Post 1997-1998 Asian financial crisis, the country has solidified its position as a rising economy. Even during the 2008-2009 global downturn, it still managed to keep its GDP growth quite stably.

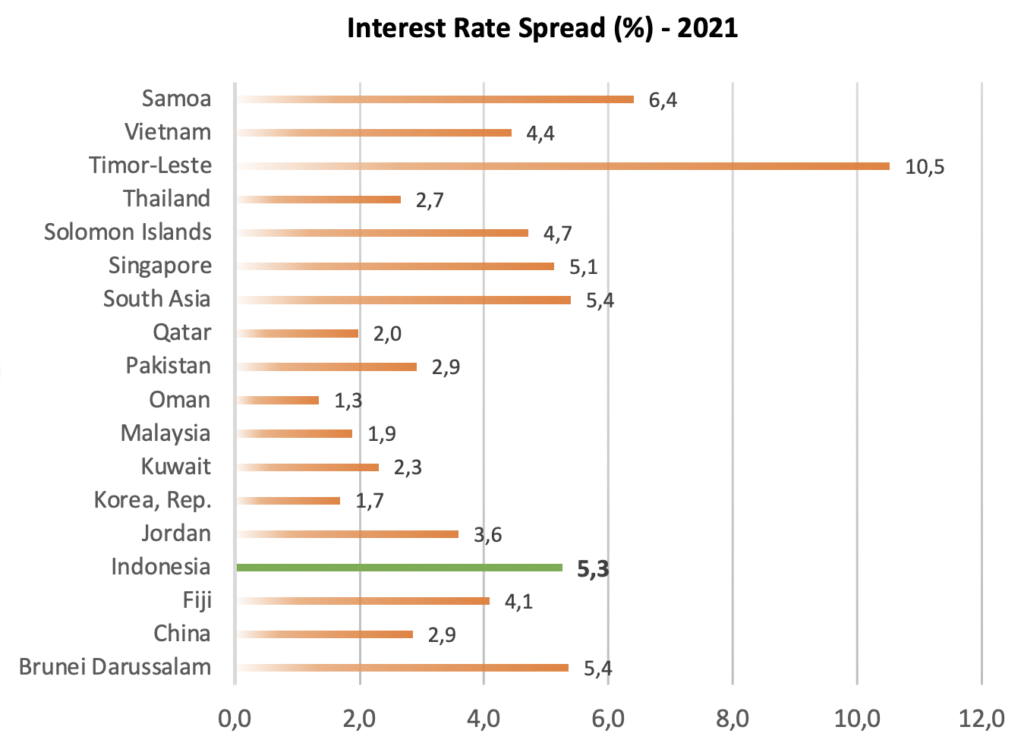

One reason could be due to the strength of its banking system. Compared to other countries, interest rate spread (2021) between lending rate and deposit rate is broader than some Asia Pacific countries.

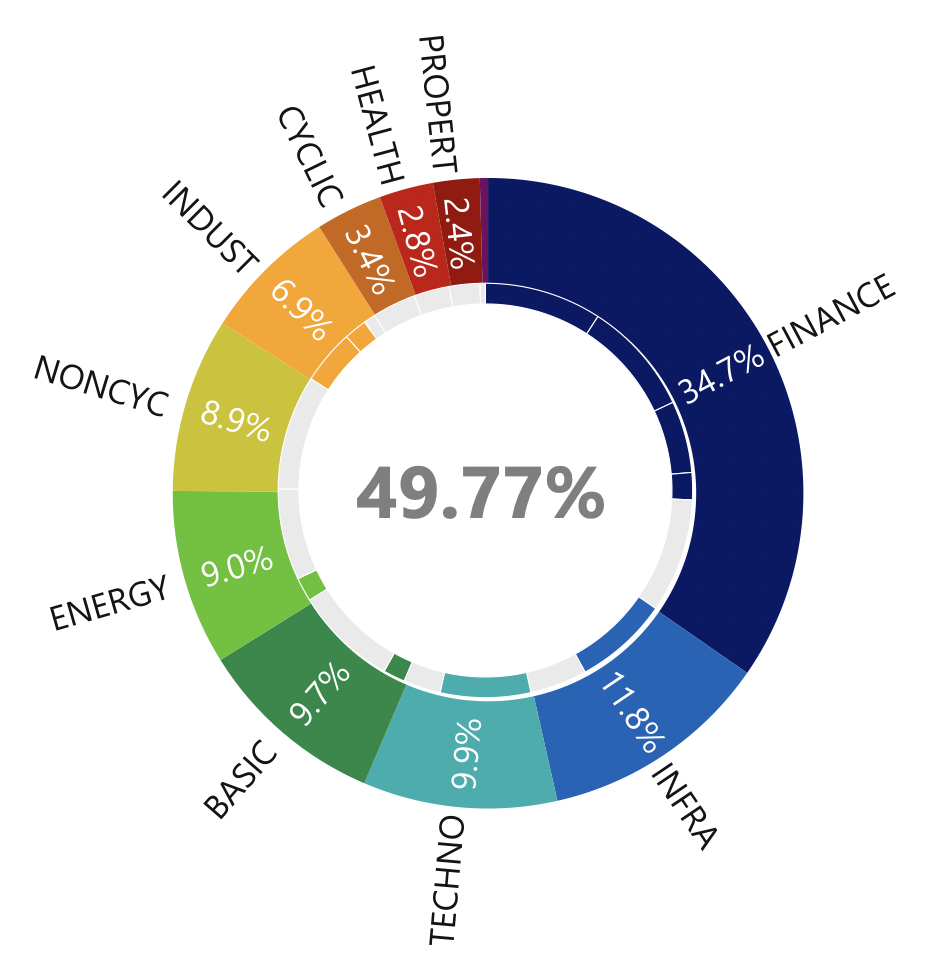

This wide spread allows the banks to be very profitable despite some non-performing loans, debt rollovers, etc. In fact, the financial sector has been dominating (34.7%) the stock market.

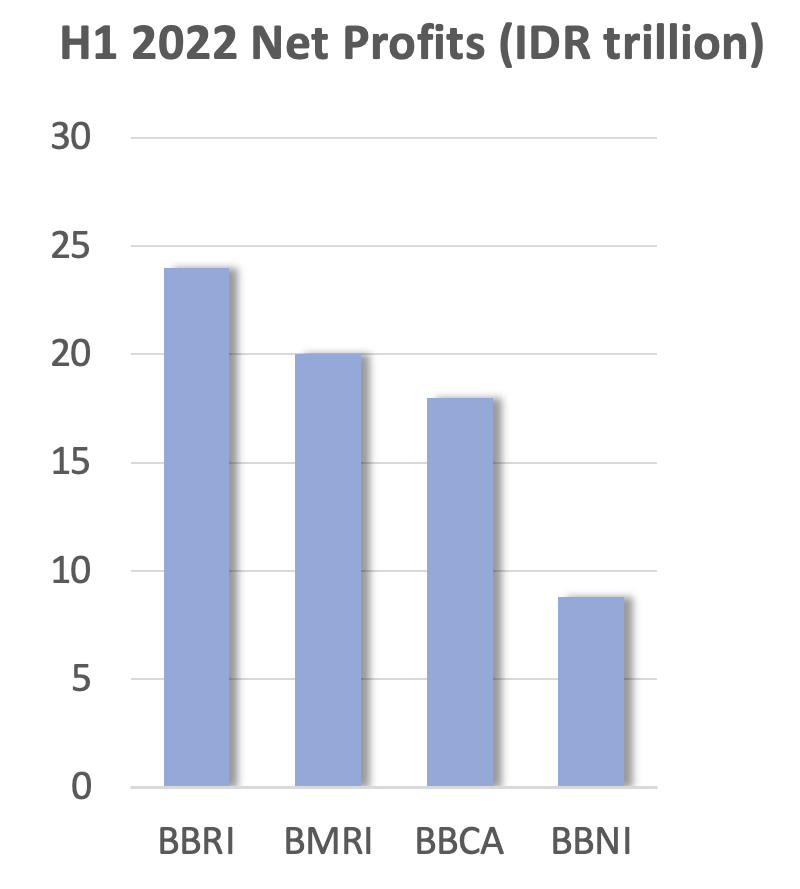

Not to mention, the big 4 banks have delivered record breaking profits in spite of the pandemic.

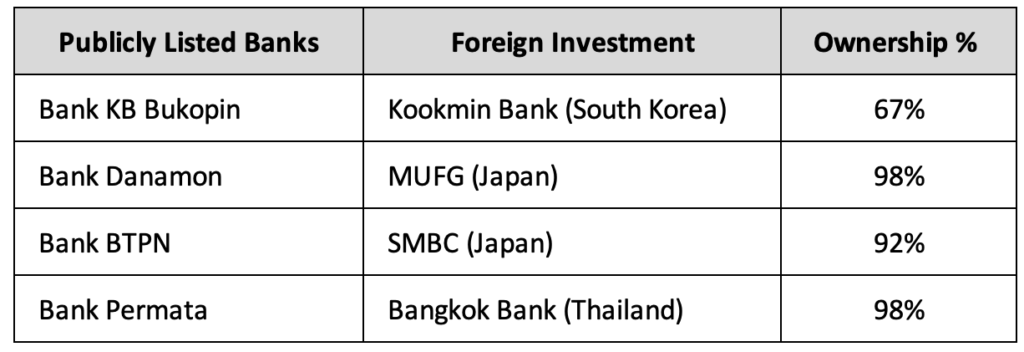

Such attractive businesses lured many foreign financial institutions to invest in or acquire local banks in recent years.

As more small-to-mid-size banks (e.g. BACA, BNBA) plan to strengthen their capital (equity) to comply with the new regulation; this could open up for more acquisition / investments.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.