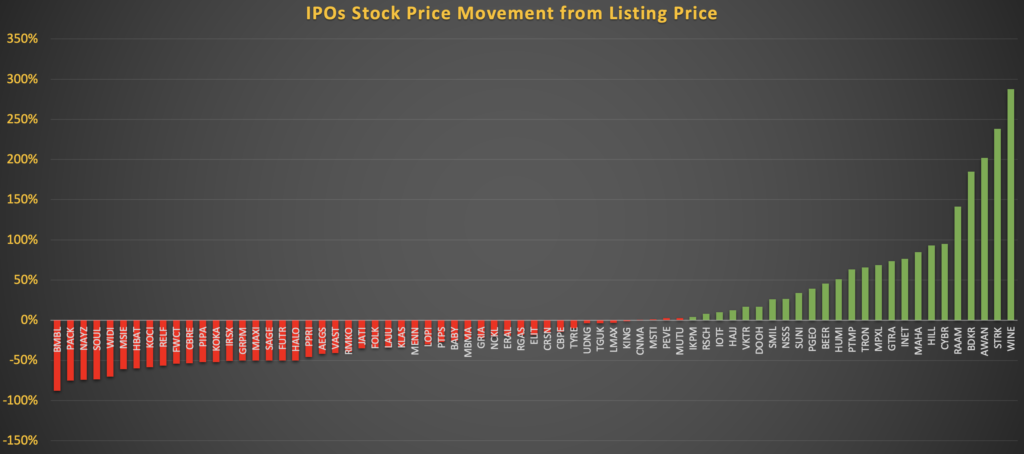

This year marks a record for IPO listing in the market, despite sluggish macroeconomic and geopolitical tension. A record breaking of 77 IPOs so far this year, with over IDR 50 trillion raised.

Good for businesses, especially small to mid sizes, that acquire funding via these IPOs. No need to pay interest to the banks since the funds were raised through equity.

But, how does it fare for Investors that participated in the capital raise during book buildings?

As the figure shows, 44 of these IPO’s experience falls in their stock prices from listing price. The median capital loss is around -15%.

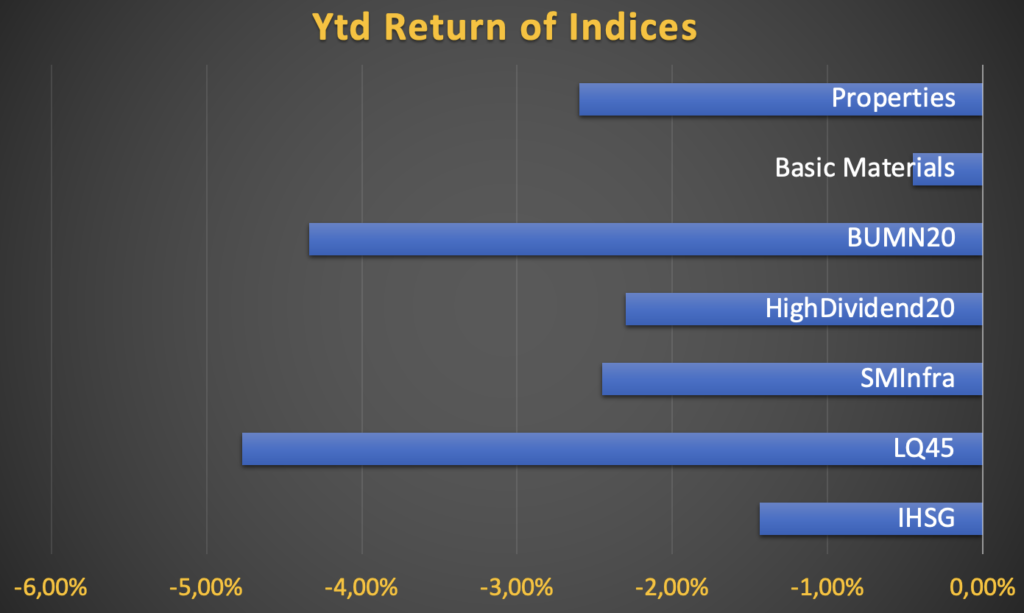

Some might say it is due to gloomy market. Half right. Still… despite market condition, the YTD return of major indices do not plunge as much as the IPO’s prices.

What is happening here? Were these IPO’s already overvalued when listed? How transparent and fair was the valuation?

It appears that the ones benefitting from these IPO’s are the Companies, Market Makers, and Securities; while retail Investors tend to be worse off in the short run.

As the famous Warren B once said, “An IPO is like a negotiated transaction – the seller chooses when to come public – and it’s unlikely to be a time that’s favorable to you.”

Disclaimer: NOT FINANCIAL / INVESTMENT ADVICE. This article is of writer’s personal opinion. Any information contained here is for education and informational purpose only. Readers should seek other sources or professional advice for further clarification where deemed necessary.