Fundamental analysis on stocks can be tedious sometimes. Depending on Investors’ eagerness, the analysis can be carried out as extensive as it can be.

Quite often however, Investors race against time to make swift decisions in volatile market.

Some quick ways to analyze in such situation.

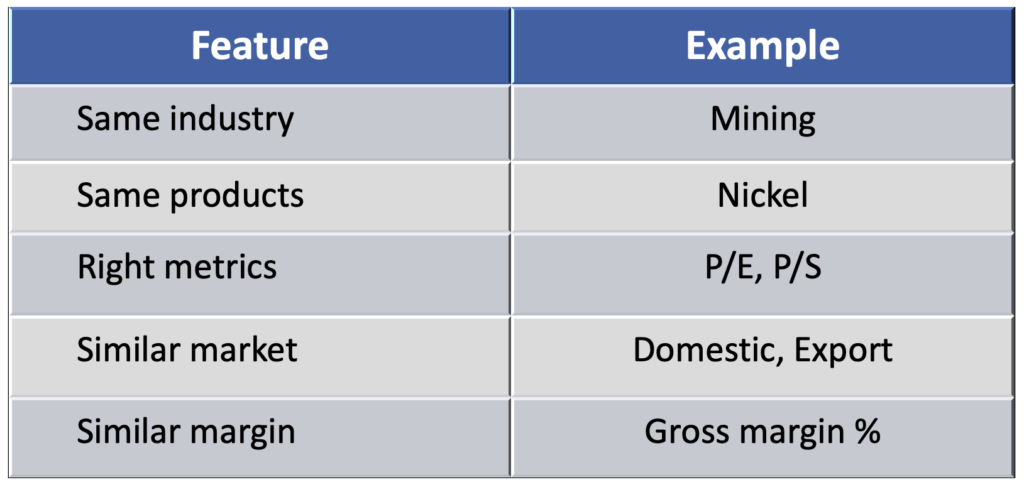

Peer Comparison

One could easily tell whether a stock is valued more or less than its peers. Just make sure that it is apple to apple association, not apple to orange.

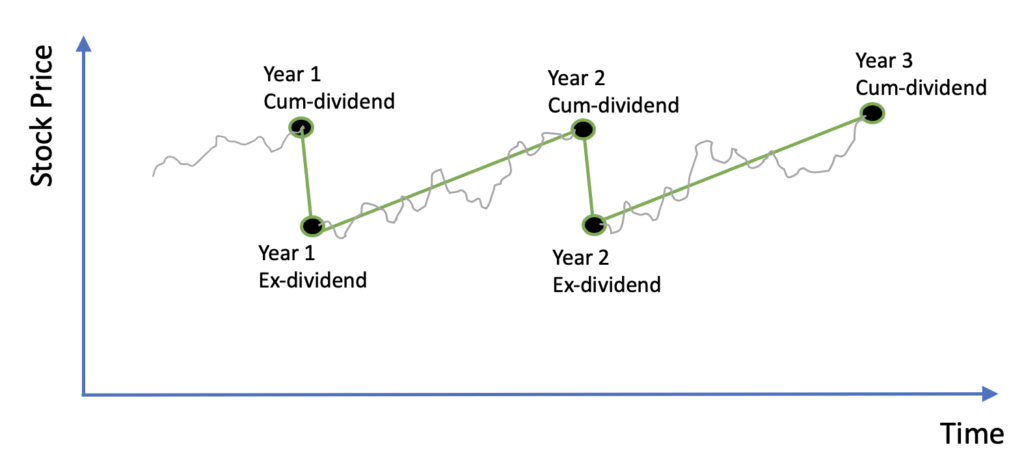

Dividend Yield

There is nothing wrong with chasing dividends. It is true that a stock price might decline on ex-dividend date.

However, one must realize that the stock price could rebound back to the same level as cum-dividend date within one year.

This strategy suits those Investors looking for passive income but high yield (e.g. compared to bank deposits).

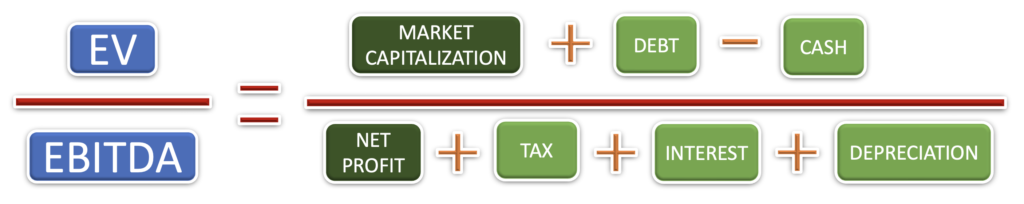

EV / EBITDA

Possibly the most powerful metrics of all, EV / EBITDA offer the simplest yet comprehensive look into company’s financial position relative to its stock valuation.

It considers company’s cash & debt position, tax position, asset depreciation, net profits, and current market capitalization.

One might say, there is no way to calculate this EV/EBITDA ratio. Fortunately, there are some apps that already provide this ratio in their analysis feature, such as iPOT apps.

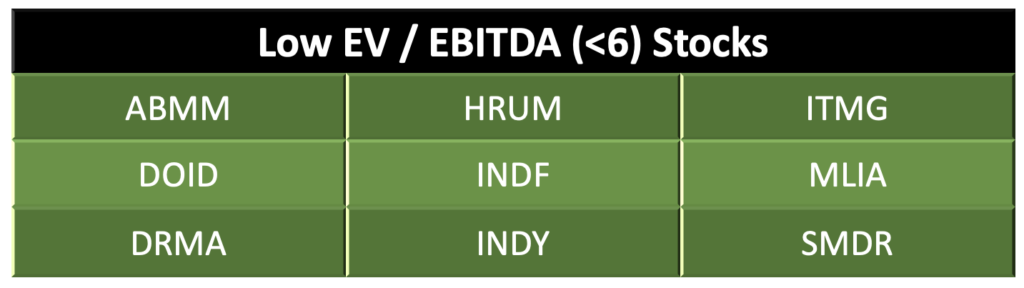

Several attractive EV / EBITDA stocks: