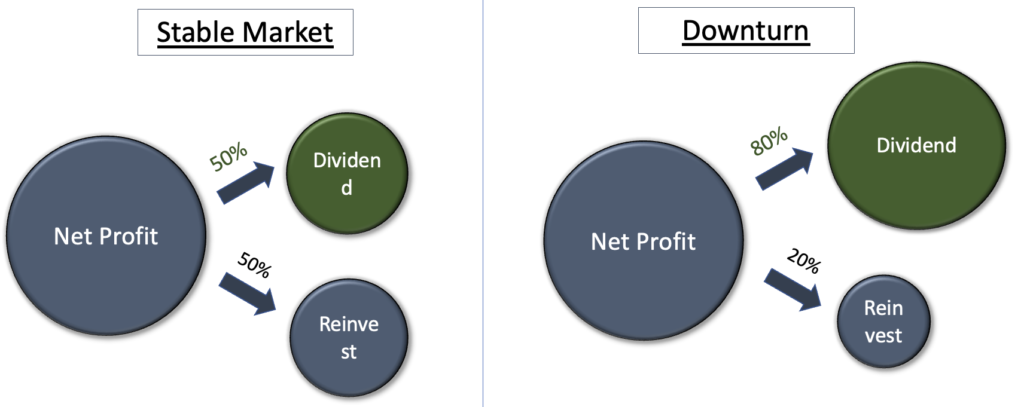

3. Higher dividends

With little option to invest & grow during downturns, Companies tend to return more profits as Dividends.

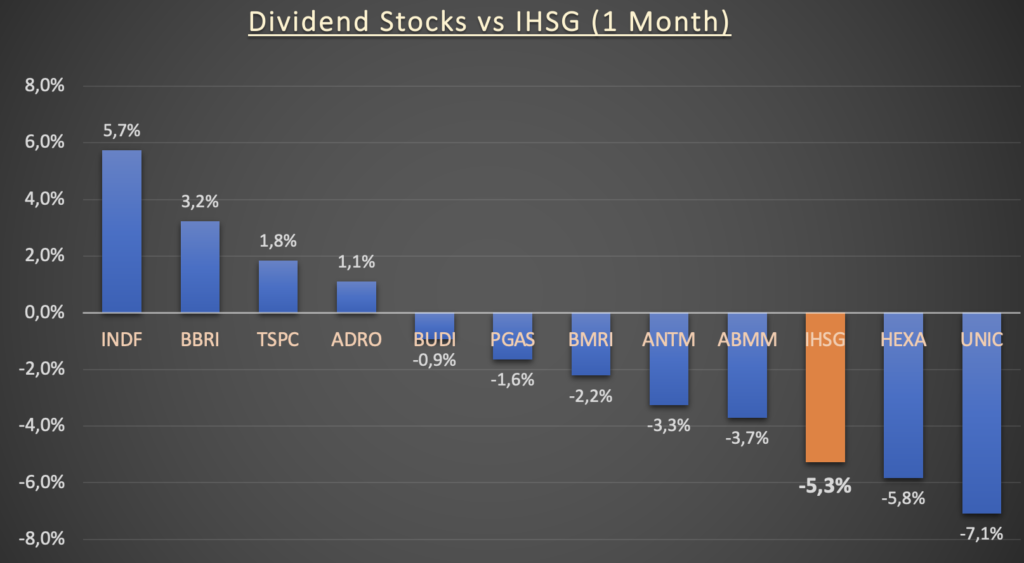

4. Stock performance

During downturns, these Dividend Stocks tend to perform better than main index.

Looking at the last 1 month of stock market rout, here’s how the stock prices fare against the index.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.