Year 2021 could be remembered as the benchmark for economic recovery. The country has emerged strongly from the tip of recession into enviable growth of 3.69%.

The IHSG index has reached all time high as of April 2022; thanks to increasing number of investors, companies’ performance, and foreign investment inflows.

Several top performing Companies in 2021:

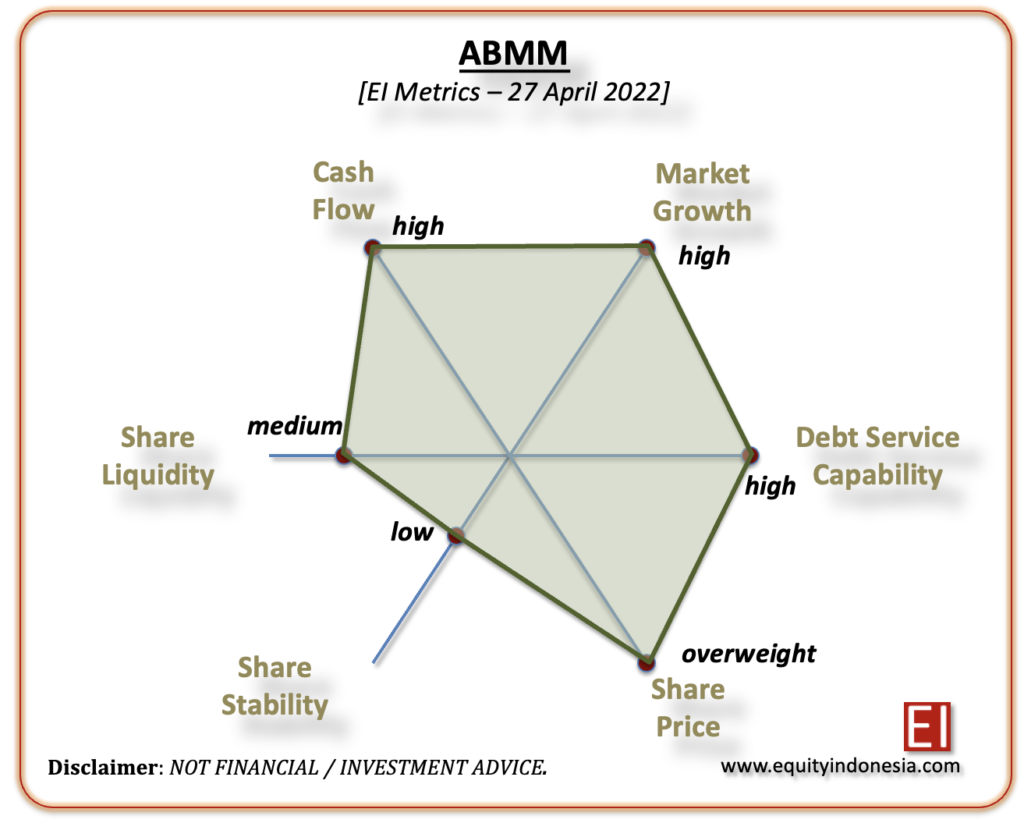

ABM Investama (ABMM)

Despite skyrocketing coal prices, ABMM is relatively unheard of. It is one of the most integrated resource company from mining, services to infrastructure.

Investors may expect for high dividend yield this year. Current PER (Price to Earnings Ratio) of 3 is quite alluring.

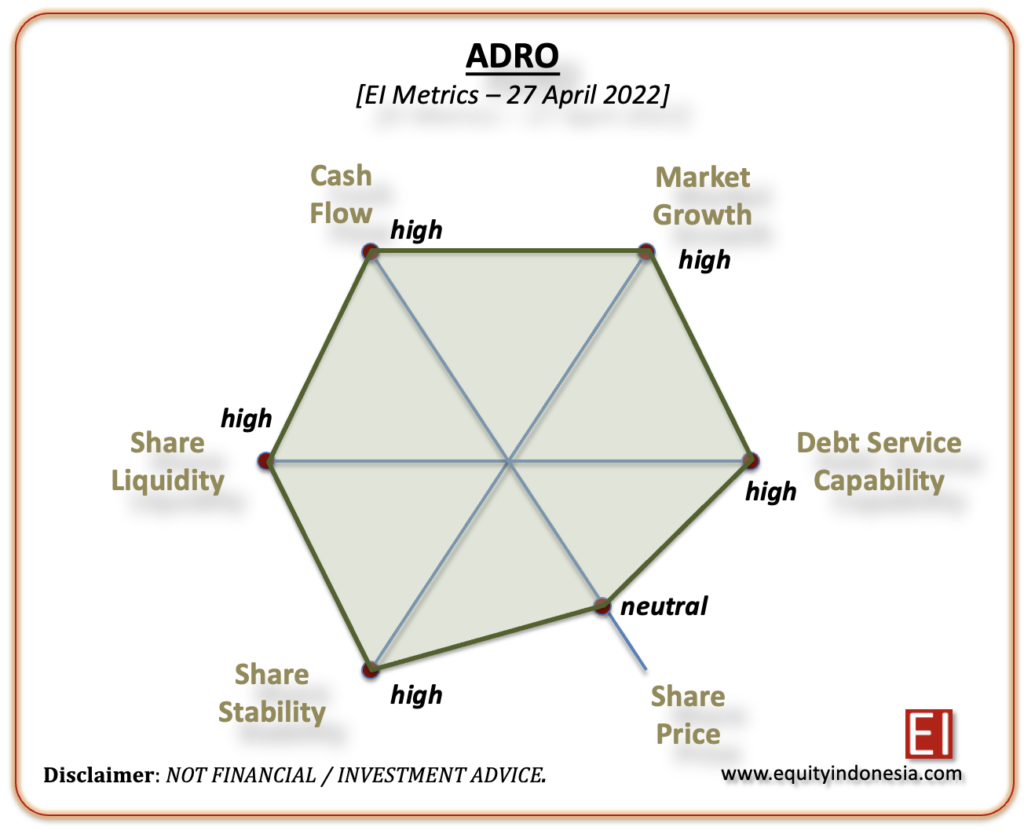

Adaro Energy Indonesia (ADRO)

Considered one of the most efficient coal mines, ADRO generated more than USD 2 billion in EBITDA.

Its subsidiary, Adaro Minerals (ADMR) is the best IPO performer in 2022 so far.

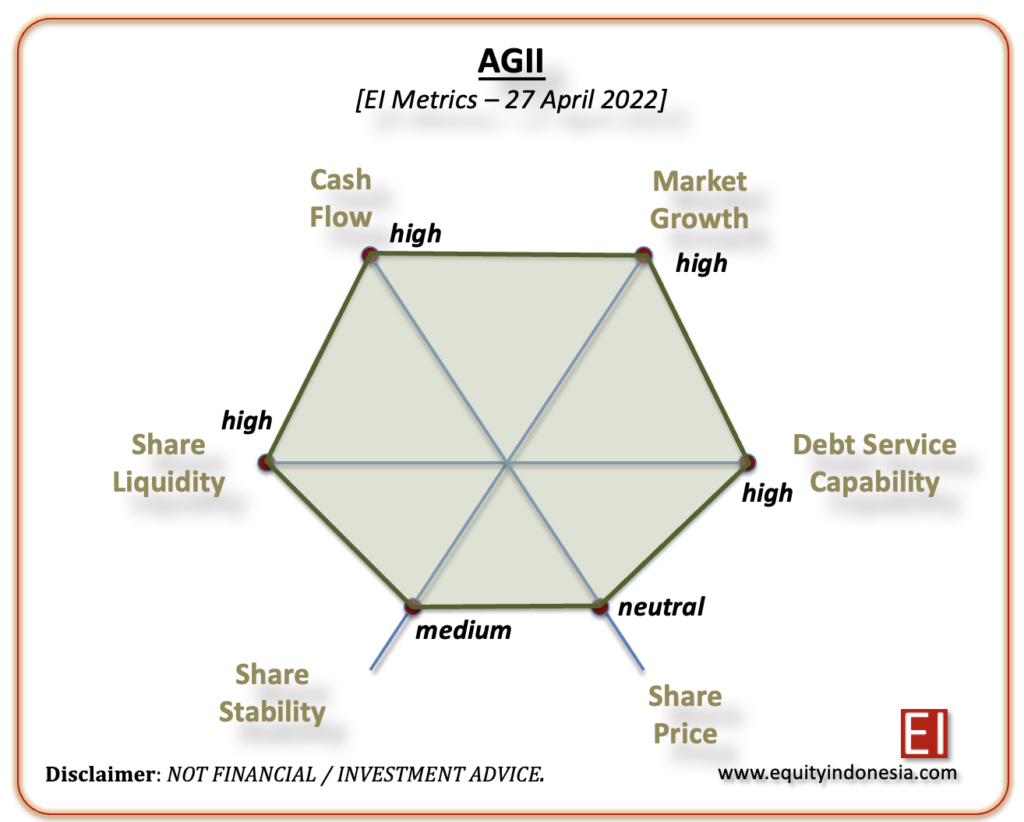

Aneka Gas Industri (AGII)

Uniquely positioned as one of few industrial gas producers; AGII has delivered more than 100% increase in profits.

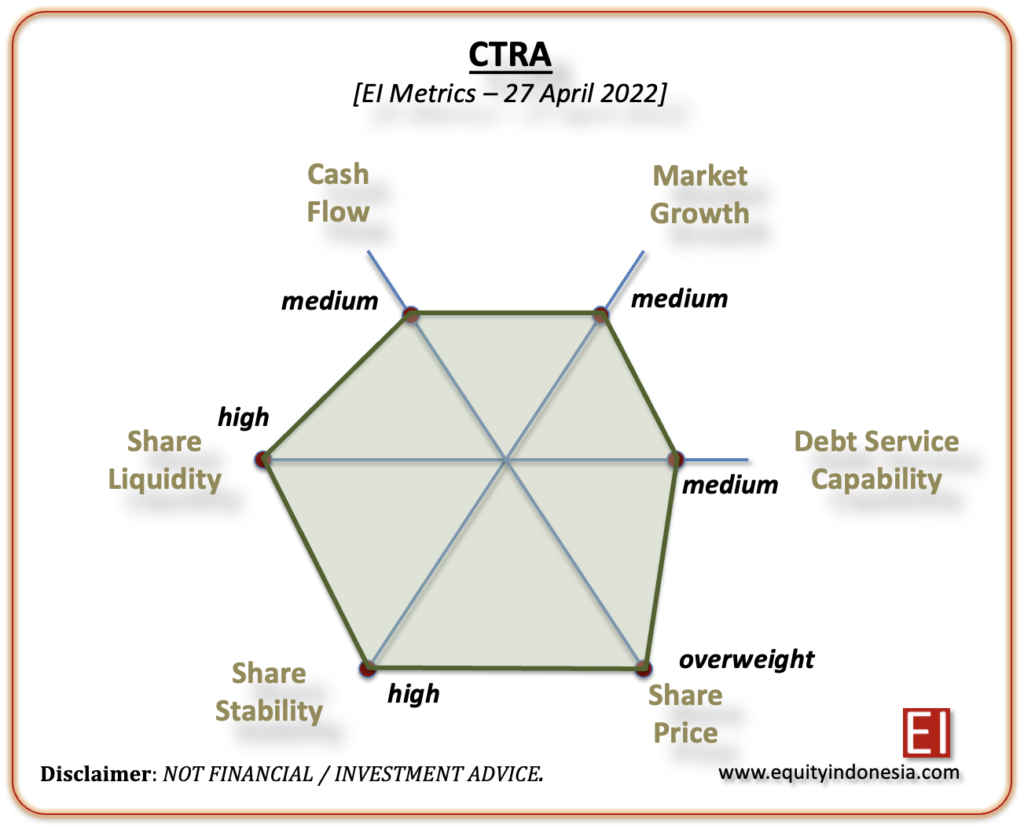

Ciputra Development (CTRA)

Apart from being the largest listed property developer, the Company is able to maintain strong growth. It managed to generate strong profit (net margin > 15%) while the overall property market was not doing so well.

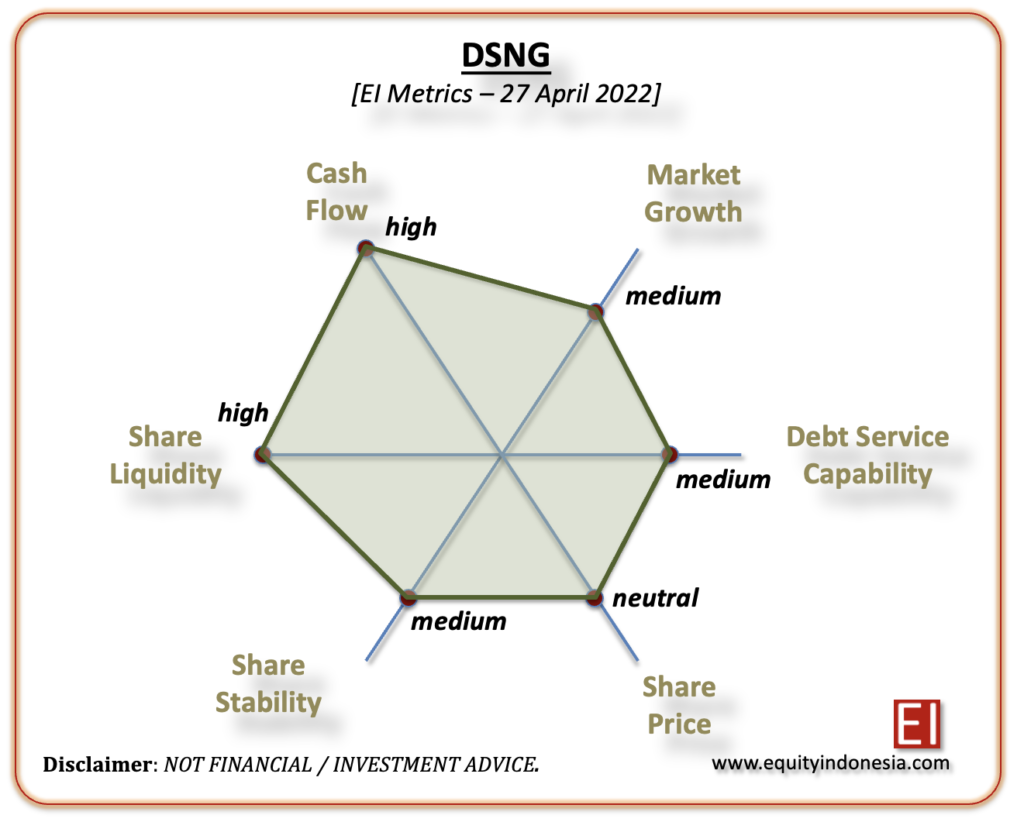

Dharma Satya Nusantara (DSNG)

As a palm oil Company with good ESG and accreditation, it has consistently delivered growth in revenues, profits, and dividends over the years.

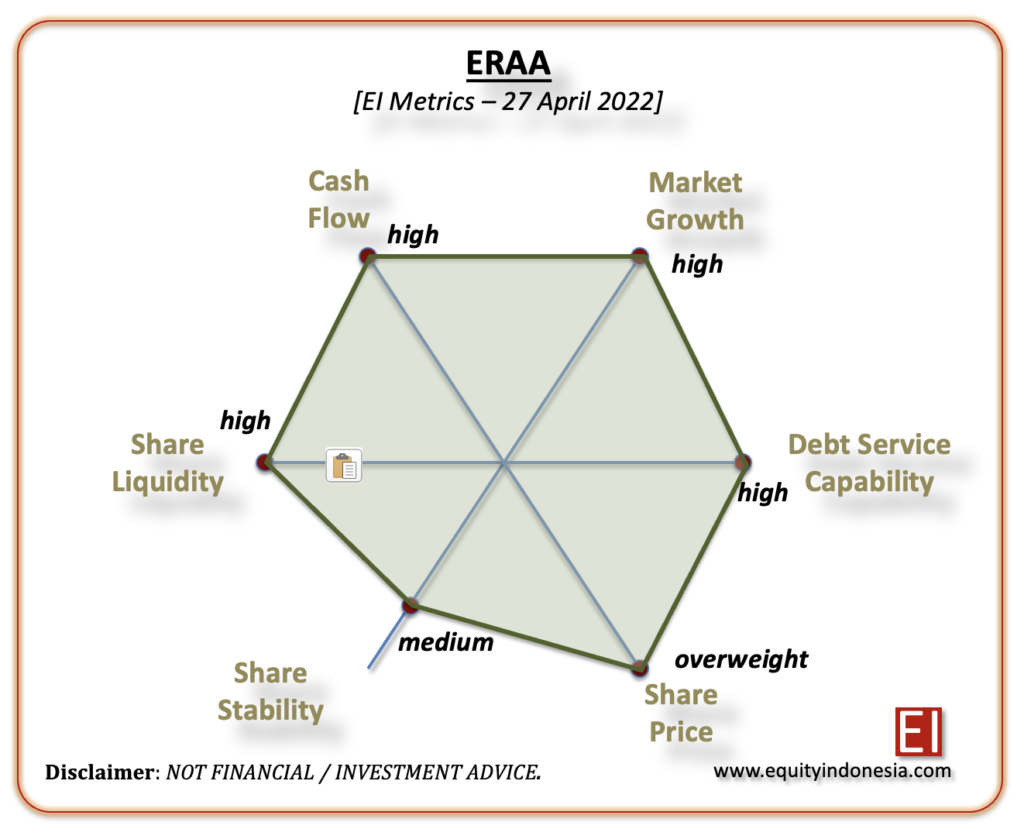

Erajaya Swasembada (ERAA)

The Company has and will continue to benefit from digitalization of the economy. The revenue derived from selling smart phones and tablets grew more than 30%.

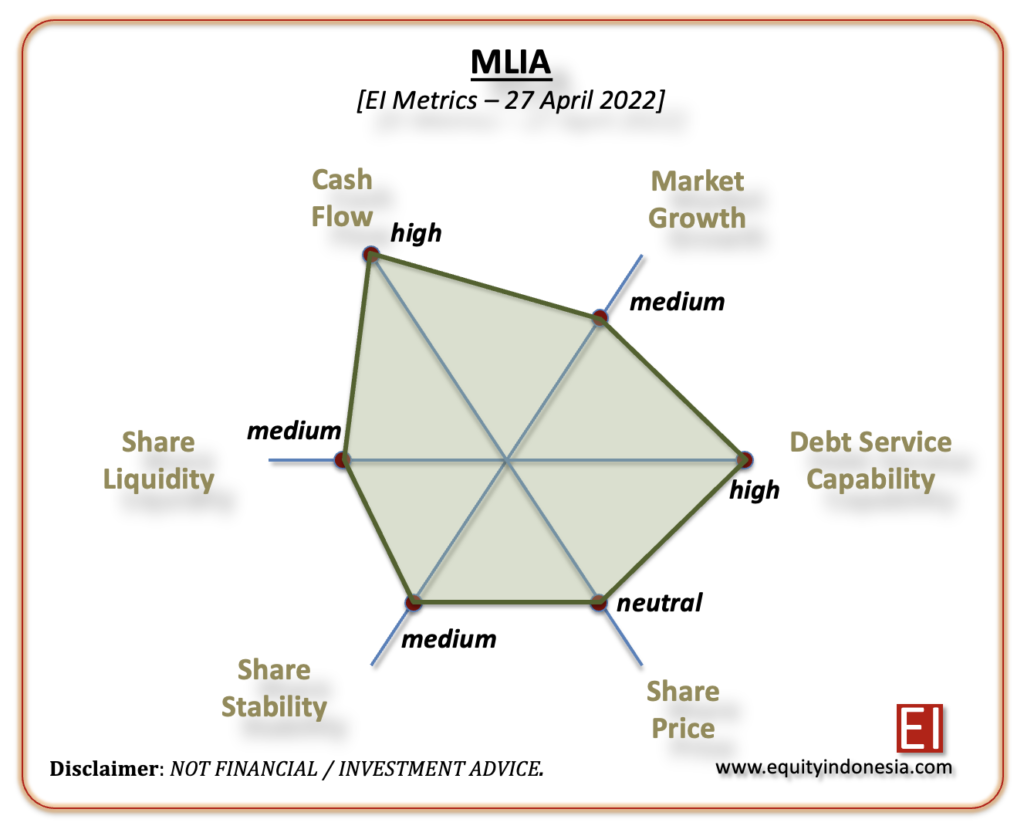

Mulia Industrindo (MLIA)

In 2021, the Company generated profit 11x more than it did in 2020.

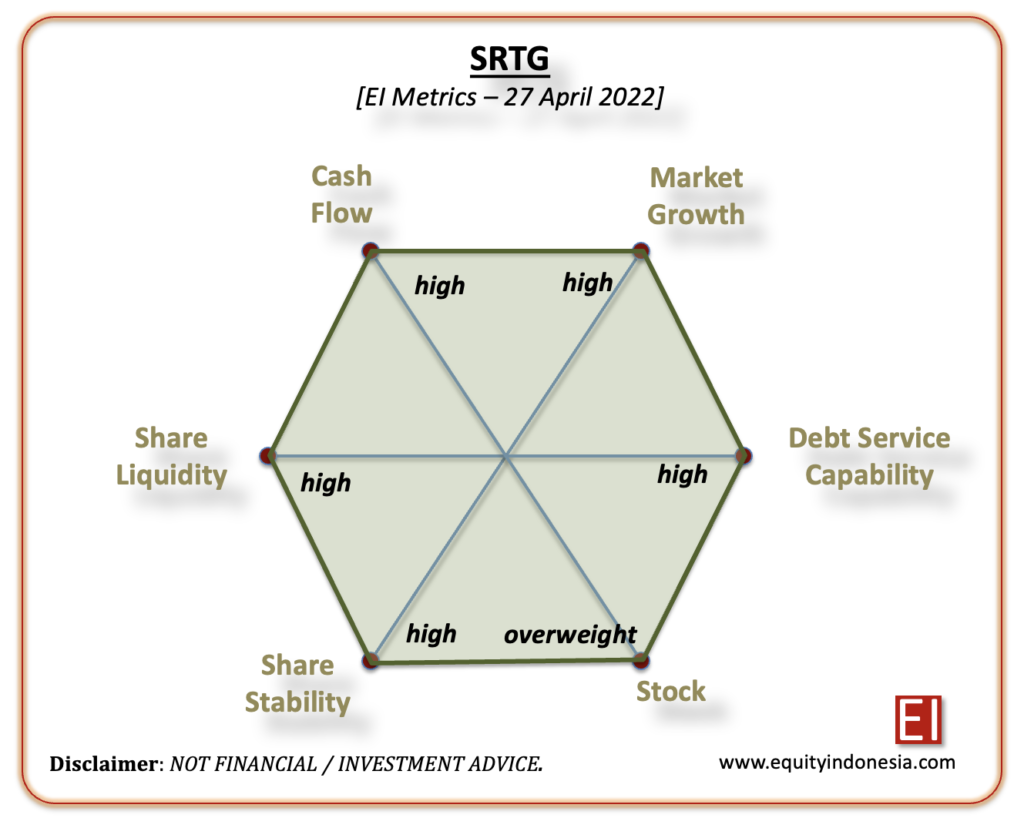

Saratoga Investama Sedaya (SRTG)

Probably the largest conglomerate with the most diversified portfolio in the country.

Its current market capitalization (IDR 50 trillion) is relatively undervalued compared to its NAV of IDR 60 trillion. As well, consider the market capitalization of its portfolio (i.e. ADRO @ IDR 100 trillion, TBIG @ IDR 70 trillion, MDKA @ IDR 120 trillion, etc).

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.