The topic of FIRE (Financially Independent, Retire Early) is increasingly being discussed among the younger generations.

Let’s probe several common questions here.

-

What does it mean to be financially independent?

Some say it means not having to work anymore to live comfortably.

It can be either due to vast wealth accumulated; or due to passive income.

-

Why would someone choose to (semi) retire early?

At some stage in life, some people will get fatigued from work. Constant (boring) and / or overload work can be quite excessive beyond mental and physical health.

Short-term vacation is an option. Semi or permanent retirement is another option.

-

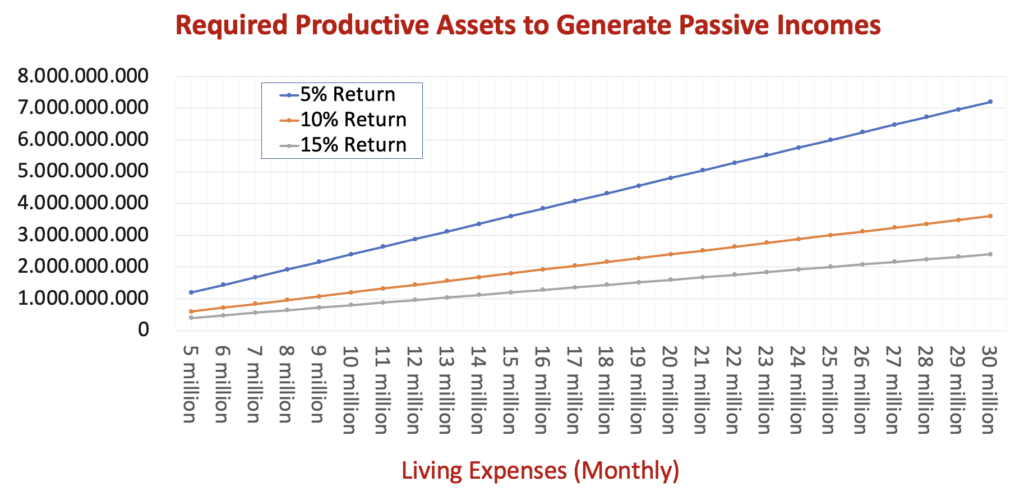

How much wealth (money) is enough?

It depends. Some have kids to feed; some have mortgage instalments ongoing. Some choose to retire in low-cost cities (or suburbs), some choose to retire in high-cost cities.

Under most circumstances, it is better to live off passive income (e.g. stock dividends / capital gains, deposit interests) rather than live off depreciating the assets (gradually selling down the assets) over time.

Unforeseen expenses might arise in the future (e.g. health condition, traffic accident, inflation). This is when the assets become handy.

-

When is the right time to retire early?

No definite answer. One needs to be ready with the consequences. Try to live off passive income for a couple years before making firm decision whether to choose the path of FIRE or not.

-

How about additional income apart from passive incomes?

Retirement from full-time work sometimes open many doors for other incomes.

Opening mini cafe, freelance consulting, online sales (e.g. tokopedia), stock trading, etc.

Be mindful, doing what you enjoy can be exhausting. Waking up before sunrise for shop preparation, earning less despite putting more hours as freelancers, etc.

One should never burn the bridge. Be open to go back to full-time employment, should it be necessary.

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.